If the following balances are exist in the adjusted trial balance:Service revenues $ 45,000lnterest expense S 10,000Salaries Expense S 30,000Rent Revenues $ 4,000Depreciation Expense $ 7,000Drawings $ 3.000 The closing entry for the Expense Accounts should affect the Income summary account as: O a. Income summary account should be Debited (Dr.) by $ 47,000. O b. Income summary account should be Debited (Dr.) by $ 50,000. O . Income summary account should be Credited (Cr.) by $ 50,000. O d. Income summary account should be Credited (Cr.) by $ 47,000.

If the following balances are exist in the adjusted trial balance:Service revenues $ 45,000lnterest expense S 10,000Salaries Expense S 30,000Rent Revenues $ 4,000Depreciation Expense $ 7,000Drawings $ 3.000 The closing entry for the Expense Accounts should affect the Income summary account as: O a. Income summary account should be Debited (Dr.) by $ 47,000. O b. Income summary account should be Debited (Dr.) by $ 50,000. O . Income summary account should be Credited (Cr.) by $ 50,000. O d. Income summary account should be Credited (Cr.) by $ 47,000.

Corporate Financial Accounting

15th Edition

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Carl Warren, Jeff Jones

Chapter5: Accounting For Retailing Businesses

Section: Chapter Questions

Problem 5.35EX

Related questions

Question

100%

these multiple choice Questions from ACCOUNTING PRINCIPLES 1 Course.I need the final.

Transcribed Image Text:15

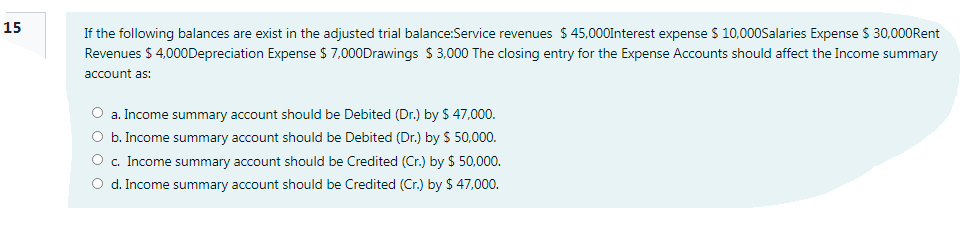

If the following balances are exist in the adjusted trial balance:Service revenues $ 45,000Interest expense $ 10,000Salaries Expense $ 30,000Rent

Revenues $ 4,00ODepreciation Expense $ 7,000Drawings $3,000 The closing entry for the Expense Accounts should affect the Income summary

account as:

O a. Income summary account should be Debited (Dr.) by $ 47,000.

O b. Income summary account should be Debited (Dr.) by $ 50,000.

O . Income summary account should be Credited (Cr.) by $ 50,000.

O d. Income summary account should be Credited (Cr.) by $ 47,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning