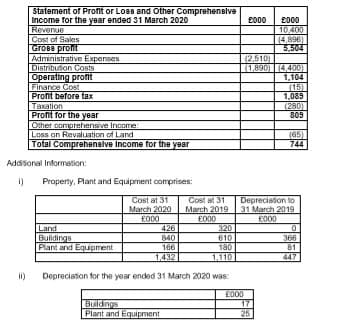

iii) Plant and equipment disposed of during the year had a net book value of £11,000 (cost £45,000). The loss on disposal of £6,000 is included in the cost of sales. iv) All land was revalued on 31 March 2020, the decrease in value of £65,000 was deducted from the revaluation reserve. v) The cost of sales includes £15,000 for development expenditure amortized during the year and £10,000 for impairment of the purchased brand name. vi) On 1 November 2019, Robinson Plc issued £1 equity shares at a premium. No other finance was raised during the year. vii) Robinson Plc paid a dividend during the year. viii) Other provisions relating to legal claims made against Robinson Plc during the year ended 31 March 2020. The amount provided is based on legal opinion on 31 March 2020 and is included in the cost of sales. Required: With reference to IAS 7, Statement of Cash Flows: a) Prepare a statement of cash flows, using the indirect method, for Robinson Plc for the year ended 31 March 2020. Your workings, where applicable must be presented using ledger accounts. b) Prepare a report to the directors of Robinson Plc, analyzing the statement of cash flows highlighting the key features of each category of cash flows for the year ended 31 March 2020.

Other Additional Information:-

iii) Plant and equipment disposed of during the year had a net book value of £11,000 (cost £45,000). The loss on disposal of £6,000 is included in the cost of sales.

iv) All land was revalued on 31 March 2020, the decrease in value of £65,000 was deducted from the revaluation reserve.

v) The cost of sales includes £15,000 for development expenditure amortized during the year and £10,000 for impairment of the purchased brand name.

vi) On 1 November 2019, Robinson Plc issued £1 equity shares at a premium. No other finance was raised during the year.

vii) Robinson Plc paid a dividend during the year.

viii) Other provisions relating to legal claims made against Robinson Plc during the year ended 31 March 2020. The amount provided is based on legal opinion on 31 March 2020 and is included in the cost of sales.

Required:

With reference to IAS 7, Statement of

a) Prepare a statement of cash flows, using the indirect method, for Robinson Plc for the year ended 31 March 2020. Your workings, where applicable must be presented using ledger accounts.

b) Prepare a report to the directors of Robinson Plc, analyzing the statement of cash flows highlighting the key features of each category of cash flows for the year ended 31 March 2020.

Step by step

Solved in 4 steps with 5 images