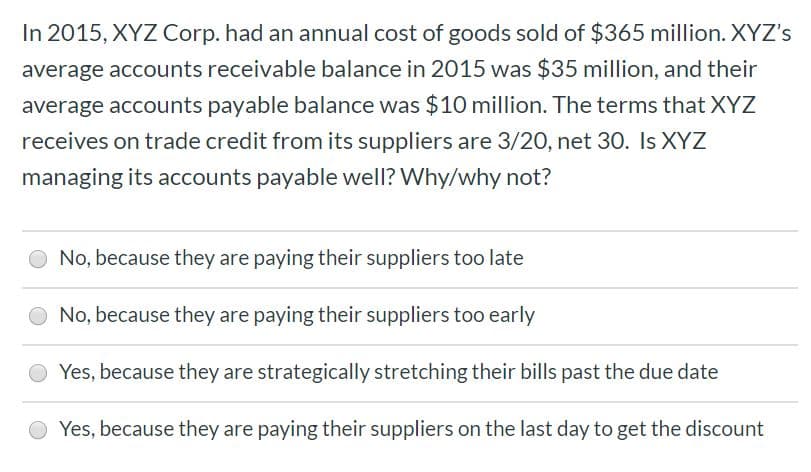

In 2015, XYZ Corp. had an annual cost of goods sold of $365 million. XYZ's average accounts receivable balance in 2015 was $35 million, and their average accounts payable balance was $10 million. The terms that XYZ receives on trade credit from its suppliers are 3/20, net 30. Is XYZ managing its accounts payable well? Why/why not? No, because they are paying their suppliers too late No, because they are paying their suppliers too early Yes, because they are strategically stretching their bills past the due date Yes, because they are paying their suppliers on the last day to get the discount

In 2015, XYZ Corp. had an annual cost of goods sold of $365 million. XYZ's average accounts receivable balance in 2015 was $35 million, and their average accounts payable balance was $10 million. The terms that XYZ receives on trade credit from its suppliers are 3/20, net 30. Is XYZ managing its accounts payable well? Why/why not? No, because they are paying their suppliers too late No, because they are paying their suppliers too early Yes, because they are strategically stretching their bills past the due date Yes, because they are paying their suppliers on the last day to get the discount

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:In 2015, XYZ Corp. had an annual cost of goods sold of $365 million. XYZ's

average accounts receivable balance in 2015 was $35 million, and their

average accounts payable balance was $10 million. The terms that XYZ

receives on trade credit from its suppliers are 3/20, net 30. Is XYZ

managing its accounts payable well? Why/why not?

No, because they are paying their suppliers too late

No, because they are paying their suppliers too early

Yes, because they are strategically stretching their bills past the due date

Yes, because they are paying their suppliers on the last day to get the discount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College