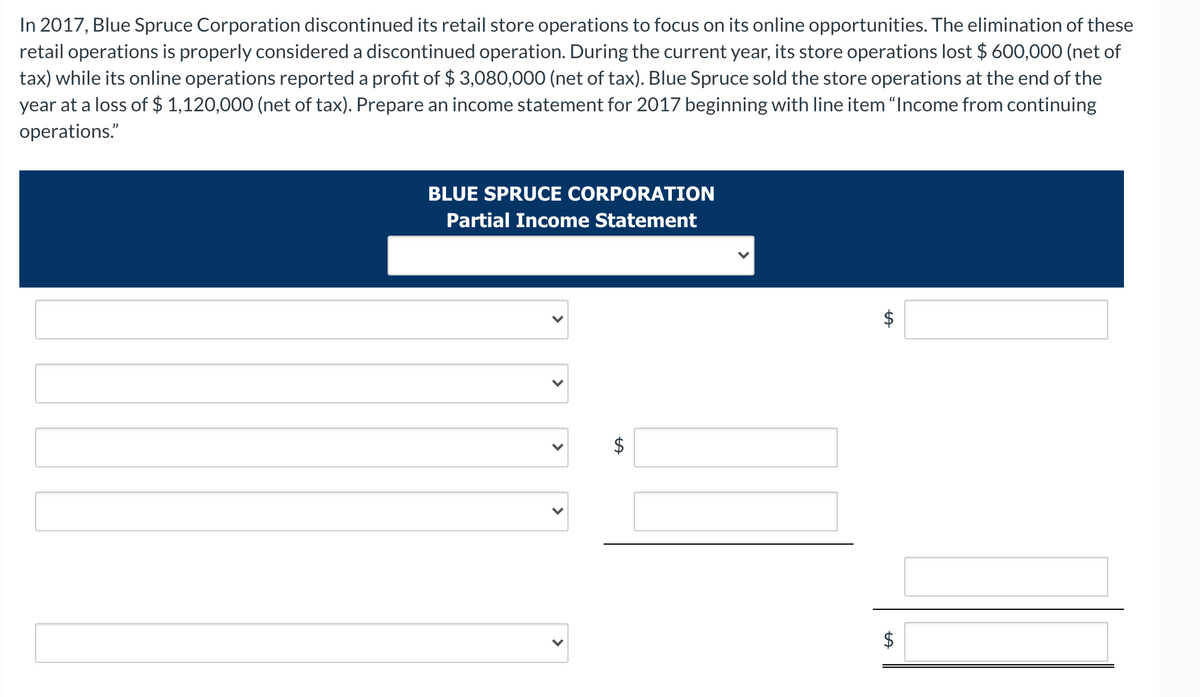

In 2017, Blue Spruce Corporation discontinued its retail store operations to focus on its online opportunities. The elimination of these retail operations is properly considered a discontinued operation. During the current year, its store operations lost $ 600,000 (net of tax) while its online operations reported a profit of $ 3,080,000 (net of tax). Blue Spruce sold the store operations at the end of the year at a loss of $ 1,120,000 (net of tax). Prepare an income statement for 2017 beginning with line item "Income from continuing operations." BLUE SPRUCE CORPORATION Partial Income Statement $ 2$ $

In 2017, Blue Spruce Corporation discontinued its retail store operations to focus on its online opportunities. The elimination of these retail operations is properly considered a discontinued operation. During the current year, its store operations lost $ 600,000 (net of tax) while its online operations reported a profit of $ 3,080,000 (net of tax). Blue Spruce sold the store operations at the end of the year at a loss of $ 1,120,000 (net of tax). Prepare an income statement for 2017 beginning with line item "Income from continuing operations." BLUE SPRUCE CORPORATION Partial Income Statement $ 2$ $

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:In 2017, Blue Spruce Corporation discontinued its retail store operations to focus on its online opportunities. The elimination of these

retail operations is properly considered a discontinued operation. During the current year, its store operations lost $ 600,000 (net of

tax) while its online operations reported a profit of $ 3,080,000 (net of tax). Blue Spruce sold the store operations at the end of the

year at a loss of $ 1,120,000 (net of tax). Prepare an income statement for 2017 beginning with line item “Income from continuing

operations."

BLUE SPRUCE CORPORATION

Partial Income Statement

$

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning