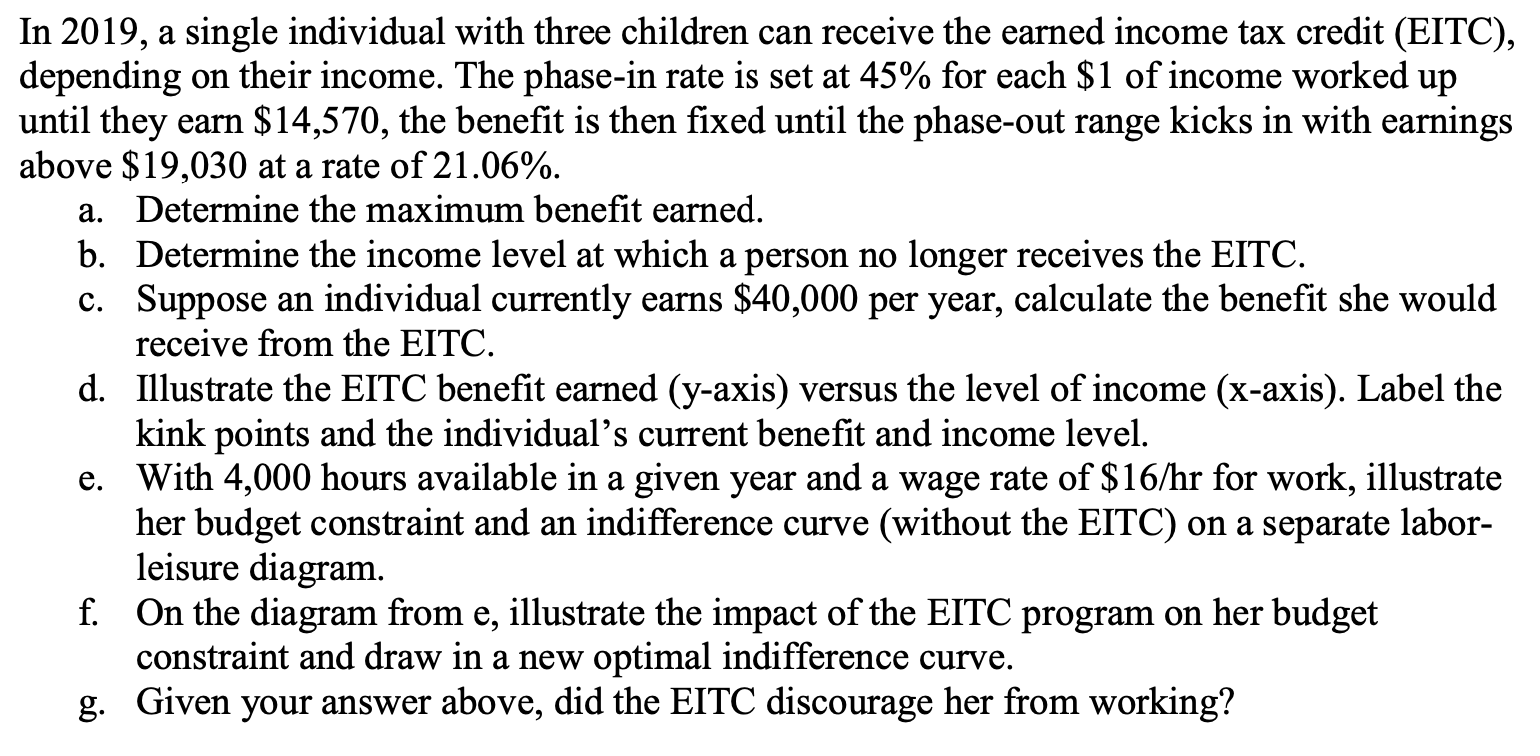

In 2019, a single individual with three children can receive the earned income tax credit (EITC), depending on their income. The phase-in rate is set at 45% for each $1 of income worked up until they earn $14,570, the benefit is then fixed until the phase-out range kicks in with earnings above $19,030 at a rate of 21.06%. a. Determine the maximum benefit earned. b. Determine the income level at which a person no longer receives the EITC. c. Suppose an individual currently earns $40,000 per year, calculate the benefit she would receive from the EITC. d. Illustrate the EITC benefit earned (y-axis) versus the level of income (x-axis). Label the kink points and the individual's current benefit and income level. e. With 4,000 hours available in a given year and a wage rate of $16/hr for work, illustrate her budget constraint and an indifference curve (without the EITC) on a separate labor- leisure diagram. f. On the diagram from e, illustrate the impact of the EITC program on her budget constraint and draw in a new optimal indifference curve. g. Given your answer above, did the EITC discourage her from working?

In 2019, a single individual with three children can receive the earned income tax credit (EITC), depending on their income. The phase-in rate is set at 45% for each $1 of income worked up until they earn $14,570, the benefit is then fixed until the phase-out range kicks in with earnings above $19,030 at a rate of 21.06%. a. Determine the maximum benefit earned. b. Determine the income level at which a person no longer receives the EITC. c. Suppose an individual currently earns $40,000 per year, calculate the benefit she would receive from the EITC. d. Illustrate the EITC benefit earned (y-axis) versus the level of income (x-axis). Label the kink points and the individual's current benefit and income level. e. With 4,000 hours available in a given year and a wage rate of $16/hr for work, illustrate her budget constraint and an indifference curve (without the EITC) on a separate labor- leisure diagram. f. On the diagram from e, illustrate the impact of the EITC program on her budget constraint and draw in a new optimal indifference curve. g. Given your answer above, did the EITC discourage her from working?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 9E

Related questions

Question

Transcribed Image Text:In 2019, a single individual with three children can receive the earned income tax credit (EITC),

depending on their income. The phase-in rate is set at 45% for each $1 of income worked up

until they earn $14,570, the benefit is then fixed until the phase-out range kicks in with earnings

above $19,030 at a rate of 21.06%.

a. Determine the maximum benefit earned.

b. Determine the income level at which a person no longer receives the EITC.

c. Suppose an individual currently earns $40,000 per year, calculate the benefit she would

receive from the EITC.

d. Illustrate the EITC benefit earned (y-axis) versus the level of income (x-axis). Label the

kink points and the individual's current benefit and income level.

e. With 4,000 hours available in a given year and a wage rate of $16/hr for work, illustrate

her budget constraint and an indifference curve (without the EITC) on a separate labor-

leisure diagram.

f. On the diagram from e, illustrate the impact of the EITC program on her budget

constraint and draw in a new optimal indifference curve.

g. Given your answer above, did the EITC discourage her from working?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning