In addition to the bonds and preferred stock described in requirements 1 and 2, Micro Advantage has 60,000 shares of common stock outstanding that has a pa value of $10 per share and a current market price of $150 per share. The expected after-tax market return on the firm's common equity is 20%. What is Micro Advantage's weighted-average cost of capital (WACC)? (Round "Interest or Dividend Rate", "After-tax Rate or Expected Return" and "Cost of Capital Component to 2 decimal places (i.e. .1234 = 12.34%), "Weights" to 3 decimal places, and other answers to the nearest whole dollar amount.) Bond Preferred Stock Common Stock Total $ Book Value 0 Interest or Dividend Rate % % % After-tax Rate or Expected Return % % % Current Market Values $ 0 Weights 0.000 Cost of Capital Components % % % 0.00 % Show less

In addition to the bonds and preferred stock described in requirements 1 and 2, Micro Advantage has 60,000 shares of common stock outstanding that has a pa value of $10 per share and a current market price of $150 per share. The expected after-tax market return on the firm's common equity is 20%. What is Micro Advantage's weighted-average cost of capital (WACC)? (Round "Interest or Dividend Rate", "After-tax Rate or Expected Return" and "Cost of Capital Component to 2 decimal places (i.e. .1234 = 12.34%), "Weights" to 3 decimal places, and other answers to the nearest whole dollar amount.) Bond Preferred Stock Common Stock Total $ Book Value 0 Interest or Dividend Rate % % % After-tax Rate or Expected Return % % % Current Market Values $ 0 Weights 0.000 Cost of Capital Components % % % 0.00 % Show less

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 16P

Related questions

Question

qw.127.

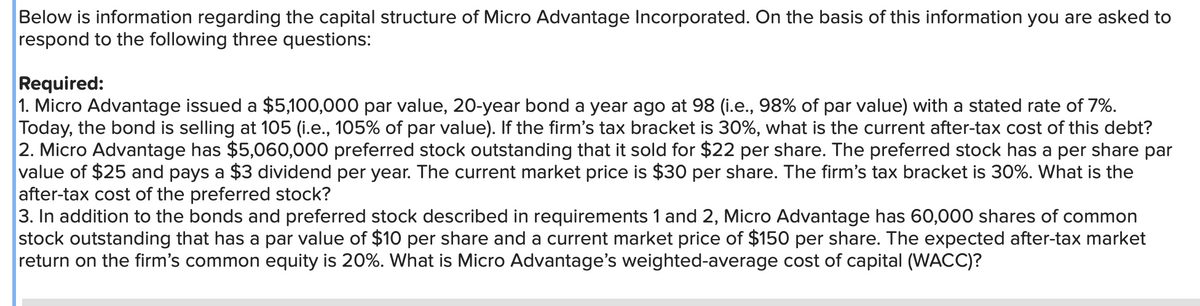

Transcribed Image Text:Below is information regarding the capital structure of Micro Advantage Incorporated. On the basis of this information you are asked to

respond to the following three questions:

Required:

1. Micro Advantage issued a $5,100,000 par value, 20-year bond a year ago at 98 (i.e., 98% of par value) with a stated rate of 7%.

Today, the bond is selling at 105 (i.e., 105% of par value). If the firm's tax bracket is 30%, what is the current after-tax cost of this debt?

2. Micro Advantage has $5,060,000 preferred stock outstanding that it sold for $22 per share. The preferred stock has a per share par

value of $25 and pays a $3 dividend per year. The current market price is $30 per share. The firm's tax bracket is 30%. What is the

after-tax cost of the preferred stock?

3. In addition to the bonds and preferred stock described in requirements 1 and 2, Micro Advantage has 60,000 shares of common

stock outstanding that has a par value of $10 per share and a current market price of $150 per share. The expected after-tax market

return on the firm's common equity is 20%. What is Micro Advantage's weighted-average cost of capital (WACC)?

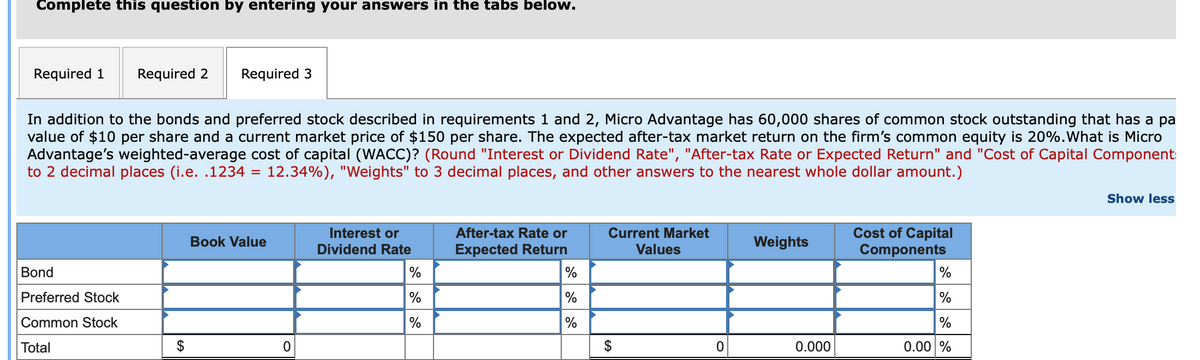

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1 Required 2

In addition to the bonds and preferred stock described in requirements 1 and 2, Micro Advantage has 60,000 shares of common stock outstanding that has a pa

value of $10 per share and a current market price of $150 per share. The expected after-tax market return on the firm's common equity is 20%. What is Micro

Advantage's weighted-average cost of capital (WACC)? (Round "Interest or Dividend Rate", "After-tax Rate or Expected Return" and "Cost of Capital Component:

to 2 decimal places (i.e. .1234 = 12.34%), "Weights" to 3 decimal places, and other answers to the nearest whole dollar amount.)

Bond

Preferred Stock

Common Stock

Total

Required 3

$

Book Value

0

Interest or

Dividend Rate

%

%

%

After-tax Rate or

Expected Return

%

%

%

Current Market

Values

$

EA

0

Weights

0.000

Cost of Capital

Components

%

%

%

0.00 %

Show less

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College