In an effort to improve its competitive position, Oregon Co. recently introduced a new inventory control system. Its management accountant assembled the following data regarding the recent change Item Production cycle time Inventory level Total sales Before new system After new system 50 days $400,000 40 days $300,000 $1,800,000 $2,000,000 Estimated cost data, % of sales Direct materials 35% 30% Direct labor 20% 15% Variable overhead 15% 10% Fixed overhead 10% 5% The company's inventory financing cost is estimated as 10% per year. Required: 1. Estimate the net financial benefit (expressed in terms of operating income) that the company realized from the switch to a new inventory control system. 2. List four (4) non-financial benefits the company might expect as a result to its move to new inventory control system. 3. What are the primary expected costs of implementing a new inventory control system?

In an effort to improve its competitive position, Oregon Co. recently introduced a new inventory control system. Its management accountant assembled the following data regarding the recent change Item Production cycle time Inventory level Total sales Before new system After new system 50 days $400,000 40 days $300,000 $1,800,000 $2,000,000 Estimated cost data, % of sales Direct materials 35% 30% Direct labor 20% 15% Variable overhead 15% 10% Fixed overhead 10% 5% The company's inventory financing cost is estimated as 10% per year. Required: 1. Estimate the net financial benefit (expressed in terms of operating income) that the company realized from the switch to a new inventory control system. 2. List four (4) non-financial benefits the company might expect as a result to its move to new inventory control system. 3. What are the primary expected costs of implementing a new inventory control system?

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 4CP: Golden Eagle Company began operations on April 1 by selling a single product. Data on purchases and...

Related questions

Question

answer part 3 only

i have attached the naswers to part 1 and 2

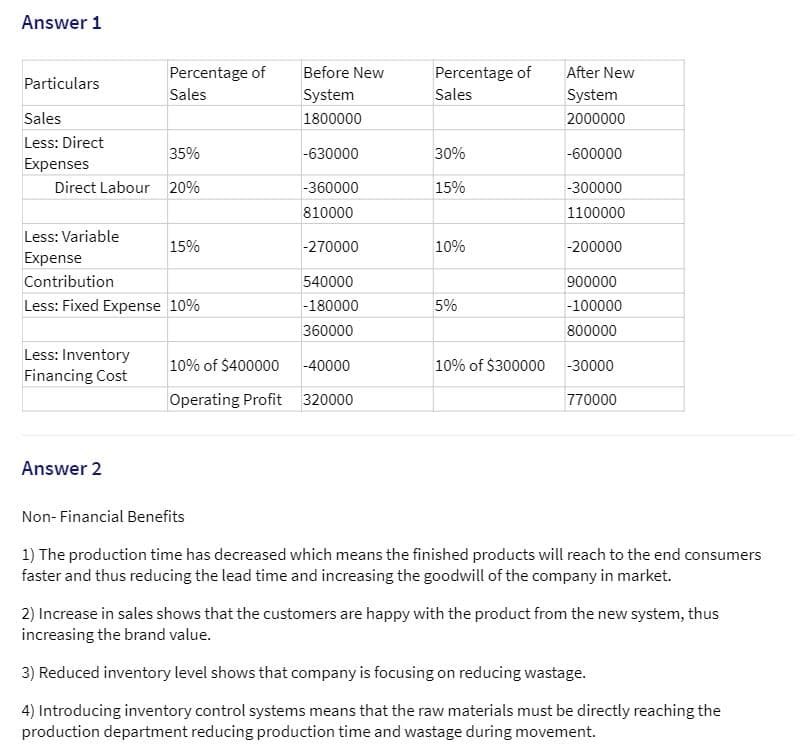

Transcribed Image Text:Answer 1

Percentage of

Before New

Percentage of

After New

Particulars

Sales

System

Sales

System

Sales

1800000

2000000

Less: Direct

35%

-630000

30%

-600000

Expenses

Direct Labour 20%

-360000

15%

-300000

810000

1100000

Less: Variable

15%

-270000

10%

-200000

Expense

Contribution

540000

900000

Less: Fixed Expense 10%

-180000

5%

-100000

360000

800000

Less: Inventory

10% of $400000

-40000

10% of $300000 -30000

Financing Cost

Operating Profit

320000

770000

Answer 2

Non- Financial Benefits

1) The production time has decreased which means the finished products will reach to the end consumers

faster and thus reducing the lead time and increasing the goodwill of the company in market.

2) Increase in sales shows that the customers are happy with the product from the new system, thus

increasing the brand value.

3) Reduced inventory level shows that company is focusing on reducing wastage.

4) Introducing inventory control systems means that the raw materials must be directly reaching the

production department reducing production time and wastage during movement.

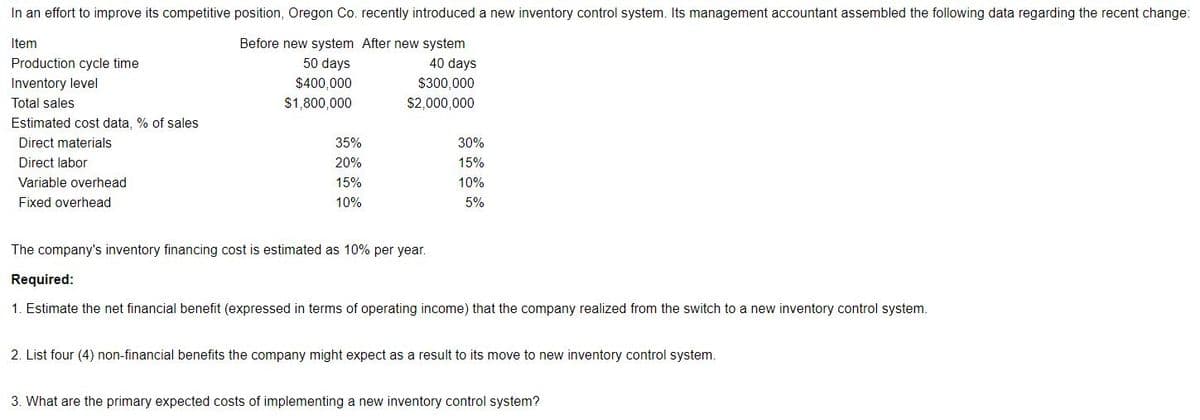

Transcribed Image Text:In an effort to improve its competitive position, Oregon Co. recently introduced a new inventory control system. Its management accountant assembled the following data regarding the recent change:

Item

Before new system After new system

Production cycle time

50 days

40 days

Inventory level

$400,000

$300,000

Total sales

$1,800,000

$2,000,000

Estimated cost data, % of sales

Direct materials

35%

30%

Direct labor

20%

15%

Variable overhead

15%

10%

Fixed overhead

10%

5%

The company's inventory financing cost is estimated as 10% per year.

Required:

1. Estimate the net financial benefit (expressed in terms of operating income) that the company realized from the switch to a new inventory control system.

2. List four (4) non-financial benefits the company might expect as a result to its move to new inventory control system.

3. What are the primary expected costs of implementing a new inventory control system?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub