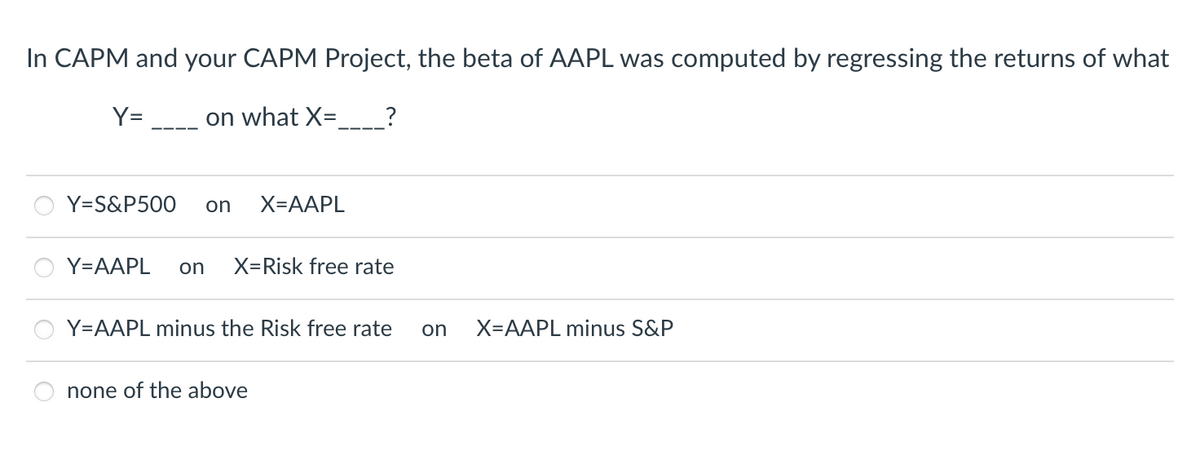

In CAPM and your CAPM Project, the beta of AAPL was computed by regressing the returns of what on what X= Y= Y=S&P500 on X=AAPL ? Y=AAPL on X=Risk free rate Y=AAPL minus the Risk free rate none of the above on X=AAPL minus S&P

Q: Jason just won the Island Luck grand prize give away of $1,200,000. He is offered $100,000 a year…

A: The value of money decreases with time because of inflation. The money received today can be…

Q: 3. A bank pays 4% compounded annually. At the end of 4 years, a 2% bonus is paid on the balance. If…

A: Effective interest rate is the interest rate earned after any additional bonus or any extra benefit…

Q: You buy a share of The Ludwig Corporation stock for $22.90. You expect it to pay dividends of $1.05,…

A: 1). The growth rate in dividend is calculated using following compounded average growth rate…

Q: ssuming that Icebreaker designates the forward contract as a fair value hedge of a foreign currency…

A: Journal entries

Q: When Su Young-Ji went to withdraw $3,000 from the Nationwide Fidelity Mutual fund, he was informed…

A: This is a case of exit load. Exit load is that fee that mutual funds charge when an investor exit a…

Q: Mary Cooper, Sheldon's mother, who lives in east Texas, wants to help pay for her grandchild's…

A: Information Provided: Future value = $295,000 Annual investment = $10,000 Interest rate = 6%

Q: 2. Financial statements for Skyline Inc. and industry average financial ratios are shown below.…

A: Ratios Formula used Current Ratio Current Asset/ Current Liabilities Days Sales Outstanding…

Q: You invested $5,000 in an account 16 years ago. This account paid 8% compounded monthly for the…

A: Given, Amount invested is $5,000 Term is 16 years

Q: The 2020 balance sheet of Osaka's Tennis Shop, Incorporated, showed $640,000 in the common stock…

A: Paid-in Surplus: An account that reflects the extra amount that shareholders have paid to the…

Q: The COVID-19 pandemic is over, and you decide to celebrate by going on a vacation to Japan. The…

A: We have exchange rates between two currency for two different points in time. We have to see how one…

Q: Total Inc. recently purchased a new office building costing $15 million. The firm financed this…

A: Loan amount (P) = $15,000,000 Quarterly payment (C) = $400,000 Quarterly interest rate (r) = 0.015…

Q: Phoebe sued Phyllis and was granted judgment on October 25, Year 1, totaling $9,741.62 inclusive of…

A: Data given: Date of judgement = October 25 (Year 1) Grant awarded (inclusive of the judgment,…

Q: Investments and loans base their interest calculations on one of two possible methods: the interest…

A: As per Bartleby guidelines, If multiple questions are posted, only the first 1 question will be…

Q: Jack is celebrating his 24th birthday today. He wants to start saving in one year’s time, and retire…

A: Data given: FV=SGD 700,000 Rate=3% p.a. (compounded annually) N=70-25+1=46 (70 inclusive) nper=70…

Q: Blue Sky Drone Company has a total asset turnover ratio of 3.50x, net annual sales of $25 million,…

A: Financial leverage refers to the use of debt finance in the capital structure. Leverage ratios…

Q: 1. Calculate the future worth of 20 annual $4,000 deposits in a savings account that earns 8%…

A: Future value of annuity is the value of fixed series of payments after certains time period. The…

Q: A Treasury STRIPS matures in 7 years and has a yield to maturity of 9.4 percent. Assume the par…

A: Treasury strips refer to the bonds that is to be sold at the fair value in the market and at the…

Q: Solve the following rate of return problems. a. An investment of $1,700 today returns $64,000 in 50…

A: IRR is the rate at which present value of future cash flows will be equal to initial investment.…

Q: A young couple buying their first home borrow $60,000 for 30 years at 7.1%, compounded monthly, and…

A:

Q: What rate of interest compounded annually is the same as the rate of interest of 6% compounded…

A: Concept . A = P (1+R)n Where A = amount avaliable after compound interest. P = principal amount. R…

Q: A customer has 3 application options and wants to know which is the best option. - Savings that…

A: As the given options are on different time lines, Interest rates should be converted to per annum…

Q: 3.37 Find the present worth in year 0 for the cash flows shown. Let i= 10% per year. i = 10% 4 2 200…

A: Present value To make an investment, it is important to understand the current value of the…

Q: A mechanical device will cost $30,000 when purchased. Maintenance will cost $2,000 each year. The…

A: The concept of time value of money will be used here. As per the concept of time value of money the…

Q: Henderson's Hardware has an ROA of 15%, a 4.5% profit margin, and an ROE of 25%. What is its total…

A: Given, ROA is 15% Profit margin is 4.5% ROE is 25%

Q: Jason Momoa put up $18,000 to take a long position in XYZ stock with a price of $30. a) If the…

A: Borrowing The act of receiving funds from a lender is called borrowing. The person who borrows money…

Q: . A company had cash and marketable securities worth $200,000 accounts payables worth $51,000,…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: the last year, Bakers Score's Donuts and Sweets has sold, on average, 1,213 ''Fudgie'' brownies per…

A: The contribution is very in the short term profitability and contribution is difference between the…

Q: You and nine friends equally contributed $10,000 to begin a business. 200 shares were authorized…

A: First let us cover the definition of authorized shares and issued shares. Authorized shares are the…

Q: If the rate of inflation is 5.8%, what nominal interest rate is necessary for you to eam a 3.4% real…

A: Data given: Rate of inflation (i)=5.8% Real interest rate (r) =3.4% Nominal interest rate (N)=?…

Q: Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset…

A: Ratio analysis is very important technique of management accounting. Under this various type of…

Q: Given i(4) = 3.150%, find the equivalent effective bi-weekly rate. O a. 0.11592% O b. 0.11954% O c.…

A: Interest rate (r) = 3.15% Number of compounding in a year (n)= 4 Effective annual rate =…

Q: The following information relates to ABC Ltd for the year ended 31 May 2015: Sales Variable costs…

A: Sales R4,50,000.00 Variable Costs R2,70,000.00 Fixed Costs…

Q: If a security currently worth $9,200 will be worth $15,767.18 seven years in the future, what is the…

A: Here,

Q: List 3 operational problems or issues in the Banking & Financial Services sector.

A: 1. Increase in competition There is a huge competition to banks due to emerging fintech companies…

Q: 12-25. Expert Analysts Resources (EAR) has provided you with the following information about three…

A: Degree of operating leverage - It is referred to as the percentage change in net operating income in…

Q: ED eBook Problem Walk-Through Thomson Trucking has $24 billion in assets, and its tax rate is 25%.…

A: Time interest ratio is very important for the company and debts and loans are given on the basis of…

Q: You have just sold your house for $1,100,000 in cash. Your mortgage was originally a 30-year…

A: Given, Value of house $700,000 Rate is 5.25%Term is 30 years

Q: Kevin holds a $10,000 portfolio that consists of four stocks. His investment in each stock, as well…

A: Systematic risk is the risk that a company faces because of the overall condition of the market. It…

Q: You are considering a new product launch. The project will cost $980,000, have a 5-year life, and…

A: Net present value helps in estimating the future value of the cash flows in a specified period of…

Q: If the nominal interest rate is 12% per year compounded monthly, then the effective interest rate…

A: Given: Interest rate = 12% Compounding =Monthly Want effective rate for 6 months.

Q: On September 1, 20x2, Jackson Company entered into a 60-day forward contract denominated in euros.…

A: Given: 1st September 20X2 spot rate = $0.75 Forward contract was entered on 1st September 20X2…

Q: A company has a $170,000 note due in 5 years. How much should be deposited at the end of each…

A: A sinking fund refers to the account in which money is to be set aside for paying the amount of debt…

Q: A company in a line of business similar to ABSA recently issued at par noncallable bonds with a…

A: Current value of the bond refers to the sum of interest payments and maturity value discounted at…

Q: fy received 18,600 from his original 21,000 salary loan. If the lending company charged him 10.2%…

A: Discount is the form of interest which is charged on the principal amount and it is deducted from…

Q: 4. Present value Finding a present value is the reverse of finding a future value. is the process of…

A: Given, The amount paid $10500 Term is 13 years

Q: A bond sells for $866.09 and has a coupon rate of 6.40 percent. If the bond has 14 years until…

A: Bond price = $866.09 Semiannual coupon amount = $1000 * 0.064 / 2 = $32 Semiannual maturity period =…

Q: Suppose a European call option to buy 1 euro for 1.40 CAD costs 0.08 CAD. The option maturity is in…

A: Strike price is 1.40 CAD Premium is 0.08CAD Forward rate is 1.50CAD Note: Ignoring time Value of…

Q: Marshall and Tiana have a new grandson. How much money should they invest now so that he will have…

A: Information Provided: Future value = $63,000 Interest rate = 4.65% compounded annually Period of…

Q: QUESTION 1 What is the present value of $12,350 to be received 4 years from today if the discount…

A: Note: Hi! Thank you for the question, As per the Honor code, we are allowed to answer one question…

Q: Red, Incorporated, Yellow Corporation, and Blue Company each will pay a dividend of $3.30 next year.…

A: Given The expected dividend is $3.30 Growth rate is 5%

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- The SML implies that if you could find an investment with a negative beta, its expected return, E(k), would be: E(k) < 0 E(k) < k f 0 < E(k) < k f kF < E(k) < E(kM)An analyst has modeled the stock of Crisp Trucking using a two-factor APTmodel. The risk-free rate is 6%, the expected return on the first factor (r1) is12%, and the expected return on the second factor (r2) is 8%. If bi1 5= 0.7 andbi2 5= 0.9, what is Crisp’s required return?Assume that an investment is expected to generate the following returns: a 10% chance of a $1,400 return, a 50% chance of a $6,600 return, and a 40% chance of a $1,500 return. What is the expected rate of return on this investment? Note: The solution must be displayed on an Excel sheet using Excel functions such as =PV(...) and =FV(...) etc.

- You observe the following: ABC Inc. has 1.8 Beta and .2 Expected return XYZ Inc has 1.6 Beta and .19 Expected return What would the risk free rate be if ABC and XYZ, were priced correctly?If X-Co has a Beta of 1.6, and the risk-free rate is 4.5%, and the average market risk premium is 6%, what is X-Co’s estimated required return per the CAPM? (show calculations)assume that risk free rate, RF, is currently 8%, the market return, 1m, is 12%, and asset a beta ba, is 1.10. (a) Draw the SML on a set of "non-diversifiable risk Please sent me complete this question for further reliance.

- Assume that the risk-free rate, RF, is currently 9% and that the market return, rm, is currently 16%. a. Calculate the market risk premium. b. Given the previous data, calculate the required return on asset A having a beta of 0.4 and asset B having a beta of 1.8.An analyst has modeled the stock of Crisp Trucking using a two-factor APT model. The risk-free rate is 6%, the expected return on the first factor (r1) is 12%, and the expected return on the second factor (r2) is 8%. If bi1 = 0.7 and bi2 = 0.9, what is Crisp’s required return?Use the required return-beta equation from the CAPM What is the required return if the risk-free rate is 4%, beta 1.5 and the expected market return 8%? What is the risk-free rate if beta is 1.1, the required return 8.4% and the expected market return 8%? What is beta if the risk-free rate is 4%, the required return 12% and the expected market return 8%? What is the expected market return if the risk-free rate is 4%, beta 1.5 and the required return 12%?

- Given the following probability distributions, what are the expected returns for the Market and for Security J? Statei Pr i rM rJ 1 0.3 −10% 40% 2 0.4 10 −20 3 0.3 30 30 Group of answer choices 10.0%; 11.3% 9.5%; 13.0% 10.0%; 9.5% 10.0%; 13.0% 13.0%; 10.0%You observe the following: ABC Inc. has 1.8 Beta and .2 Expected return ABC Inc. has 1.8 Beta and .2 Expected return XYZ Inc has 1.6 Beta and .19 Expected return If the risk free rate is 6% what are the reward to risk ratios for XYZ Inc?The risk-free rate and the expected market rate of return and 0.056 and 0.125. Using the CAPM model, the expected rate of return of a security, that you are interested in, has a beta of 1.25 would be equal to Calculate the expected rate of return