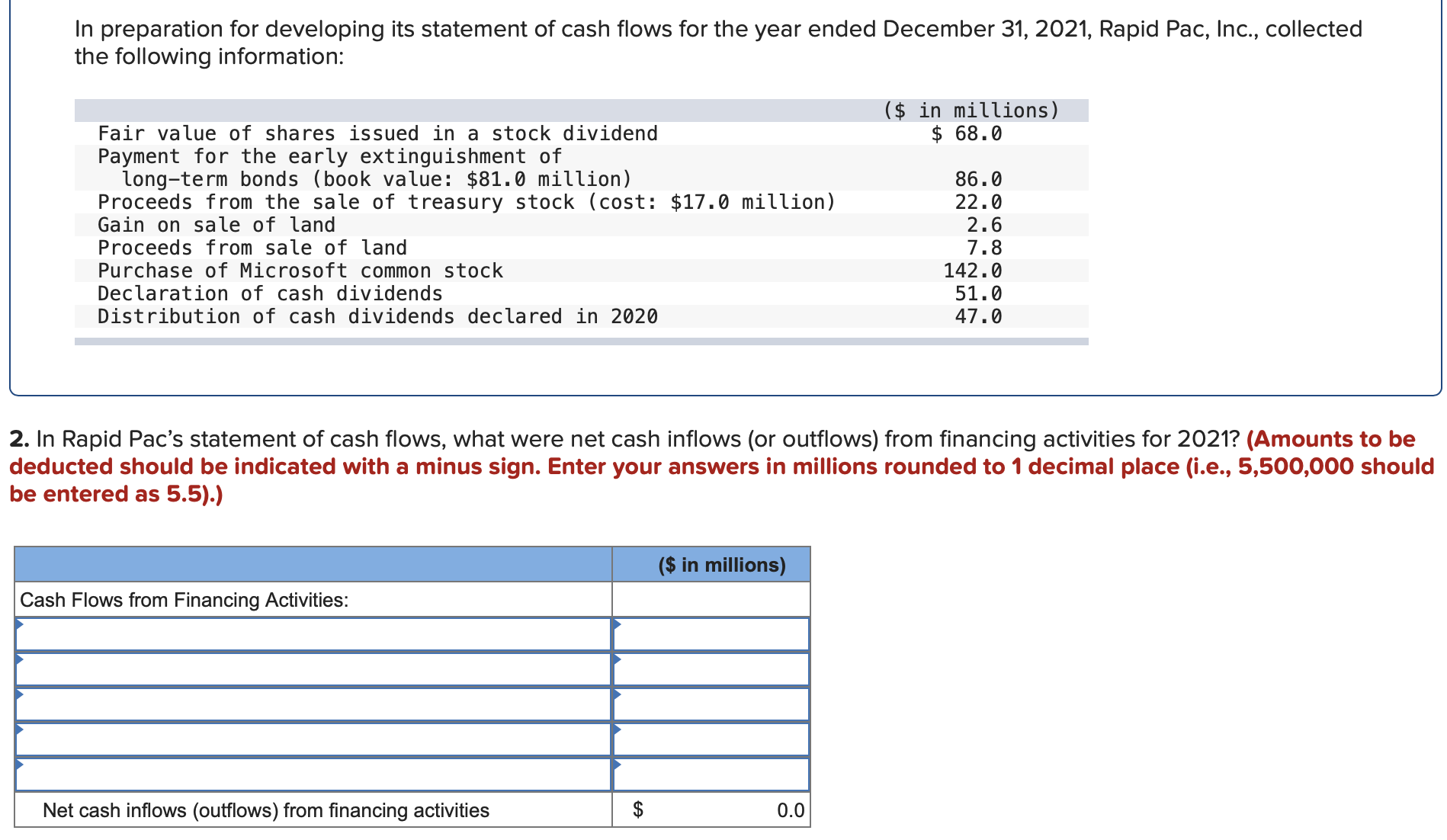

In preparation for developing its statement of cash flows for the year ended December 31, 2021, Rapid Pac, Inc., collected the following information: ($ in millions) $ 68.0 Fair value of shares issued in a stock dividend Payment for the early extinguishment of long-term bonds (book value: $81.0 million) Proceeds from the sale of treasury stock (cost: $17.0 million) Gain on sale of land Proceeds from sale of land Purchase of Microsoft common stock Declaration of cash dividends Distribution of cash dividends declared in 2020 86.0 22.0 2.6 7.8 142.0 51.0 47.0 2. In Rapid Pac's statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2021? (Amounts to be deducted should be indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).)

In preparation for developing its statement of cash flows for the year ended December 31, 2021, Rapid Pac, Inc., collected the following information: ($ in millions) $ 68.0 Fair value of shares issued in a stock dividend Payment for the early extinguishment of long-term bonds (book value: $81.0 million) Proceeds from the sale of treasury stock (cost: $17.0 million) Gain on sale of land Proceeds from sale of land Purchase of Microsoft common stock Declaration of cash dividends Distribution of cash dividends declared in 2020 86.0 22.0 2.6 7.8 142.0 51.0 47.0 2. In Rapid Pac's statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2021? (Amounts to be deducted should be indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 32BE

Related questions

Question

Transcribed Image Text:In preparation for developing its statement of cash flows for the year ended December 31, 2021, Rapid Pac, Inc., collected

the following information:

($ in millions)

$ 68.0

Fair value of shares issued in a stock dividend

Payment for the early extinguishment of

long-term bonds (book value: $81.0 million)

Proceeds from the sale of treasury stock (cost: $17.0 million)

Gain on sale of land

Proceeds from sale of land

Purchase of Microsoft common stock

Declaration of cash dividends

Distribution of cash dividends declared in 2020

86.0

22.0

2.6

7.8

142.0

51.0

47.0

2. In Rapid Pac's statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2021? (Amounts to be

deducted should be indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should

be entered as 5.5).)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,