In the short run, a firm in a monopolistically competitive industry has a cost function equal to C(Q) = 300 + 5Q where Q is annual output, so the firm's annual fixed cost is 300 and its marginal cost is 5. Each firm in the industry has its own demand equal to QD = 100 – 4P, so its inverse demand is P = 25 – 0.25QD, and its revenue is Qp(25 – 0.25QD), and its marginal revenue is 25 – 0.5QD. %3D (a) Calculate the price and quantity that maximizes the firm's profits. What is the firm's annual profit at that price? (b) Calculate the elasticity of demand at the monopoly price and quantity. (c) Assuming new firms have the same costs and can expect the demand to be the same for them as it is for existing firms, can new firms profitably enter this industry?

In the short run, a firm in a monopolistically competitive industry has a cost function equal to C(Q) = 300 + 5Q where Q is annual output, so the firm's annual fixed cost is 300 and its marginal cost is 5. Each firm in the industry has its own demand equal to QD = 100 – 4P, so its inverse demand is P = 25 – 0.25QD, and its revenue is Qp(25 – 0.25QD), and its marginal revenue is 25 – 0.5QD. %3D (a) Calculate the price and quantity that maximizes the firm's profits. What is the firm's annual profit at that price? (b) Calculate the elasticity of demand at the monopoly price and quantity. (c) Assuming new firms have the same costs and can expect the demand to be the same for them as it is for existing firms, can new firms profitably enter this industry?

Principles of Economics, 7th Edition (MindTap Course List)

7th Edition

ISBN:9781285165875

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter16: Monopolistic Competition

Section: Chapter Questions

Problem 4PA

Related questions

Question

Transcribed Image Text:8.

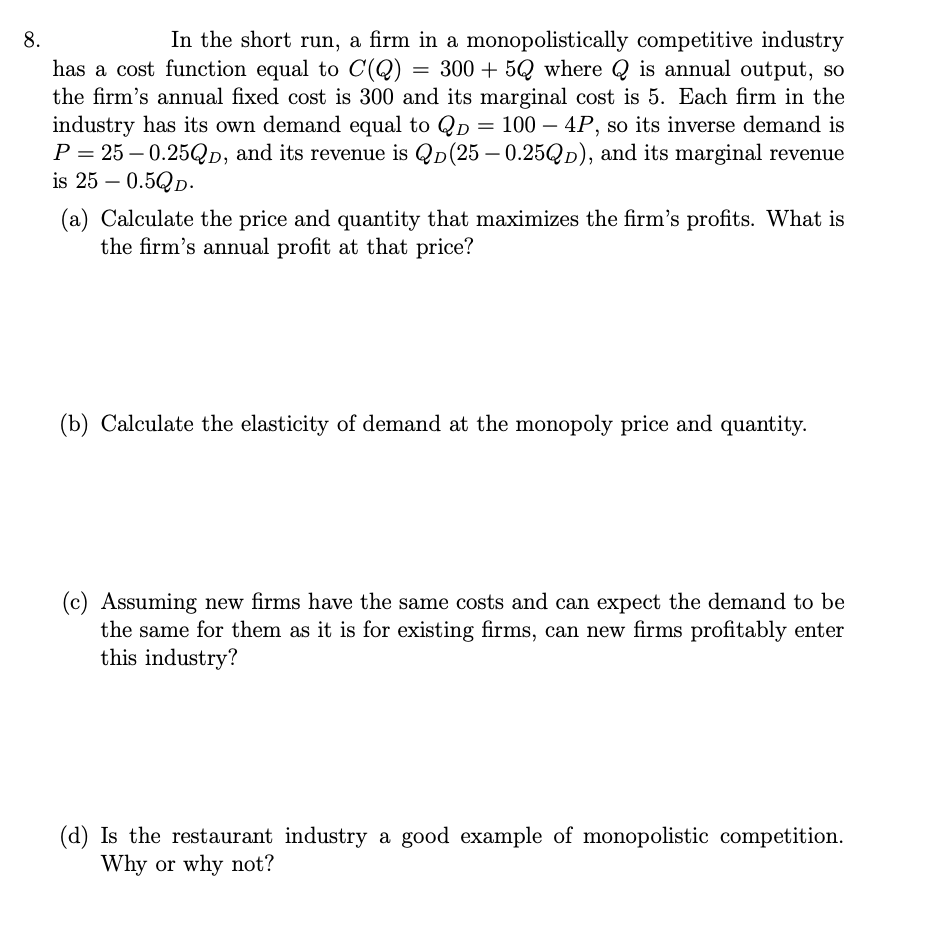

In the short run, a firm in a monopolistically competitive industry

has a cost function equal to C(Q) = 300 + 5Q where Q is annual output, so

the firm's annual fixed cost is 300 and its marginal cost is 5. Each firm in the

industry has its own demand equal to QD = 100 – 4P, so its inverse demand is

P = 25 – 0.25QD, and its revenue is Qp(25 – 0.25QD), and its marginal revenue

is 25 – 0.5QD.

(a) Calculate the price and quantity that maximizes the firm's profits. What is

the firm's annual profit at that price?

(b) Calculate the elasticity of demand at the monopoly price and quantity.

(c) Assuming new firms have the same costs and can expect the demand to be

the same for them as it is for existing firms, can new firms profitably enter

this industry?

(d) Is the restaurant industry a good example of monopolistic competition.

Why or why not?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning