In this question the income tax calculated how was it found? what is the transactions? help please

In this question the income tax calculated how was it found? what is the transactions? help please

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter16: Multijurisdictional Taxation

Section: Chapter Questions

Problem 17P

Related questions

Question

In this question the income tax calculated how was it found? what is the transactions? help please

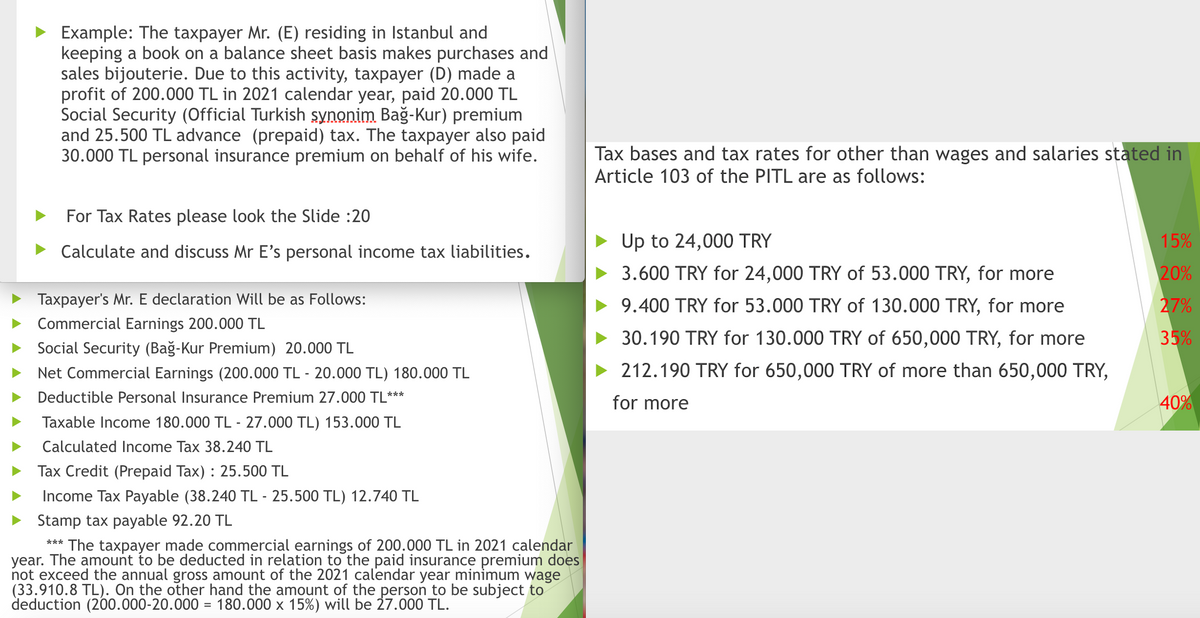

Transcribed Image Text:Example: The taxpayer Mr. (E) residing in Istanbul and

keeping a book on a balance sheet basis makes purchases and

sales bijouterie. Due to this activity, taxpayer (D) made a

profit of 200.000 TL in 2021 calendar year, paid 20.000 TL

Social Security (Official Turkish şynonim. Bağ-Kur) premium

and 25.500 TL advance (prepaid) tax. The taxpayer also paid

30.000 TL personal insurance premium on behalf of his wife.

Tax bases and tax rates for other than wages and salaries stated in

Article 103 of the PITL are as follows:

For Tax Rates please look the Slide :20

• Up to 24,000 TRY

15%

Calculate and discuss Mr E's personal income tax liabilities.

3.600 TRY for 24,000 TRY of 53.000 TRY, for more

20%

Taxpayer's Mr. E declaration Will be as Follows:

9.400 TRY for 53.000 TRY of 130.000 TRY, for more

27%

Commercial Earnings 200.000 TL

• 30.190 TRY for 130.000 TRY of 650,000 TRY, for more

35%

Social Security (Bağ-Kur Premium) 20.000 TL

Net Commercial Earnings (200.000 TL - 20.000 TL) 180.000 TL

• 212.190 TRY for 650,000 TRY of more than 650,000 TRY,

Deductible Personal Insurance Premium 27.000 TL

***

for more

40%

Taxable Income 180.000 TL - 27.000 TL) 153.000 TL

Calculated Income Tax 38.240 TL

Tax Credit (Prepaid Tax) : 25.500 TL

Income Tax Payable (38.240 TL - 25.500 TL) 12.740 TL

Stamp tax payable 92.20 TL

*** The taxpayer made commercial earnings of 200.000 TL in 2021 calendar

year. The amount to be deducted in relation to the paid insurance premium does

not exceed the annual gross amount of the 2021 calendar year minimum wage

(33.910.8 TL). On the other hand the amount of the person to be subject to

deduction (200.000-20.000 = 180.000 x 15%) will be 27.000 TL.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you