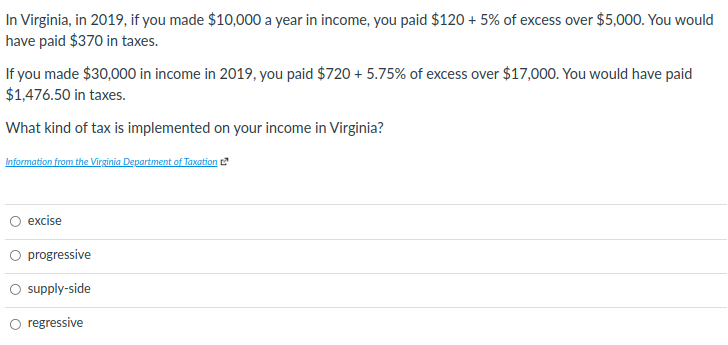

In Virginia, in 2019, if you made $10,000 a year in income, you paid $120 + 5% of excess over $5,000. You would have paid $370 in taxes. If you made $30,000 in income in 2019, you paid $720 + 5.75% of excess over $17,000. You would have paid $1,476.50 in taxes. What kind of tax is implemented on your income in Virginia? Information from the Virsinia Department of Taxation e O excise O progressive O supply-side regressive

In Virginia, in 2019, if you made $10,000 a year in income, you paid $120 + 5% of excess over $5,000. You would have paid $370 in taxes. If you made $30,000 in income in 2019, you paid $720 + 5.75% of excess over $17,000. You would have paid $1,476.50 in taxes. What kind of tax is implemented on your income in Virginia? Information from the Virsinia Department of Taxation e O excise O progressive O supply-side regressive

Chapter16: The Public Sector

Section: Chapter Questions

Problem 9SQP

Related questions

Question

Answer this question for me mate. Much appreciated. :)

Transcribed Image Text:In Virginia, in 2019, if you made $10,000 a year in income, you paid $120 + 5% of excess over $5,000. You would

have paid $370 in taxes.

If you made $30,000 in income in 2019, you paid $720 + 5.75% of excess over $17,000. You would have paid

$1,476.50 in taxes.

What kind of tax is implemented on your income in Virginia?

Information from the Virginia Department of Taxation

O excise

O progressive

O supply-side

O regressive

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning