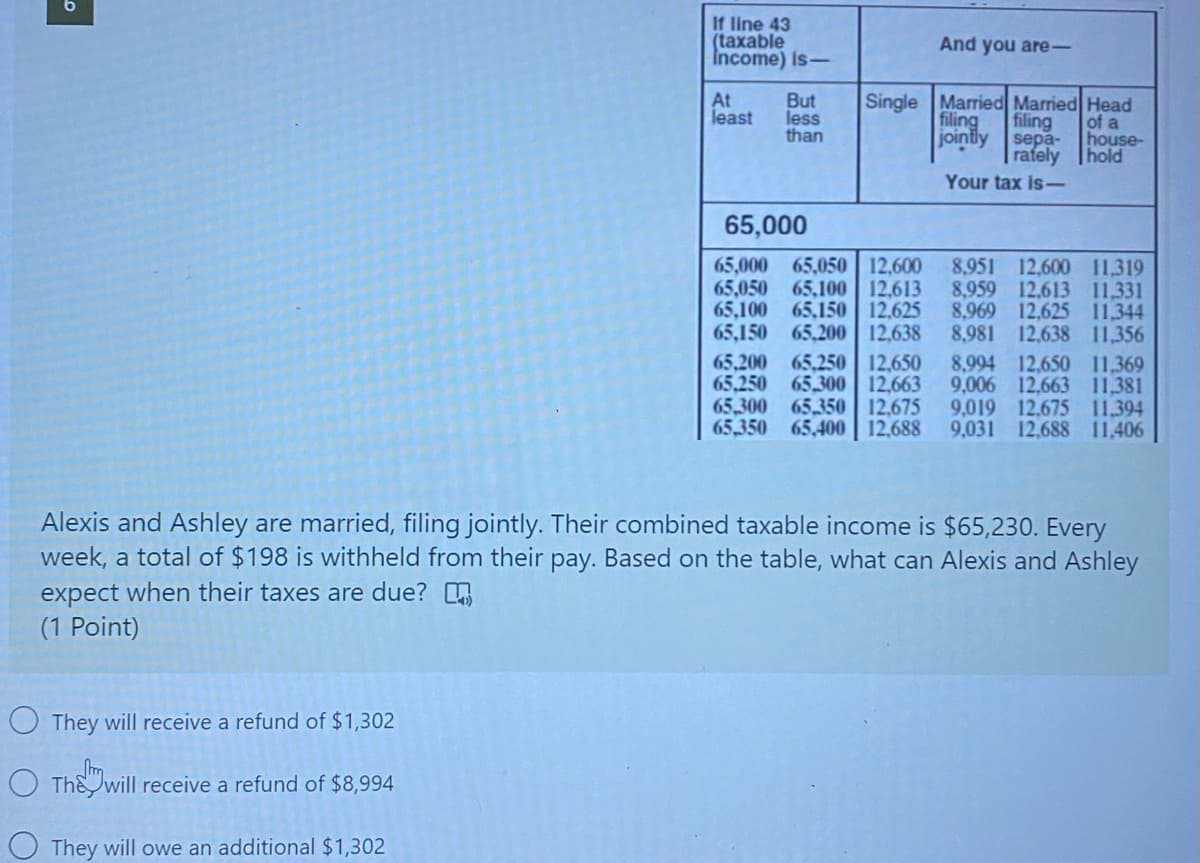

Income) Is- Single Married Married Head of a house- rafely hold At least But less than filing filing jointly sepa- Your tax is- 65,000 65,000 65,050 12,600 8,951 12,600 11,319 65,050 65,100 12,613 65,100 65,150 12,625 65,150 65,200 12,638 65,200 65,250 12,650 8,994 12,650 11,369 65.250 65.300 12,663 65,300 65,350 12,675 65,350 65,400 12,688 8,959 12,613 11,331 8,969 12,625 11.344 8,981 12,638 11,356 9,006 12,663 11,381 9,019 12,675 11,394 9,031 12,688 11,406 Alexis and Ashley are married, filing jointly. Their combined taxable income is $65,230. Every week, a total of $198 is withheld from their pay. Based on the table, what can Alexis and Ashley expect when their taxes are due? (1 Point) O They will receive a refund of $1,302 O Thế will receive a refund of $8,994 ) They will owe an additional $1.302

Income) Is- Single Married Married Head of a house- rafely hold At least But less than filing filing jointly sepa- Your tax is- 65,000 65,000 65,050 12,600 8,951 12,600 11,319 65,050 65,100 12,613 65,100 65,150 12,625 65,150 65,200 12,638 65,200 65,250 12,650 8,994 12,650 11,369 65.250 65.300 12,663 65,300 65,350 12,675 65,350 65,400 12,688 8,959 12,613 11,331 8,969 12,625 11.344 8,981 12,638 11,356 9,006 12,663 11,381 9,019 12,675 11,394 9,031 12,688 11,406 Alexis and Ashley are married, filing jointly. Their combined taxable income is $65,230. Every week, a total of $198 is withheld from their pay. Based on the table, what can Alexis and Ashley expect when their taxes are due? (1 Point) O They will receive a refund of $1,302 O Thế will receive a refund of $8,994 ) They will owe an additional $1.302

Chapter16: Property Transactions: Capital Gains And Losses

Section: Chapter Questions

Problem 47P

Related questions

Question

Transcribed Image Text:If line 43

(taxable

Income) Is-

And you are-

At

least

But

less

than

Single Married Married Head

filing

jointly

of a

house-

rafely hold

filing

sepa-

Your tax is

65,000

65,000 65,050 12,600

65,050 65,100 12,613

65,100 65,150 12.625

65,150 65,200 12,638

65,200 65,250 12,650

65,250

65,300 65350 12,675

65,350 65,400 12,688

8,951 12,600 11.319

8,959 12,613 11,331

8,969 12,625 11,344

8,981 12,638 11,356

8,994 12,650 11,369

9,006 12,663 11,381

9,019 12,675 11,394

9,031 12,688 11,406

65,300 12,663

Alexis and Ashley are married, filing jointly. Their combined taxable income is $65,230. Every

week, a total of $198 is withheld from their pay. Based on the table, what can Alexis and Ashley

expect when their taxes are due?

(1 Point)

O They will receive a refund of $1,302

Thế will receive a refund of $8,994

O They will owe an additional $1,302

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT