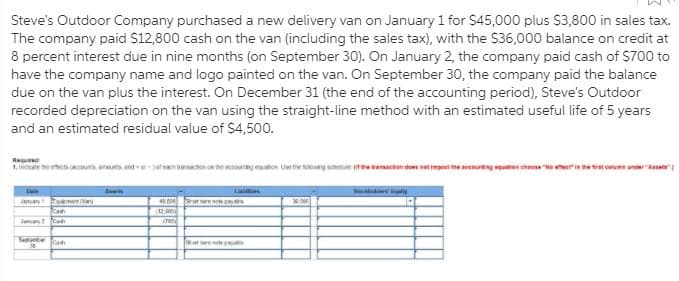

Indicate the effects (accounts, amounts, and + or −) of each transaction on the accounting equation.

[The following information applies to the questions displayed below.]

Steve's Outdoor Company purchased a new delivery van on January 1 for $45,000 plus $3,800 in sales tax. The company paid $12,800 cash on the van (including the sales tax), signing an 8 percent note for the $36,000 balance due in nine months (on September 30). On January 2, the company paid cash of $700 to have the company name and logo painted on the van. On September 30, the company paid the balance due on the van plus the interest. On December 31 (the end of the accounting period), Steve's Outdoor recorded

Required:

1. Indicate the effects (accounts, amounts, and + or −) of each transaction on the

Trending now

This is a popular solution!

Step by step

Solved in 2 steps