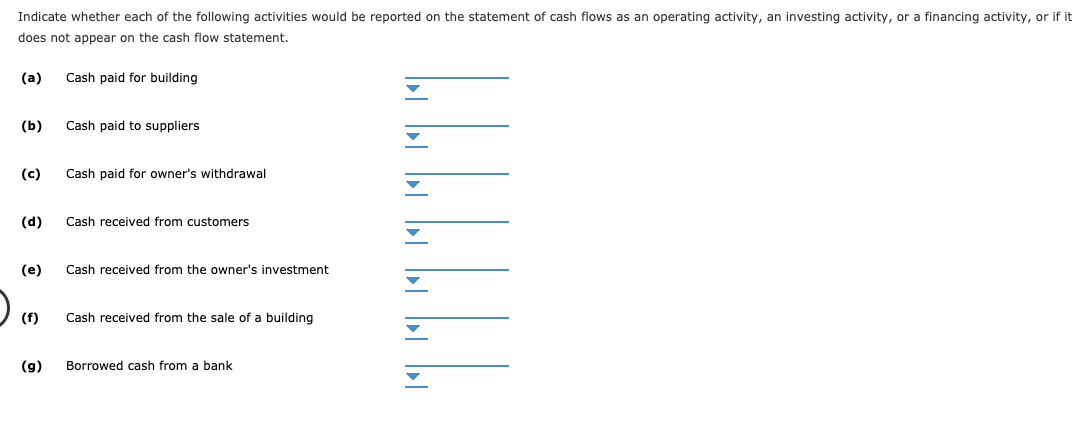

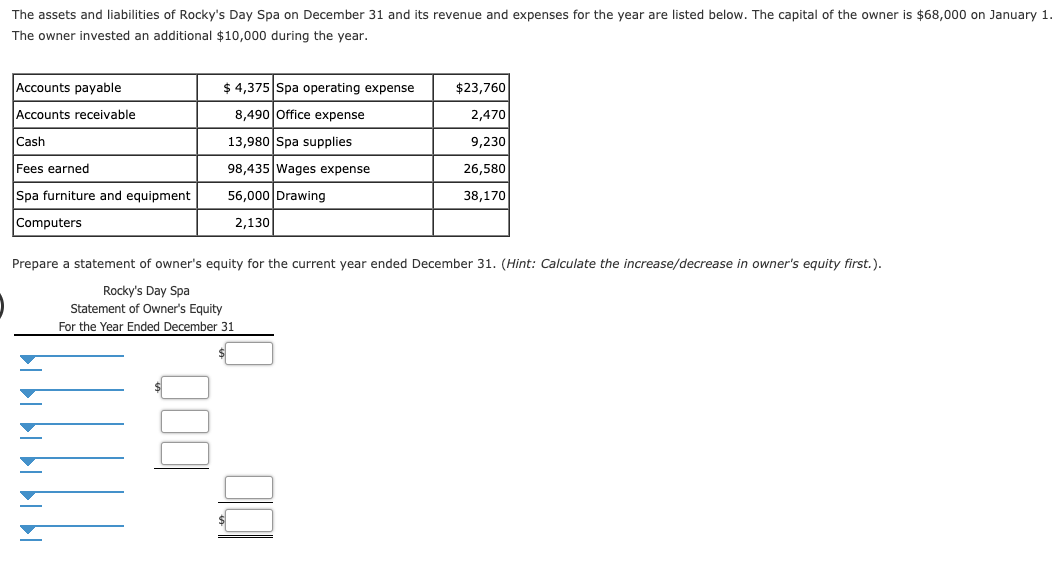

Indicate whether each of the following activities would be reported on the statement of cash flows as an operating activity, an investing activity, or a financing activity, or if it does not appear on the cash flow statement. Cash paid for building (a) Cash paid to suppliers (b) (c) Cash paid for owner's withdrawal Cash received from customers (d) (e) Cash received from the owner's investment (f) Cash received from the sale of a building Borrowed cash from a bank (g) The assets and liabilities of Rocky's Day Spa on December 31 and its revenue and expenses for the year are listed below. The capital of the owner is $68,000 on January 1. The owner invested an additional $10,000 during the year. Accounts payable $ 4,375 Spa operating expense $23,760 8,490 Office expense Accounts receivable 2,470 13,980 Spa supplies Cash 9,230 98,435 Wages expense Fees earned 26,580 Spa furniture and equipment 56,000 Drawing 38,170 2,130 Computers Prepare a statement of owner's equity for the current year ended December 31. (Hint: Calculate the increase/decrease in owner's equity first.) Rocky's Day Spa Statement of Owner's Equity For the Year Ended December 31

Indicate whether each of the following activities would be reported on the statement of cash flows as an operating activity, an investing activity, or a financing activity, or if it does not appear on the cash flow statement. Cash paid for building (a) Cash paid to suppliers (b) (c) Cash paid for owner's withdrawal Cash received from customers (d) (e) Cash received from the owner's investment (f) Cash received from the sale of a building Borrowed cash from a bank (g) The assets and liabilities of Rocky's Day Spa on December 31 and its revenue and expenses for the year are listed below. The capital of the owner is $68,000 on January 1. The owner invested an additional $10,000 during the year. Accounts payable $ 4,375 Spa operating expense $23,760 8,490 Office expense Accounts receivable 2,470 13,980 Spa supplies Cash 9,230 98,435 Wages expense Fees earned 26,580 Spa furniture and equipment 56,000 Drawing 38,170 2,130 Computers Prepare a statement of owner's equity for the current year ended December 31. (Hint: Calculate the increase/decrease in owner's equity first.) Rocky's Day Spa Statement of Owner's Equity For the Year Ended December 31

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter7: Receivables And Investments

Section: Chapter Questions

Problem 7.19MCE

Related questions

Question

two questions

Transcribed Image Text:Indicate whether each of the following activities would be reported on the statement of cash flows as an operating activity, an investing activity, or a financing activity, or if it

does not appear on the cash flow statement.

Cash paid for building

(a)

Cash paid to suppliers

(b)

(c)

Cash paid for owner's withdrawal

Cash received from customers

(d)

(e)

Cash received from the owner's investment

(f)

Cash received from the sale of a building

Borrowed cash from a bank

(g)

Transcribed Image Text:The assets and liabilities of Rocky's Day Spa on December 31 and its revenue and expenses for the year are listed below. The capital of the owner is $68,000 on January 1.

The owner invested an additional $10,000 during the year.

Accounts payable

$ 4,375 Spa operating expense

$23,760

8,490 Office expense

Accounts receivable

2,470

13,980 Spa supplies

Cash

9,230

98,435 Wages expense

Fees earned

26,580

Spa furniture and equipment

56,000 Drawing

38,170

2,130

Computers

Prepare a statement of owner's equity for the current year ended December 31. (Hint: Calculate the increase/decrease in owner's equity first.)

Rocky's Day Spa

Statement of Owner's Equity

For the Year Ended December 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning