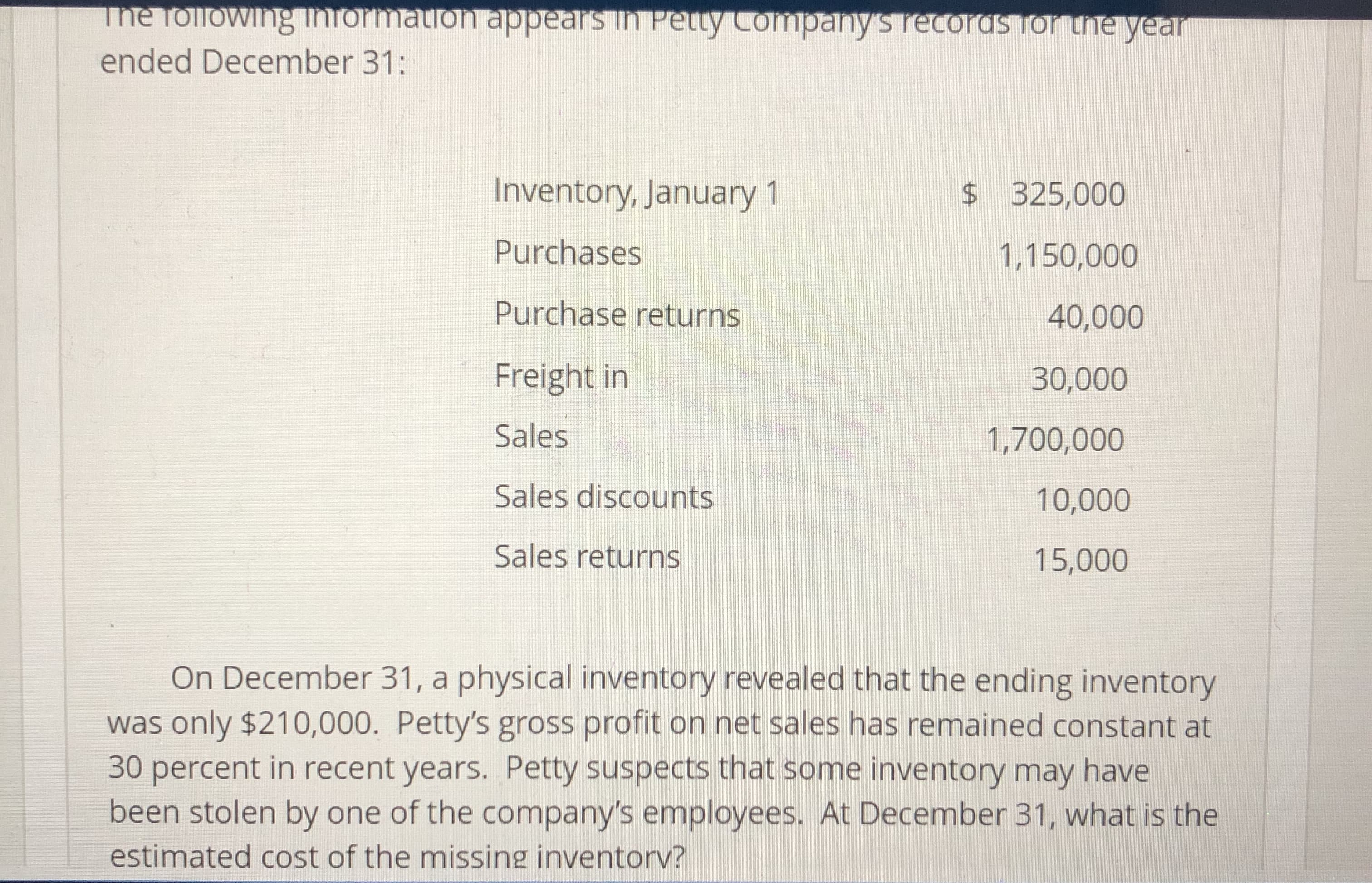

Ine Toirowing inormation appears in Pety Company s recoras for ue year ended December 31: Inventory, January 1 Purchases Purchase returns Freight in Sales Sales discounts Sales returns $325,000 1,150,000 40,000 30,000 1,700,000 10,000 15,000 On December 31, a physical inventory revealed that the ending inventory was only $210,000. Petty's gross profit on net sales has remained constant at 30 percent in recent years. Petty suspects that some inventory may have been stolen by one of the company's employees. At December 31, what is the estimated cost of the missing inventorv?

Ine Toirowing inormation appears in Pety Company s recoras for ue year ended December 31: Inventory, January 1 Purchases Purchase returns Freight in Sales Sales discounts Sales returns $325,000 1,150,000 40,000 30,000 1,700,000 10,000 15,000 On December 31, a physical inventory revealed that the ending inventory was only $210,000. Petty's gross profit on net sales has remained constant at 30 percent in recent years. Petty suspects that some inventory may have been stolen by one of the company's employees. At December 31, what is the estimated cost of the missing inventorv?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 14RE: On January 1 of Year 1, Dorso Company adopted the dollar-value LIFO method of inventory costing....

Related questions

Question

Transcribed Image Text:Ine Toirowing inormation appears in Pety Company s recoras for ue year

ended December 31:

Inventory, January 1

Purchases

Purchase returns

Freight in

Sales

Sales discounts

Sales returns

$325,000

1,150,000

40,000

30,000

1,700,000

10,000

15,000

On December 31, a physical inventory revealed that the ending inventory

was only $210,000. Petty's gross profit on net sales has remained constant at

30 percent in recent years. Petty suspects that some inventory may have

been stolen by one of the company's employees. At December 31, what is the

estimated cost of the missing inventorv?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning