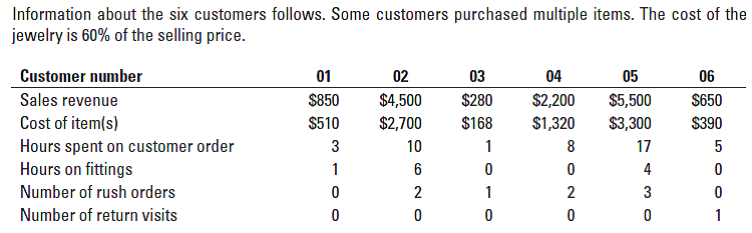

Information about the six customers follows. Some customers purchased multiple items. The cost of the jewelry is 60% of the selling price. Customer number 03 $280 05 01 02 04 06 Sales revenue $850 $4,500 $2,200 $5,500 $650 Cost of item(s) Hours spent on customer order Hours on fittings $3,300 $510 $2,700 $168 $1,320 $390 10 8 17 6 Number of rush orders 2 3 Number of return visits 1. Calculate the customer-level operating income for each customer. Rank the customers in order of most to least profitable and prepare a customer-profitability analysis, as in Exhibits 14-3 and 14-4. 2. Are any customers unprofitable? What is causing this? What should Bracelet Delights do about these customers? Required

Information about the six customers follows. Some customers purchased multiple items. The cost of the jewelry is 60% of the selling price. Customer number 03 $280 05 01 02 04 06 Sales revenue $850 $4,500 $2,200 $5,500 $650 Cost of item(s) Hours spent on customer order Hours on fittings $3,300 $510 $2,700 $168 $1,320 $390 10 8 17 6 Number of rush orders 2 3 Number of return visits 1. Calculate the customer-level operating income for each customer. Rank the customers in order of most to least profitable and prepare a customer-profitability analysis, as in Exhibits 14-3 and 14-4. 2. Are any customers unprofitable? What is causing this? What should Bracelet Delights do about these customers? Required

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter2: Basic Managerial Accounting Concepts

Section: Chapter Questions

Problem 15MCQ: Use the following information for Multiple- Choice Questions 2-13 through 2-18: Last year, Barnard...

Related questions

Question

Customer profitability. Bracelet Delights is a new company that manufactures custom jewelry. Bracelet Delights currently has six customers referenced by customer number: 01, 02, 03, 04, 05, and 06. Besides the costs of making the jewelry, the company has the following activities:

- Customer orders. The salespeople, designers, and jewelry makers spend time with the customer. The cost-driver rate is $42 per hour spent with a customer.

- Customer fittings. Before the jewelry piece is completed, the customer may come in to make sure it looks right and fits properly. Cost-driver rate is $30 per hour.

- Rush orders. Some customers want their jewelry quickly. The cost-driver rate is $90 per rush order.

- Number of customer return visits. Customers may return jewelry up to 30 days after the pickup of the jewelry to have something refitted or repaired at no charge. The cost-driver rate is $40 per return visit.

Transcribed Image Text:Information about the six customers follows. Some customers purchased multiple items. The cost of the

jewelry is 60% of the selling price.

Customer number

03

$280

05

01

02

04

06

Sales revenue

$850

$4,500

$2,200

$5,500

$650

Cost of item(s)

Hours spent on customer order

Hours on fittings

$3,300

$510

$2,700

$168

$1,320

$390

10

8

17

6

Number of rush orders

2

3

Number of return visits

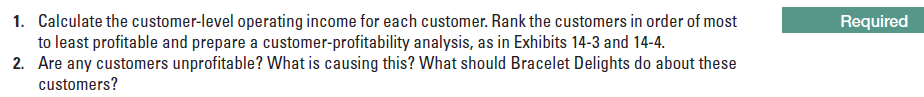

Transcribed Image Text:1. Calculate the customer-level operating income for each customer. Rank the customers in order of most

to least profitable and prepare a customer-profitability analysis, as in Exhibits 14-3 and 14-4.

2. Are any customers unprofitable? What is causing this? What should Bracelet Delights do about these

customers?

Required

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage