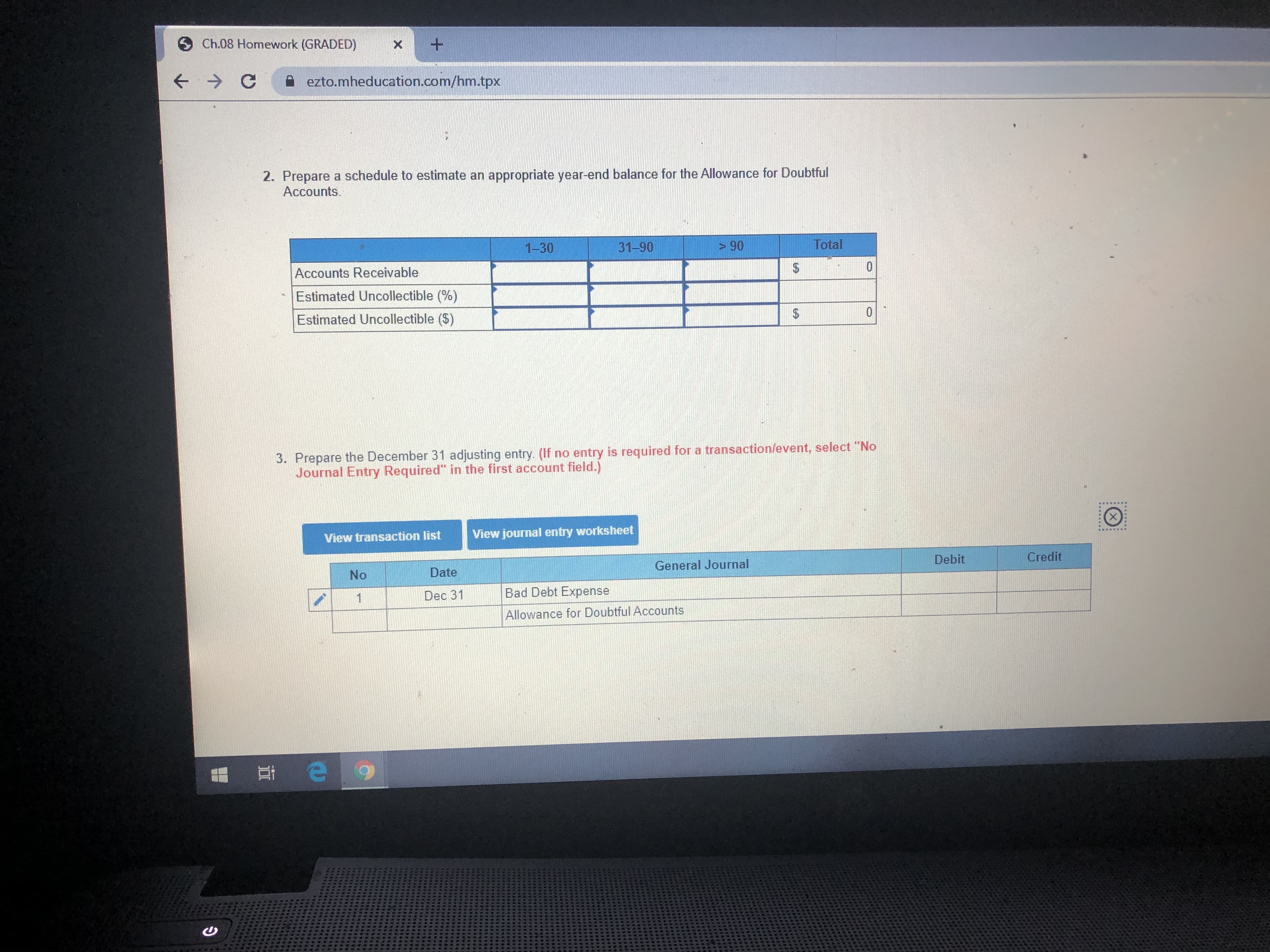

Innovative Tech Inc. (ITI) uses the percentage of credit sales method to estimate bad debts each month and then uses the aging method at year-end. During November, ITI sold services on account for $160,000 and estimated that 1 of one percent of those sales would be uncollectible. At its December 31 year-end, total Accounts Receivable is $80,000, aged as follows: (1) 1-30 days old, $65,000; (2) 31-90 days old, $12,000; and (3) more than 90 days old, $3,000. Experience has shown that for each age group, the average rate of uncollectibility is (1) 12 percent, (2) 24 percent, and (3) 48 percent, respectively. Before the end-of-year adjusting entry is made, the Allowance for Doubtful Accounts has a $1,100 credit balance at December 31. 4 Required: 1. Prepare the November adjusting entry for bad debts. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet Xx No Date General Journal Debit Credit 1 Nov 30 Bad Debt Expense 1,200 Allowance for Doubtful Accounts 1,200 S Ch.08 Homework (GRADED) + C ezto.mheducation.com/hm.tpx 2. Prepare a schedule to estimate an appropriate year-end balance for the Allowance for Doubtful Accounts. Total > 90 31-90 1-30 0 Accounts Receivable Estimated Uncollectible (%) $ Estimated Uncollectible ($) 3. Prepare the December 31 adjusting entry. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View journal entry worksheet View transaction list Credit Debit General Journal Date No Bad Debt Expense Dec 31 1 Allowance for Doubtful Accounts C

Innovative Tech Inc. (ITI) uses the percentage of credit sales method to estimate bad debts each month and then uses the aging method at year-end. During November, ITI sold services on account for $160,000 and estimated that 1 of one percent of those sales would be uncollectible. At its December 31 year-end, total Accounts Receivable is $80,000, aged as follows: (1) 1-30 days old, $65,000; (2) 31-90 days old, $12,000; and (3) more than 90 days old, $3,000. Experience has shown that for each age group, the average rate of uncollectibility is (1) 12 percent, (2) 24 percent, and (3) 48 percent, respectively. Before the end-of-year adjusting entry is made, the Allowance for Doubtful Accounts has a $1,100 credit balance at December 31. 4 Required: 1. Prepare the November adjusting entry for bad debts. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet Xx No Date General Journal Debit Credit 1 Nov 30 Bad Debt Expense 1,200 Allowance for Doubtful Accounts 1,200 S Ch.08 Homework (GRADED) + C ezto.mheducation.com/hm.tpx 2. Prepare a schedule to estimate an appropriate year-end balance for the Allowance for Doubtful Accounts. Total > 90 31-90 1-30 0 Accounts Receivable Estimated Uncollectible (%) $ Estimated Uncollectible ($) 3. Prepare the December 31 adjusting entry. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View journal entry worksheet View transaction list Credit Debit General Journal Date No Bad Debt Expense Dec 31 1 Allowance for Doubtful Accounts C

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 2CE: Tonis Tech Shop has total credit sales for the year of 170,000 and estimates that 3% of its credit...

Related questions

Question

Using the information in the first pic to solve 2 and 3

Transcribed Image Text:Innovative Tech Inc. (ITI) uses the percentage of credit sales method to estimate bad debts each month and

then uses the aging method at year-end. During November, ITI sold services on account for $160,000 and

estimated that 1 of one percent of those sales would be uncollectible. At its December 31 year-end, total

Accounts Receivable is $80,000, aged as follows: (1) 1-30 days old, $65,000; (2) 31-90 days old, $12,000;

and (3) more than 90 days old, $3,000. Experience has shown that for each age group, the average rate of

uncollectibility is (1) 12 percent, (2) 24 percent, and (3) 48 percent, respectively. Before the end-of-year

adjusting entry is made, the Allowance for Doubtful Accounts has a $1,100 credit balance at December 31.

4

Required:

1. Prepare the November adjusting entry for bad debts. (If no entry is required for a transaction/event,

select "No Journal Entry Required" in the first account field.)

View transaction list

View journal entry worksheet

Xx

No

Date

General Journal

Debit

Credit

1

Nov 30

Bad Debt Expense

1,200

Allowance for Doubtful Accounts

1,200

Transcribed Image Text:S Ch.08 Homework (GRADED)

+

C

ezto.mheducation.com/hm.tpx

2. Prepare a schedule to estimate an appropriate year-end balance for the Allowance for Doubtful

Accounts.

Total

> 90

31-90

1-30

0

Accounts Receivable

Estimated Uncollectible (%)

$

Estimated Uncollectible ($)

3. Prepare the December 31 adjusting entry. (If no entry is required for a transaction/event, select "No

Journal Entry Required" in the first account field.)

View journal entry worksheet

View transaction list

Credit

Debit

General Journal

Date

No

Bad Debt Expense

Dec 31

1

Allowance for Doubtful Accounts

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning