Home Insert Page Layout Formulas Data Review A 1 Theoretical capacity 2 Practical capacity 3 Normal capacity utilization 4 Selling price 5 Beginning inventory 6 Production 7 Sales volume 8 Variable budgeted manufacturing cost 9 Total budgeted fixed manufacturing costs 10 Total budgeted operating (non-manuf.) costs (all fixed) $ 500,000 300,000 units 279,070 units 232,558 units 50 per unit 40,000 units 240,000 units 260,000 units 10 per unit $3,000,000 There are no price, spending, or efficiency variances. Actual operating costs equal budgeted operating costs. The production-volume variance is written off to cost of goods sold. For each choice of denominator level, the budgeted production cost per unit is also the cost per unit of beginning inventory. 1. What is the production-volume variance in 2017 when the denominator level is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization? 2. Prepare absorption costing-based income statements for Magic Me Corporation using theoretical ca- pacity, practical capacity, and normal capacity utilization as the denominator levels. 3. Why is the operating income under normal capacity utilization lower than the other two scenarios? 4. Reconcile the difference in operating income based on theoretical capacity and practical capacity with the difference in fixed manufacturing overhead included in inventory. Required

Home Insert Page Layout Formulas Data Review A 1 Theoretical capacity 2 Practical capacity 3 Normal capacity utilization 4 Selling price 5 Beginning inventory 6 Production 7 Sales volume 8 Variable budgeted manufacturing cost 9 Total budgeted fixed manufacturing costs 10 Total budgeted operating (non-manuf.) costs (all fixed) $ 500,000 300,000 units 279,070 units 232,558 units 50 per unit 40,000 units 240,000 units 260,000 units 10 per unit $3,000,000 There are no price, spending, or efficiency variances. Actual operating costs equal budgeted operating costs. The production-volume variance is written off to cost of goods sold. For each choice of denominator level, the budgeted production cost per unit is also the cost per unit of beginning inventory. 1. What is the production-volume variance in 2017 when the denominator level is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization? 2. Prepare absorption costing-based income statements for Magic Me Corporation using theoretical ca- pacity, practical capacity, and normal capacity utilization as the denominator levels. 3. Why is the operating income under normal capacity utilization lower than the other two scenarios? 4. Reconcile the difference in operating income based on theoretical capacity and practical capacity with the difference in fixed manufacturing overhead included in inventory. Required

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter11: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 11.16E

Related questions

Topic Video

Question

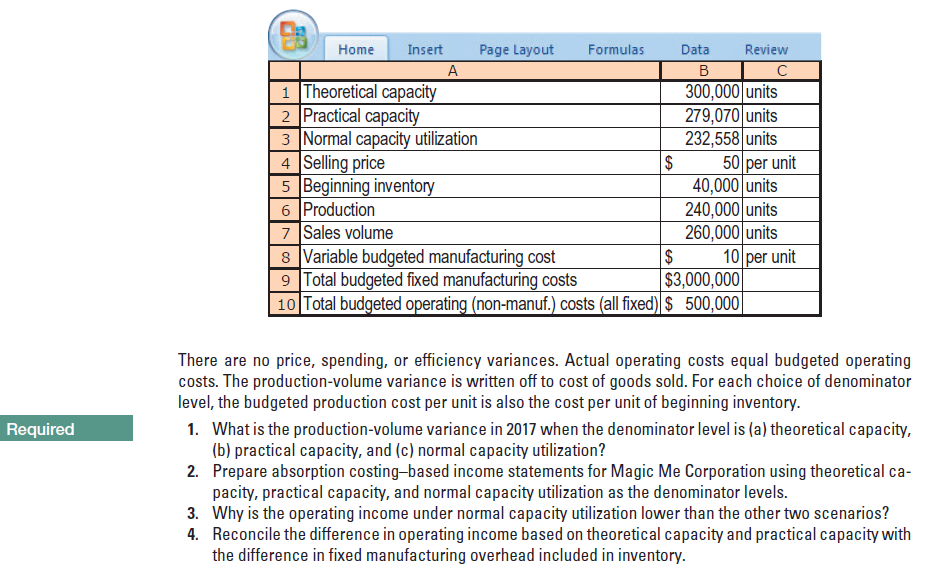

Denominator-level choices, changes in inventory levels, effect on operating income. Magic Me is a manufacturer of magic kits. It uses absorption costing based on

Transcribed Image Text:Home

Insert

Page Layout

Formulas

Data

Review

A

1 Theoretical capacity

2 Practical capacity

3 Normal capacity utilization

4 Selling price

5 Beginning inventory

6 Production

7 Sales volume

8 Variable budgeted manufacturing cost

9 Total budgeted fixed manufacturing costs

10 Total budgeted operating (non-manuf.) costs (all fixed) $ 500,000

300,000 units

279,070 units

232,558 units

50 per unit

40,000 units

240,000 units

260,000 units

10 per unit

$3,000,000

There are no price, spending, or efficiency variances. Actual operating costs equal budgeted operating

costs. The production-volume variance is written off to cost of goods sold. For each choice of denominator

level, the budgeted production cost per unit is also the cost per unit of beginning inventory.

1. What is the production-volume variance in 2017 when the denominator level is (a) theoretical capacity,

(b) practical capacity, and (c) normal capacity utilization?

2. Prepare absorption costing-based income statements for Magic Me Corporation using theoretical ca-

pacity, practical capacity, and normal capacity utilization as the denominator levels.

3. Why is the operating income under normal capacity utilization lower than the other two scenarios?

4. Reconcile the difference in operating income based on theoretical capacity and practical capacity with

the difference in fixed manufacturing overhead included in inventory.

Required

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning