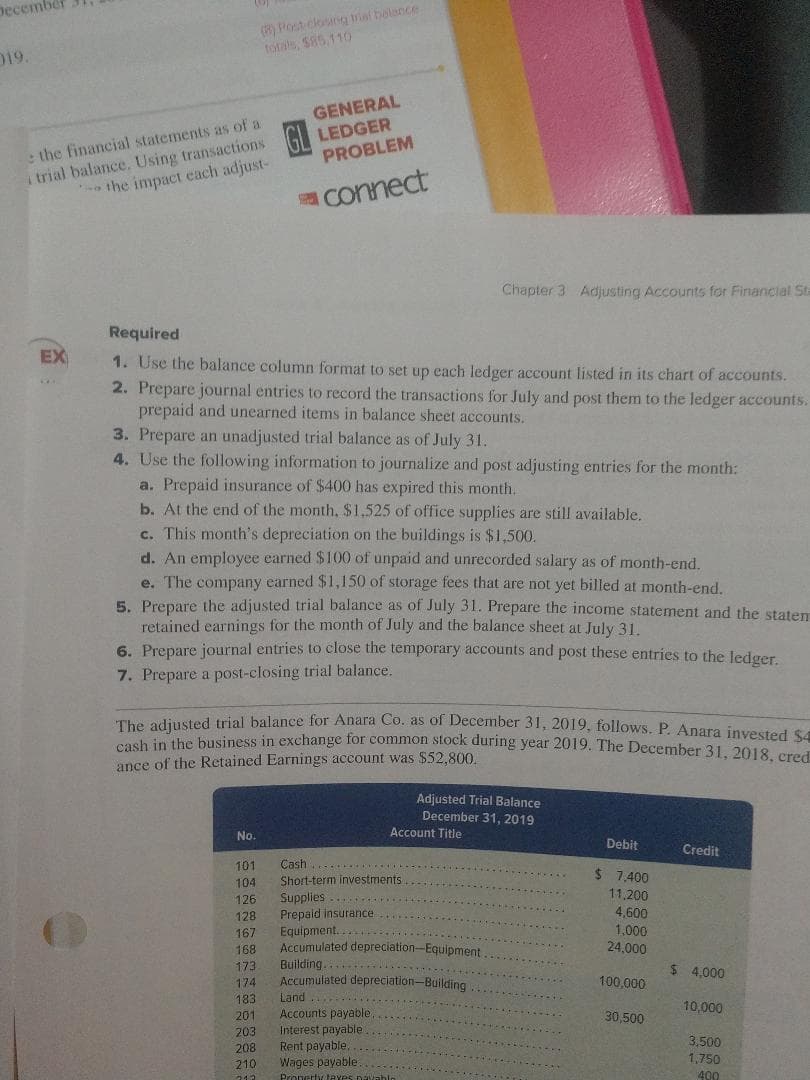

Interest earned Depreciation expense-Trucks Depreciation expense-Equipment Salaries expense Wages expense 34000 29,000 48,000 74000 300 000 Interest expense Office supplies expense Advertising expense Repairs expense-Trucks Totals. 609 $1.5 530.800 quired 2 the information in the adjusted trial balance to prepare (a) the income statement for the year ended cember 31; (b) the statement of retained earnings for the year ended December 31 [Note: Retained rnings at Dec. 31 of the prior year was $110,000]; and (c) the balance sheet as of December 31. July 1, Lula Plume created a new self-storage business, Safe Storage Co. The following transactions curred during the company's first month. Plume invested $30,000 cash and buildings worth S150,000 in the company in exchange for ly common stock. 2 The company rented equipment by paying $2,000 cash for the first month's (July) rent. The company purchased $2,400 of office supplies for cash. 10 The company paid $7,200 cash for the premium on a 12-month insurance policy. Coverage begins on July 11. 14 The company paid an employee $1,000 cash for two weeks' salary earned. 24 The company collected $9,800 cash for storage fees from customers. The company paid $1,000 cash for two weeks' salary earned by 29 employee. 28 al The company paid $950 cash for minor repairs to a leaking roof. 30 The company paid $400 cash for this month's telephone bill. The company paid $2,000 cash in dividends. 31 he company's chart of accounts follows. 307 Common Stock 640 Rent Expense 101 Cash 106 Accounts Receivable 124 Office Supplies 128 Prepaid Insurance 173 Buildings 174 Accumulated Depreciation-Buildings 318 Retained Earnings 650 Office Supplies Expense 684 Repairs Expense 688 Telephone Expense 901 Income Summary 319 Dividends 401 Storage Fees Earned 606 Depreciation Expense-Buildings 622 Salaries Expense 637 Insurance Expense 209 Salaries Payable December bolance (8) Postcng totals, $85,110 19. GENERAL the financial statements as of a itrial balance. Using transactions the impact each adjust- LEDGER PROBLEM connect Chapter 3 Adjusting Accounts foer Financial St Required EX 1. Use the balance column format to set up each ledger account listed in its chart of accounts. 2. Prepare journal entries to record the transactions for July and post them to the ledger accounts prepaid and unearned items in balance sheet accounts. 3. Prepare an unadjusted trial balance as of July 31. 4. Use the following information to journalize and post adjusting entries for the month: a. Prepaid insurance of $400 has expired this month. b. At the end of the month, $1,525 of office supplies are still available. c. This month's depreciation d. An employee earned $100 of unpaid and unrecorded salary as of month-end. e. The company earned $1,150 of storage fees that are not yet billed at month-end. 5. Prepare the adjusted trial balance as of July 31. Prepare the income statement and the staten retained earnings for the month of July and the balance sheet at July 31. 6. Prepare journal entries to close the temporary accounts and post these entries to the ledger. on the buildings is $1,500. 7. Prepare a post-closing trial balance. The adjusted trial balance for Anara Co. as of December 31, 2019, follows. P. Anara invested $ cash in the business in exchange for common stock during year 2019. The December 31, 2018, cred ance of the Retained Earnings account was $52,800. Adjusted Trial Balance December 31, 2019 Account Title No. Debit Credit Cash 101 $ 7.400 Short-term investments 104 11,200 4,600 1,000 24,000 Supplies Prepaid insurance Equipment.. Accumulated depreciation-Equipment 126 128 167 168 Building Accumulated depreciation-Building 173 $ 4,000 100,000 174 183 Land 10,000 Accounts payable Interest payable Rent payable. Wages payable 30,500 201 203 3,500 208 1,750 210 400 Pronerty navable

Interest earned Depreciation expense-Trucks Depreciation expense-Equipment Salaries expense Wages expense 34000 29,000 48,000 74000 300 000 Interest expense Office supplies expense Advertising expense Repairs expense-Trucks Totals. 609 $1.5 530.800 quired 2 the information in the adjusted trial balance to prepare (a) the income statement for the year ended cember 31; (b) the statement of retained earnings for the year ended December 31 [Note: Retained rnings at Dec. 31 of the prior year was $110,000]; and (c) the balance sheet as of December 31. July 1, Lula Plume created a new self-storage business, Safe Storage Co. The following transactions curred during the company's first month. Plume invested $30,000 cash and buildings worth S150,000 in the company in exchange for ly common stock. 2 The company rented equipment by paying $2,000 cash for the first month's (July) rent. The company purchased $2,400 of office supplies for cash. 10 The company paid $7,200 cash for the premium on a 12-month insurance policy. Coverage begins on July 11. 14 The company paid an employee $1,000 cash for two weeks' salary earned. 24 The company collected $9,800 cash for storage fees from customers. The company paid $1,000 cash for two weeks' salary earned by 29 employee. 28 al The company paid $950 cash for minor repairs to a leaking roof. 30 The company paid $400 cash for this month's telephone bill. The company paid $2,000 cash in dividends. 31 he company's chart of accounts follows. 307 Common Stock 640 Rent Expense 101 Cash 106 Accounts Receivable 124 Office Supplies 128 Prepaid Insurance 173 Buildings 174 Accumulated Depreciation-Buildings 318 Retained Earnings 650 Office Supplies Expense 684 Repairs Expense 688 Telephone Expense 901 Income Summary 319 Dividends 401 Storage Fees Earned 606 Depreciation Expense-Buildings 622 Salaries Expense 637 Insurance Expense 209 Salaries Payable December bolance (8) Postcng totals, $85,110 19. GENERAL the financial statements as of a itrial balance. Using transactions the impact each adjust- LEDGER PROBLEM connect Chapter 3 Adjusting Accounts foer Financial St Required EX 1. Use the balance column format to set up each ledger account listed in its chart of accounts. 2. Prepare journal entries to record the transactions for July and post them to the ledger accounts prepaid and unearned items in balance sheet accounts. 3. Prepare an unadjusted trial balance as of July 31. 4. Use the following information to journalize and post adjusting entries for the month: a. Prepaid insurance of $400 has expired this month. b. At the end of the month, $1,525 of office supplies are still available. c. This month's depreciation d. An employee earned $100 of unpaid and unrecorded salary as of month-end. e. The company earned $1,150 of storage fees that are not yet billed at month-end. 5. Prepare the adjusted trial balance as of July 31. Prepare the income statement and the staten retained earnings for the month of July and the balance sheet at July 31. 6. Prepare journal entries to close the temporary accounts and post these entries to the ledger. on the buildings is $1,500. 7. Prepare a post-closing trial balance. The adjusted trial balance for Anara Co. as of December 31, 2019, follows. P. Anara invested $ cash in the business in exchange for common stock during year 2019. The December 31, 2018, cred ance of the Retained Earnings account was $52,800. Adjusted Trial Balance December 31, 2019 Account Title No. Debit Credit Cash 101 $ 7.400 Short-term investments 104 11,200 4,600 1,000 24,000 Supplies Prepaid insurance Equipment.. Accumulated depreciation-Equipment 126 128 167 168 Building Accumulated depreciation-Building 173 $ 4,000 100,000 174 183 Land 10,000 Accounts payable Interest payable Rent payable. Wages payable 30,500 201 203 3,500 208 1,750 210 400 Pronerty navable

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 10E: Spreadsheet The following 2019 information is available for Payne Company: Partial additional...

Related questions

Question

im struggling with the my adjusted

![Interest earned

Depreciation expense-Trucks

Depreciation expense-Equipment

Salaries expense

Wages expense

34000

29,000

48,000

74000

300 000

Interest expense

Office supplies expense

Advertising expense

Repairs expense-Trucks

Totals.

609

$1.5

530.800

quired

2 the information in the adjusted trial balance to prepare (a) the income statement for the year ended

cember 31; (b) the statement of retained earnings for the year ended December 31 [Note: Retained

rnings at Dec. 31 of the prior year was $110,000]; and (c) the balance sheet as of December 31.

July 1, Lula Plume created a new self-storage business, Safe Storage Co. The following transactions

curred during the company's first month.

Plume invested $30,000 cash and buildings worth S150,000 in the company in exchange for

ly

common stock.

2

The company rented equipment by paying $2,000 cash for the first month's (July) rent.

The company purchased $2,400 of office supplies for cash.

10

The company paid $7,200 cash for the premium on a 12-month insurance policy. Coverage

begins on July 11.

14

The company paid an employee $1,000 cash for two weeks' salary earned.

24

The company collected $9,800 cash for storage fees from customers.

The company paid $1,000 cash for two weeks' salary earned by

29

employee.

28

al

The company paid $950 cash for minor repairs to a leaking roof.

30

The company paid $400 cash for this month's telephone bill.

The company paid $2,000 cash in dividends.

31

he company's chart of accounts follows.

307 Common Stock

640 Rent Expense

101 Cash

106 Accounts Receivable

124 Office Supplies

128 Prepaid Insurance

173 Buildings

174 Accumulated Depreciation-Buildings

318 Retained Earnings

650 Office Supplies Expense

684 Repairs Expense

688 Telephone Expense

901 Income Summary

319 Dividends

401 Storage Fees Earned

606 Depreciation Expense-Buildings

622 Salaries Expense

637 Insurance Expense

209 Salaries Payable](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F56e51315-5c8c-4a72-ace8-0e979e9ad67c%2Fc5e7617d-135f-440c-aaf0-a2d19f530285%2Fc9am18.jpeg&w=3840&q=75)

Transcribed Image Text:Interest earned

Depreciation expense-Trucks

Depreciation expense-Equipment

Salaries expense

Wages expense

34000

29,000

48,000

74000

300 000

Interest expense

Office supplies expense

Advertising expense

Repairs expense-Trucks

Totals.

609

$1.5

530.800

quired

2 the information in the adjusted trial balance to prepare (a) the income statement for the year ended

cember 31; (b) the statement of retained earnings for the year ended December 31 [Note: Retained

rnings at Dec. 31 of the prior year was $110,000]; and (c) the balance sheet as of December 31.

July 1, Lula Plume created a new self-storage business, Safe Storage Co. The following transactions

curred during the company's first month.

Plume invested $30,000 cash and buildings worth S150,000 in the company in exchange for

ly

common stock.

2

The company rented equipment by paying $2,000 cash for the first month's (July) rent.

The company purchased $2,400 of office supplies for cash.

10

The company paid $7,200 cash for the premium on a 12-month insurance policy. Coverage

begins on July 11.

14

The company paid an employee $1,000 cash for two weeks' salary earned.

24

The company collected $9,800 cash for storage fees from customers.

The company paid $1,000 cash for two weeks' salary earned by

29

employee.

28

al

The company paid $950 cash for minor repairs to a leaking roof.

30

The company paid $400 cash for this month's telephone bill.

The company paid $2,000 cash in dividends.

31

he company's chart of accounts follows.

307 Common Stock

640 Rent Expense

101 Cash

106 Accounts Receivable

124 Office Supplies

128 Prepaid Insurance

173 Buildings

174 Accumulated Depreciation-Buildings

318 Retained Earnings

650 Office Supplies Expense

684 Repairs Expense

688 Telephone Expense

901 Income Summary

319 Dividends

401 Storage Fees Earned

606 Depreciation Expense-Buildings

622 Salaries Expense

637 Insurance Expense

209 Salaries Payable

Transcribed Image Text:December

bolance

(8) Postcng

totals, $85,110

19.

GENERAL

the financial statements as of a

itrial balance. Using transactions

the impact each adjust-

LEDGER

PROBLEM

connect

Chapter 3

Adjusting Accounts foer Financial St

Required

EX

1. Use the balance column format to set up each ledger account listed in its chart of accounts.

2. Prepare journal entries to record the transactions for July and post them to the ledger accounts

prepaid and unearned items in balance sheet accounts.

3. Prepare an unadjusted trial balance as of July 31.

4. Use the following information to journalize and post adjusting entries for the month:

a. Prepaid insurance of $400 has expired this month.

b. At the end of the month, $1,525 of office supplies are still available.

c. This month's depreciation

d. An employee earned $100 of unpaid and unrecorded salary as of month-end.

e. The company earned $1,150 of storage fees that are not yet billed at month-end.

5. Prepare the adjusted trial balance as of July 31. Prepare the income statement and the staten

retained earnings for the month of July and the balance sheet at July 31.

6. Prepare journal entries to close the temporary accounts and post these entries to the ledger.

on the buildings is $1,500.

7. Prepare a post-closing trial balance.

The adjusted trial balance for Anara Co. as of December 31, 2019, follows. P. Anara invested $

cash in the business in exchange for common stock during year 2019. The December 31, 2018, cred

ance of the Retained Earnings account was $52,800.

Adjusted Trial Balance

December 31, 2019

Account Title

No.

Debit

Credit

Cash

101

$ 7.400

Short-term investments

104

11,200

4,600

1,000

24,000

Supplies

Prepaid insurance

Equipment..

Accumulated depreciation-Equipment

126

128

167

168

Building

Accumulated depreciation-Building

173

$ 4,000

100,000

174

183

Land

10,000

Accounts payable

Interest payable

Rent payable.

Wages payable

30,500

201

203

3,500

208

1,750

210

400

Pronerty

navable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Expert Answers to Latest Homework Questions

Q: Which of the following sentences are true?

Select two or more:

Climate change refers to…

Q: Draw the peptide Glycine-Alanine-Serine-Cysteine-Isoleucine-Glutamic acid Tryptophan-Valine. Circle…

Q: Draw estrogen and testosterone. Number the positions of the core steroid nucleus

NO AI

Q: Draw a triacylglycerol with 12 carbon chains that are monounsaturated (you can choose the site of…

Q: What are the observed and projected changes in the climate system?

Select two or more:

Due to…

Q: Which one of the following sentences is NOT true?

Select one:

Compared with other land-based…

Q: The adaptation planning process draws on broad principles of the ecosystem approach to fisheries…

Q: termining Net Income from Net Cash Flow from Operating Activities

Determining net income from net…

Q: What types of early adaptation measures should be prioritized in national adaptation plans or…

Q: About adaptation plans, which of the following sentences are NOT true?

Select two or more:

In…

Q: About the adaptation toolbox, which one of the following sentences is NOT true?

Select one:…

Q: Which one of the following measures CANNOT mitigate emissions of greenhouse gases in aquaculture?…

Q: Example

F(s) =

find the inverse Fourier transform:

6(s + 10)

(s + 5)(s+8)

Q: Pls answer the following questions to the best of your ability

Q: A project will produce an operating cash flow of $9,000 a year for 8 years. The initial

fixed asset…

Q: Pls answer the following

Q: The adaptation planning process starts with a stakeholder meeting. Which one is NOT a purpose of…

Q: Which one of the following measures can mitigate emissions of greenhouse gases in capture fisheries?…

Q: Which one of the following measures can mitigate emissions of greenhouse gases in capture fisheries?…

Q: About adaptation planning, which of the following sentences are true?

Select two or more:

An…

Q: K Corporation Inc. owns a restaurant business that it carries on in rented premises. The lease was…