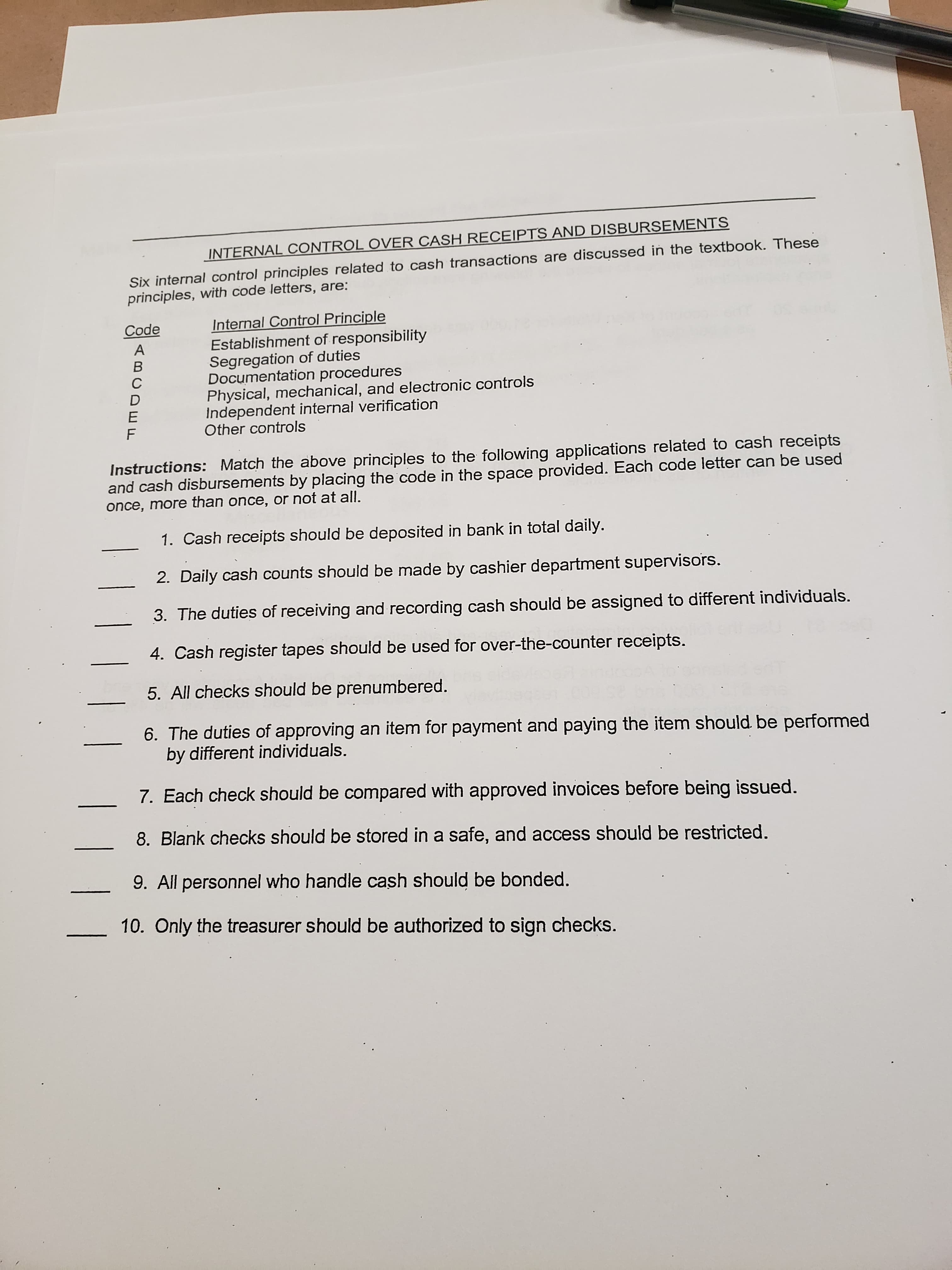

INTERNAL CONTROL OVER CASH RECEIPTS AND DISBURSEMENTS Six internal control principles related to cash transactions are discussed in the textbook. These principles, with code letters, are: Internal Control Principle Establishment of responsibility Segregation of duties Documentation procedures Physical, mechanical, and electronic controls Independent internal verification Other controls Code Instructions: Match the above principles to the following applications related to cash receipts and cash disbursements by placing the code in the space provided. Each code letter can be used once, more than once, or not at all. 1. Cash receipts should be deposited in bank in total daily. 2. Daily cash counts should be made by cashier department supervisors. 3. The duties of receiving and recording cash should be assigned to different individuals. 4. Cash register tapes should be used for over-the-counter receipts. 5. All checks should be prenumbered. 6. The duties of approving an item for payment and paying the item should be performed by different individuals. 7. Each check should be compared with approved invoices before being issued. 8. Blank checks should be stored in a safe, and access should be restricted. 9. All personnel who handle cash should be bonded. 10. Only the treasurer should be authorized to sign checks.

INTERNAL CONTROL OVER CASH RECEIPTS AND DISBURSEMENTS Six internal control principles related to cash transactions are discussed in the textbook. These principles, with code letters, are: Internal Control Principle Establishment of responsibility Segregation of duties Documentation procedures Physical, mechanical, and electronic controls Independent internal verification Other controls Code Instructions: Match the above principles to the following applications related to cash receipts and cash disbursements by placing the code in the space provided. Each code letter can be used once, more than once, or not at all. 1. Cash receipts should be deposited in bank in total daily. 2. Daily cash counts should be made by cashier department supervisors. 3. The duties of receiving and recording cash should be assigned to different individuals. 4. Cash register tapes should be used for over-the-counter receipts. 5. All checks should be prenumbered. 6. The duties of approving an item for payment and paying the item should be performed by different individuals. 7. Each check should be compared with approved invoices before being issued. 8. Blank checks should be stored in a safe, and access should be restricted. 9. All personnel who handle cash should be bonded. 10. Only the treasurer should be authorized to sign checks.

Pkg Acc Infor Systems MS VISIO CD

10th Edition

ISBN:9781133935940

Author:Ulric J. Gelinas

Publisher:Ulric J. Gelinas

Chapter11: The Billing/accounts Receivable/cash

receipts (b/ar/cr) Process

Section: Chapter Questions

Problem 2SP

Related questions

Question

Help

Transcribed Image Text:INTERNAL CONTROL OVER CASH RECEIPTS AND DISBURSEMENTS

Six internal control principles related to cash transactions are discussed in the textbook. These

principles, with code letters, are:

Internal Control Principle

Establishment of responsibility

Segregation of duties

Documentation procedures

Physical, mechanical, and electronic controls

Independent internal verification

Other controls

Code

Instructions: Match the above principles to the following applications related to cash receipts

and cash disbursements by placing the code in the space provided. Each code letter can be used

once, more than once, or not at all.

1. Cash receipts should be deposited in bank in total daily.

2. Daily cash counts should be made by cashier department supervisors.

3. The duties of receiving and recording cash should be assigned to different individuals.

4. Cash register tapes should be used for over-the-counter receipts.

5. All checks should be prenumbered.

6. The duties of approving an item for payment and paying the item should be performed

by different individuals.

7. Each check should be compared with approved invoices before being issued.

8. Blank checks should be stored in a safe, and access should be restricted.

9. All personnel who handle cash should be bonded.

10. Only the treasurer should be authorized to sign checks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub