Internal Rate of Return Method The internal rate of return method is used by King Bros. Construction Co. in analyzing a capital expenditure proposal that involves an investment of $48,592 and annual net cash flows of $16,000 for each of the four years of its useful life. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 3.465 4 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 4.917 4.355 6 4.111 3.784 3.326 4.160 7 5.582 4.868 4.564 3.605 8 6.210 5.335 4.968 4.487 3.837 5.759 6.802 5.328 4.772 4.031 6.145 10 7,360 5.650 5.019 4.192 a. Determine a present value factor for an annuity of $1 which can be used in determining the internal rate of return. If required, round your answer to three decimal places. b. Using the factor determined in part (a) and the present value of an annuity of $1 table above, determine the internal rate of return for the proposal. %

Internal Rate of Return Method The internal rate of return method is used by King Bros. Construction Co. in analyzing a capital expenditure proposal that involves an investment of $48,592 and annual net cash flows of $16,000 for each of the four years of its useful life. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 3.465 4 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 4.917 4.355 6 4.111 3.784 3.326 4.160 7 5.582 4.868 4.564 3.605 8 6.210 5.335 4.968 4.487 3.837 5.759 6.802 5.328 4.772 4.031 6.145 10 7,360 5.650 5.019 4.192 a. Determine a present value factor for an annuity of $1 which can be used in determining the internal rate of return. If required, round your answer to three decimal places. b. Using the factor determined in part (a) and the present value of an annuity of $1 table above, determine the internal rate of return for the proposal. %

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 16E

Related questions

Question

100%

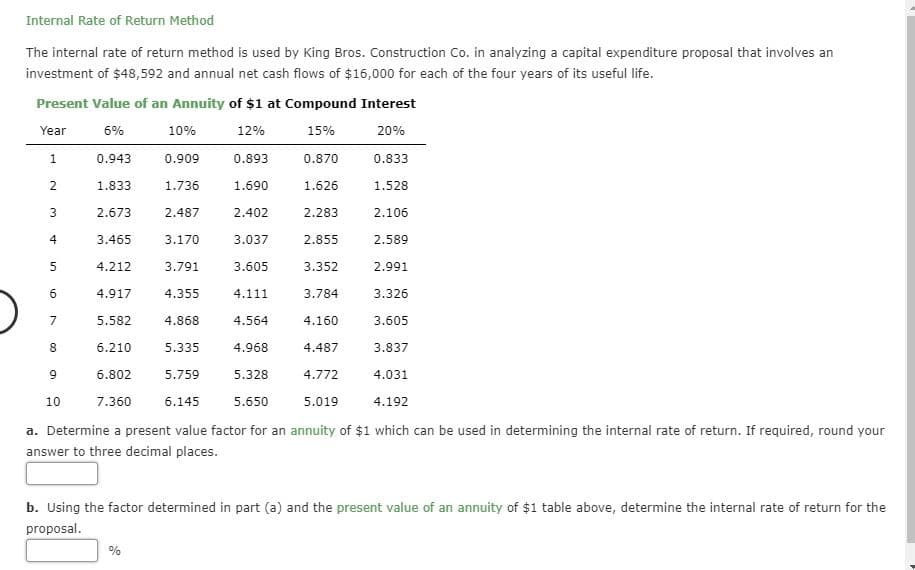

Transcribed Image Text:Internal Rate of Return Method

The internal rate of return method is used by King Bros. Construction Co. in analyzing a capital expenditure proposal that involves an

investment of $48,592 and annual net cash flows of $16,000 for each of the four years of its useful life.

Present Value of an Annuity of $1 at Compound Interest

Year

6%

10%

12%

15%

20%

1

0.943

0.909

0.893

0.870

0.833

2

1.833

1.736

1.690

1.626

1.528

3

2.673

2.487

2.402

2.283

2.106

3.465

4

3.170

3.037

2.855

2.589

5

4.212

3.791

3.605

3.352

2.991

4.917

4.355

6

4.111

3.784

3.326

4.160

7

5.582

4.868

4.564

3.605

8

6.210

5.335

4.968

4.487

3.837

5.759

6.802

5.328

4.772

4.031

6.145

10

7,360

5.650

5.019

4.192

a. Determine a present value factor for an annuity of $1 which can be used in determining the internal rate of return. If required, round your

answer to three decimal places.

b. Using the factor determined in part (a) and the present value of an annuity of $1 table above, determine the internal rate of return for the

proposal.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning