ist, InC. uses a tem alid nas the ToOV Beginning Inventory 124 units @ $50 per unit Purchases Purchase 1 on 3/11/20 75 units @ $52 per unit Purchase 2 on 10/18/20 94 units @ $54 per unit Sales Sale 1 on 3/15/20 110 units @ $79 per unit Sale 2 on 10/22/20 130 units @ $79 per unit All units sold on 3/15/20 were from beginning inventory. The 10/22/20 sale included 60 units from the 3/11/20 purchase and 70 units from the 10/18/20 purchase. Show how Mist's Balance Sheet and Income Statement would differ under each of the inventory cost flow assumptions. Compute Ending Inventory, COGS and Gross Profit under Specific Identification, Weighted Average Cost, FIFO and LIFO. Fill in your answers on the table. Specific Identification First-In, First-Out Last-In, First-Out Weighted Average Cost (round to 2 decimal places) 12/31/20 Balance Sheet Ending Inventory 2020 Income Statement Cost of Goods Sold Gross Profit

ist, InC. uses a tem alid nas the ToOV Beginning Inventory 124 units @ $50 per unit Purchases Purchase 1 on 3/11/20 75 units @ $52 per unit Purchase 2 on 10/18/20 94 units @ $54 per unit Sales Sale 1 on 3/15/20 110 units @ $79 per unit Sale 2 on 10/22/20 130 units @ $79 per unit All units sold on 3/15/20 were from beginning inventory. The 10/22/20 sale included 60 units from the 3/11/20 purchase and 70 units from the 10/18/20 purchase. Show how Mist's Balance Sheet and Income Statement would differ under each of the inventory cost flow assumptions. Compute Ending Inventory, COGS and Gross Profit under Specific Identification, Weighted Average Cost, FIFO and LIFO. Fill in your answers on the table. Specific Identification First-In, First-Out Last-In, First-Out Weighted Average Cost (round to 2 decimal places) 12/31/20 Balance Sheet Ending Inventory 2020 Income Statement Cost of Goods Sold Gross Profit

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 5PA

Related questions

Question

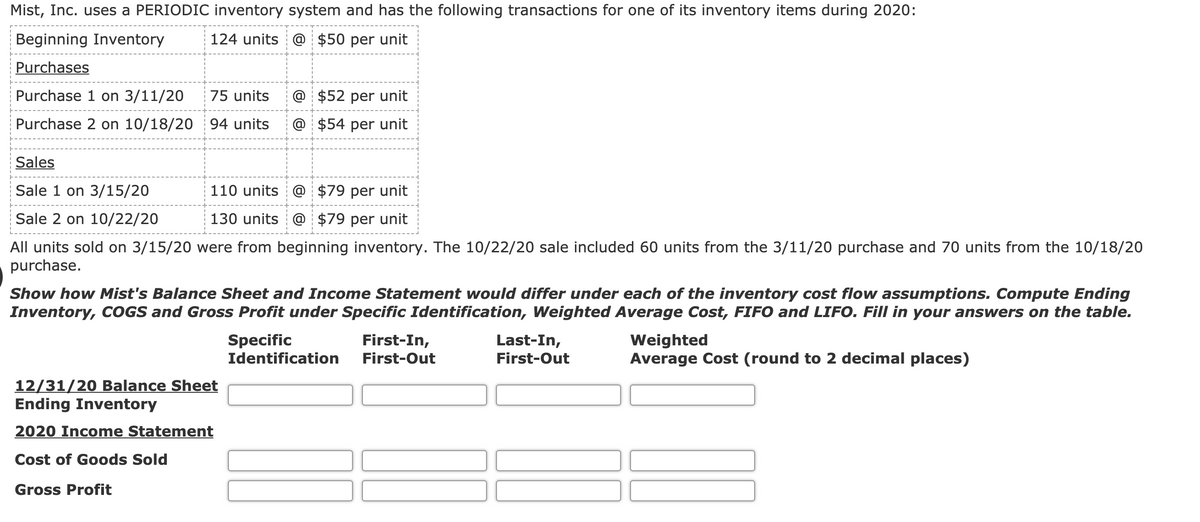

Transcribed Image Text:Mist, Inc. uses a PERIODIC inventory system and has the following transactions for one of its inventory items during 2020:

Beginning Inventory

124 units @ $50 per unit

Purchases

Purchase 1 on 3/11/20

75 units

@ $52 per unit

Purchase 2 on 10/18/20 94 units

@ $54 per unit

Sales

Sale 1 on 3/15/20

110 units @ $79 per unit

Sale 2 on 10/22/20

130 units @ $79 per unit

All units sold on 3/15/20 were from beginning inventory. The 10/22/20 sale included 60 units from the 3/11/20 purchase and 70 units from the 10/18/20

purchase.

Show how Mist's Balance Sheet and Income Statement would differ under each of the inventory cost flow assumptions. Compute Ending

Inventory, COGS and Gross Profit under Specific Identification, Weighted Average Cost, FIFO and LIFO. Fill in your answers on the table.

Specific

Identification

First-In,

First-Out

Last-In,

First-Out

Weighted

Average Cost (round to 2 decimal places)

12/31/20 Balance Sheet

Ending Inventory

2020 Income Statement

Cost of Goods Sold

Gross Profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT