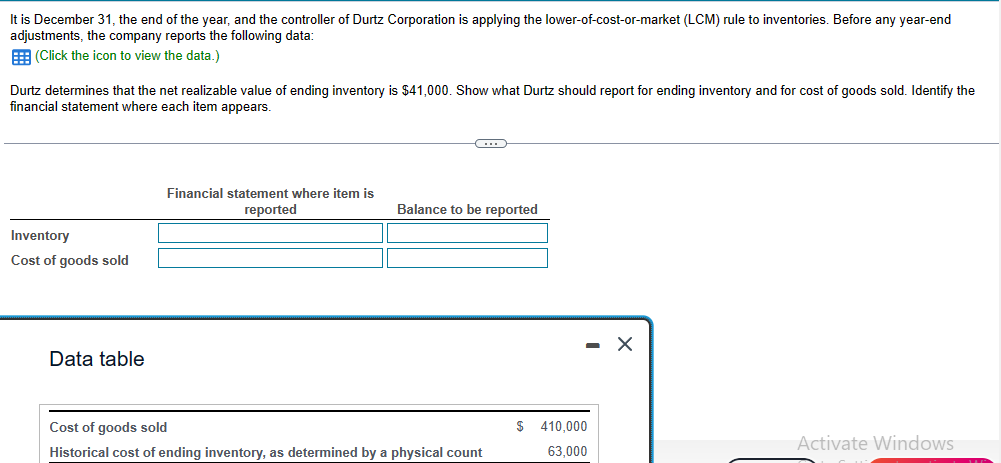

It is December 31, the end of the year, and the controller of Durtz Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Before any year-end adjustments, the company reports the following data: (Click the icon to view the data.) Durtz determines that the net realizable value of ending inventory is $41,000. Show what Durtz should report for ending inventory and for cost of goods sold. Identify the financial statement where each item appears. Inventory Cost of goods sold Data table Financial statement where item is reported C Balance to be reported Cost of goods sold Historical cost of ending inventory, as determined by a physical count $ 410,000 63,000 Activate Windows

It is December 31, the end of the year, and the controller of Durtz Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Before any year-end adjustments, the company reports the following data: (Click the icon to view the data.) Durtz determines that the net realizable value of ending inventory is $41,000. Show what Durtz should report for ending inventory and for cost of goods sold. Identify the financial statement where each item appears. Inventory Cost of goods sold Data table Financial statement where item is reported C Balance to be reported Cost of goods sold Historical cost of ending inventory, as determined by a physical count $ 410,000 63,000 Activate Windows

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 67P

Related questions

Question

Screenshot attached for question thanks

ti4wtnp4ntp2in4tp2i4nt

pin4tpi4npt

Transcribed Image Text:It is December 31, the end of the year, and the controller of Durtz Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Before any year-end

adjustments, the company reports the following data:

(Click the icon to view the data.)

Durtz determines that the net realizable value of ending inventory is $41,000. Show what Durtz should report for ending inventory and for cost of goods sold. Identify the

financial statement where each item appears.

Inventory

Cost of goods sold

Data table

Financial statement where item is

reported

C

Balance to be reported

Cost of goods sold

Historical cost of ending inventory, as determined by a physical count

$ 410,000

63,000

Activate Windows

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning