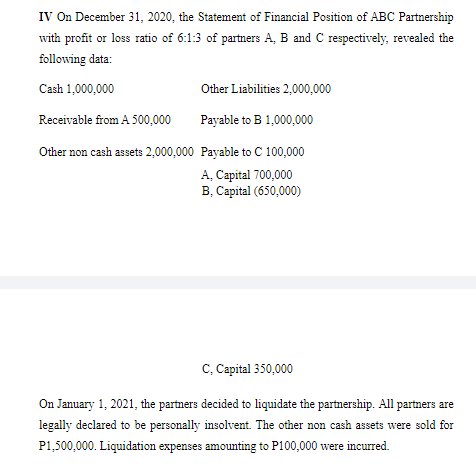

IV On December 31, 2020, the Statement of Financial Position of ABC Partnership with profit or loss ratio of 6:1:3 of partners A, B and C respectively, revealed the following data: Cash 1,000,000 Other Liabilities 2,000,000 Receivable from A 500,000 Payable to B 1,000,000 Other non cash assets 2,000,000 Payable to C 100,000 A, Capital 700,000 B. Capital (650.000)

IV On December 31, 2020, the Statement of Financial Position of ABC Partnership with profit or loss ratio of 6:1:3 of partners A, B and C respectively, revealed the following data: Cash 1,000,000 Other Liabilities 2,000,000 Receivable from A 500,000 Payable to B 1,000,000 Other non cash assets 2,000,000 Payable to C 100,000 A, Capital 700,000 B. Capital (650.000)

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.22E

Related questions

Question

How much cash was received by B at the end of

Transcribed Image Text:IV On December 31, 2020, the Statement of Financial Position of ABC Partnership

with profit or loss ratio of 6:1:3 of partners A, B and C respectively, revealed the

following data:

Cash 1,000,000

Other Liabilities 2,000,000

Receivable from A 500,000

Payable to B 1,000,000

Other non cash assets 2,000,000 Payable to C 100,000

A, Capital 700,000

B, Capital (650,000)

C, Capital 350,000

On January 1, 2021, the partners decided to liquidate the partnership. All partners are

legally declared to be personally insolvent. The other non cash assets were sold for

P1,500,000. Liquidation expenses amounting to P100,000 were incurred.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning