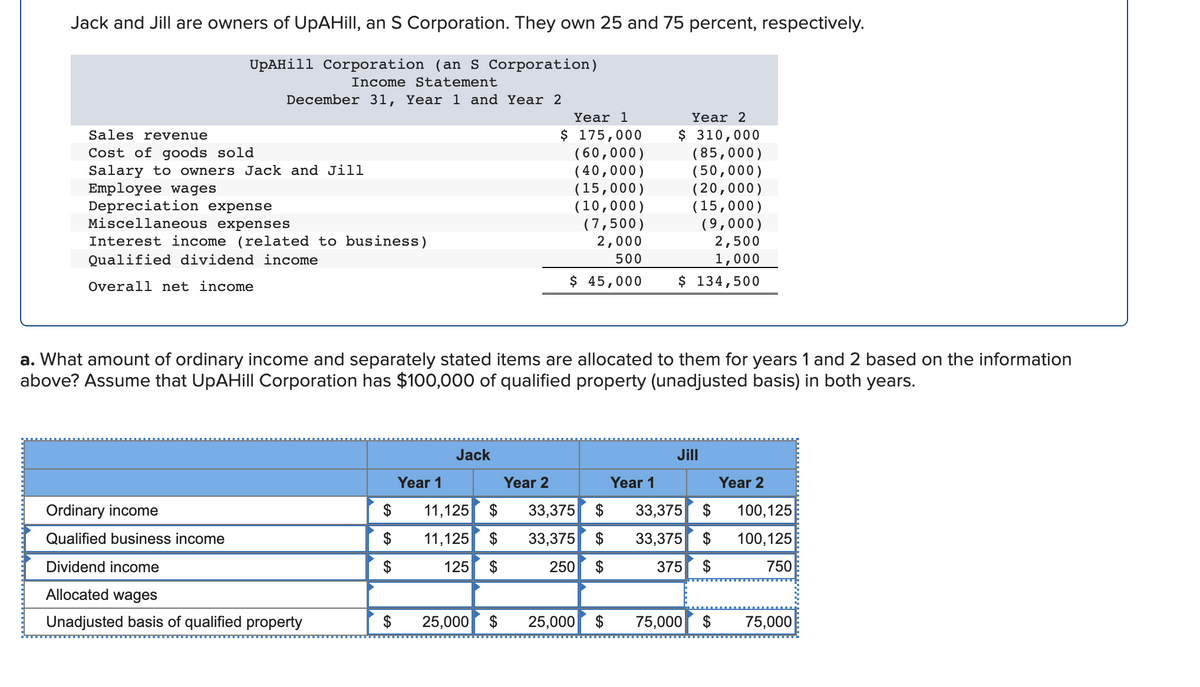

Jack and Jill are owners of UpAHill, an S Corporation. They own 25 and 75 percent, respectively. UpAHill Corporation (an S Corporation) Income Statement December 31, Year 1 and Year 2 Year 1 Year 2 $ 175,000 (60,000) (40,000) (15,000) (10,000) (7,500) 2,000 500 $ 310,000 (85,000) (50,000) (20,000) (15,000) (9,000) 2,500 1,000 Sales revenue Cost of goods sold Salary to owners Jack and Jill Employee wages Depreciation expense Miscellaneous expenses Interest income (related to business) Qualified dividend income Overall net income $ 45,000 $ 134,500 a. What amount of ordinary income and separately stated items are allocated to them for years 1 and 2 based on the information above? Assume that UpAHill Corporation has $100,000 of qualified property (unadjusted basis) in both years. Jack Jill Year 1 Year 2 Year 1 Year 2 Ordinary income $ 11,125 2$ 33,375 $ 33,375 $ 100,125 Qualified business income $ 11,125 $ 33,375 $ 33,375 $ 100,125 Dividend income $ 125 2$ 250 $ 375 $ 750 Allocated wages Unadjusted basis of qualified property $ 25,000 $ 25,000 $ 75,000 $ 75,000 %24

Jack and Jill are owners of UpAHill, an S Corporation. They own 25 and 75 percent, respectively. UpAHill Corporation (an S Corporation) Income Statement December 31, Year 1 and Year 2 Year 1 Year 2 $ 175,000 (60,000) (40,000) (15,000) (10,000) (7,500) 2,000 500 $ 310,000 (85,000) (50,000) (20,000) (15,000) (9,000) 2,500 1,000 Sales revenue Cost of goods sold Salary to owners Jack and Jill Employee wages Depreciation expense Miscellaneous expenses Interest income (related to business) Qualified dividend income Overall net income $ 45,000 $ 134,500 a. What amount of ordinary income and separately stated items are allocated to them for years 1 and 2 based on the information above? Assume that UpAHill Corporation has $100,000 of qualified property (unadjusted basis) in both years. Jack Jill Year 1 Year 2 Year 1 Year 2 Ordinary income $ 11,125 2$ 33,375 $ 33,375 $ 100,125 Qualified business income $ 11,125 $ 33,375 $ 33,375 $ 100,125 Dividend income $ 125 2$ 250 $ 375 $ 750 Allocated wages Unadjusted basis of qualified property $ 25,000 $ 25,000 $ 75,000 $ 75,000 %24

Chapter15: Taxing Business Income

Section: Chapter Questions

Problem 2DQ

Related questions

Question

Transcribed Image Text:Jack and Jill are owners of UpAHill, an S Corporation. They own 25 and 75 percent, respectively.

UpAHill Corporation (an s Corporation)

Income Statement

December 31, Year 1 and Year 2

Year 1

Year 2

$ 175,000

( 60,000)

( 40,000)

(15,000)

(10,000)

(7,500)

2,000

$ 310,000

( 85,000)

( 50,000)

(20,000)

(15,000)

(9,000)

2,500

1,000

Sales revenue

Cost of goods sold

Salary to owners Jack and Jill

Employee wages

Depreciation expense

Miscellaneous expenses

Interest income (related to business)

Qualified dividend income

500

Overall net income

$ 45,000

$ 134,500

a. What amount of ordinary income and separately stated items are allocated to them for years 1 and 2 based on the information

above? Assume that UpAHill Corporation has $100,000 of qualified property (unadjusted basis) in both years.

Jack

Jill

Year 1

Year 2

Year 1

Year 2

Ordinary income

$

11,125 $

33,375 $

33,375

$

100,125

Qualified business income

11,125 $

33,375 $

33,375 $

100,125

Dividend income

125

$

250

$

375

750

Allocated wages

Unadjusted basis of qualified property

$

25,000 $

25,000 $

75,000

$

75,000

24

Expert Solution

Ordinary income:

Ordinary income is a term used in taxation to refer to any regular or routine income that an individual or business receives in the form of wages, salaries, commissions, or profits from the sale of goods and services. This type of income is typically subject to ordinary income tax rates, which are progressive and increase as the amount of income increases.

Examples of ordinary income for individuals might include:

Wages or salaries earned from employment.

Tips and bonuses received from employers.

Income earned from freelance or contract work.

Rental income from real estate.

Interest and dividends from investments.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you