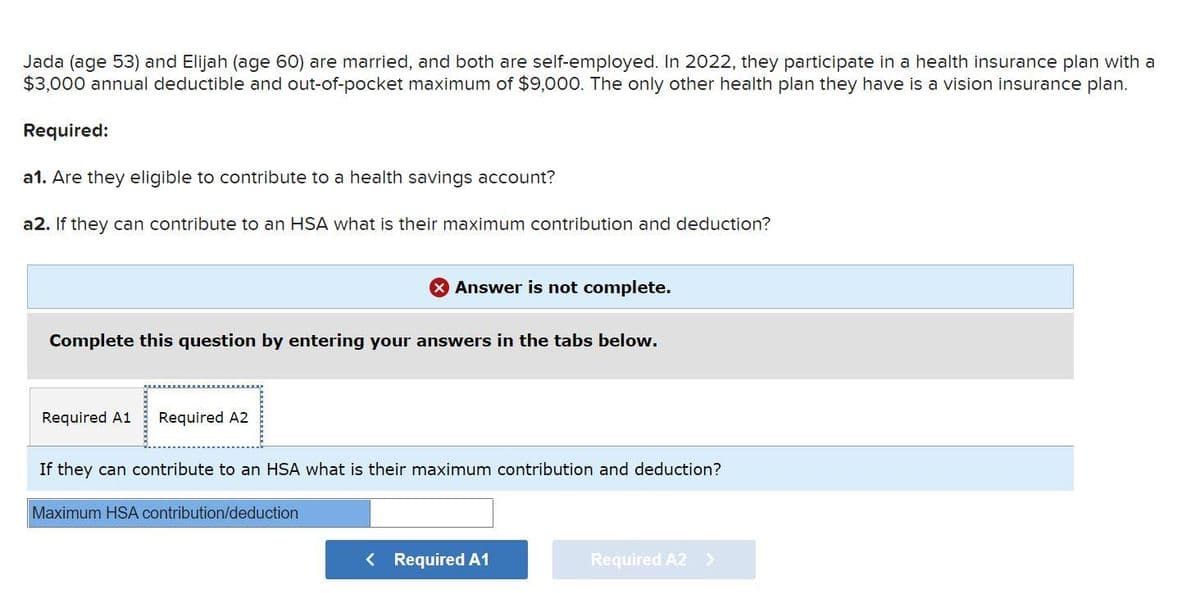

Jada (age 53) and Elijah (age 60) are married, and both are self-employed. In 2022, they participate in a health insurance plan with a $3,000 annual deductible and out-of-pocket maximum of $9,000. The only other health plan they have is a vision insurance plan. Required: a1. Are they eligible to contribute to a health savings account? a2. If they can contribute to an HSA what is their maximum contribution and deduction?

Jada (age 53) and Elijah (age 60) are married, and both are self-employed. In 2022, they participate in a health insurance plan with a $3,000 annual deductible and out-of-pocket maximum of $9,000. The only other health plan they have is a vision insurance plan. Required: a1. Are they eligible to contribute to a health savings account? a2. If they can contribute to an HSA what is their maximum contribution and deduction?

Chapter4: Income Exclusions

Section: Chapter Questions

Problem 41P

Related questions

Question

C2

Transcribed Image Text:Jada (age 53) and Elijah (age 60) are married, and both are self-employed. In 2022, they participate in a health insurance plan with a

$3,000 annual deductible and out-of-pocket maximum of $9,000. The only other health plan they have is a vision insurance plan.

Required:

a1. Are they eligible to contribute to a health savings account?

a2. If they can contribute to an HSA what is their maximum contribution and deduction?

Complete this question by entering your answers in the tabs below.

Required A1 Required A2

X Answer is not complete.

If they can contribute to an HSA what is their maximum contribution and deduction?

Maximum HSA contribution/deduction

< Required A1

Required A2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT