Jan. 16 Declared a cash dividend on the 6%, $103 par noncumulative preferred stock (1,050 shares outstanding). Declared a $0.20 per share dividend on the 100,000 shares of $2 par value common stock outstanding. The date of record is January 31, and the payment date is February 15. Feb. 15 Paid the cash dividends. Jun. 10 Split common stock 2-for-1. Jul. 30 Declared a 30% stock dividend on the common stock. The market value of the common stock was $9 per share. Aug. 15 Distributed the stock dividend. Oct. 26 Purchased 1,000 shares of treasury stock at $8 per share. Nov. 8 Sold 500 shares of treasury stock for $10 per share. 30 Sold 300 shares of treasury stock for $4 per share.

Jan. 16 Declared a cash dividend on the 6%, $103 par noncumulative preferred stock (1,050 shares outstanding). Declared a $0.20 per share dividend on the 100,000 shares of $2 par value common stock outstanding. The date of record is January 31, and the payment date is February 15. Feb. 15 Paid the cash dividends. Jun. 10 Split common stock 2-for-1. Jul. 30 Declared a 30% stock dividend on the common stock. The market value of the common stock was $9 per share. Aug. 15 Distributed the stock dividend. Oct. 26 Purchased 1,000 shares of treasury stock at $8 per share. Nov. 8 Sold 500 shares of treasury stock for $10 per share. 30 Sold 300 shares of treasury stock for $4 per share.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter15: Shareholders’ Equity: Capital Contributions And Distributions

Section: Chapter Questions

Problem 13E

Related questions

Question

Journalizing dividends and

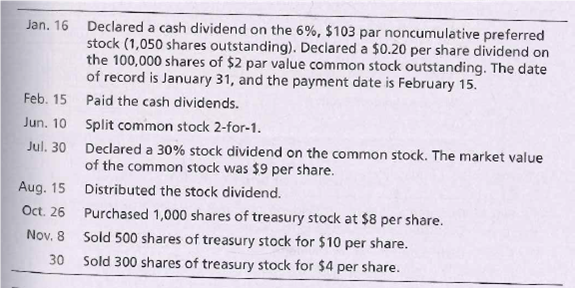

Deerborn Manufacturing Co. completed the following transactions during 2018:

Requirements

- Record the transactions in Deerborn’s general journal.

- Prepare the Deerborn’s stockholders’ equity section of the balance sheet as of December 31, 2018. Assume that Deerborn was authorized to issue 2,600 shares of

preferred stock and 400,000 shares of common stock. Both preferred stock and Common stock were issued at par. The ending balance ofretained earnings as of December 31, 2018, is $2,060,000.

Transcribed Image Text:Jan. 16 Declared a cash dividend on the 6%, $103 par noncumulative preferred

stock (1,050 shares outstanding). Declared a $0.20 per share dividend on

the 100,000 shares of $2 par value common stock outstanding. The date

of record is January 31, and the payment date is February 15.

Feb. 15 Paid the cash dividends.

Jun. 10 Split common stock 2-for-1.

Jul. 30 Declared a 30% stock dividend on the common stock. The market value

of the common stock was $9 per share.

Aug. 15

Distributed the stock dividend.

Oct. 26

Purchased 1,000 shares of treasury stock at $8 per share.

Nov. 8

Sold 500 shares of treasury stock for $10 per share.

30

Sold 300 shares of treasury stock for $4 per share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 14 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning