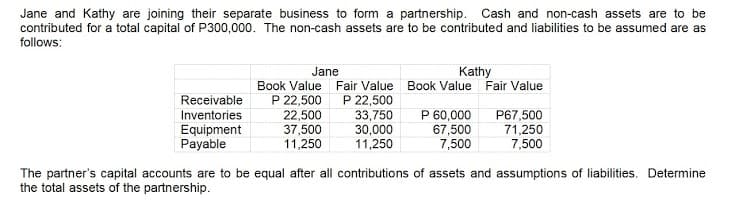

Jane and Kathy are joining their separate business to form a partnership. Cash and non-cash assets are to be contributed for a total capital of P300,000. The non-cash assets are to be contributed and liabilities to be assumed are as follows: Jane Kathy Book Value Fair Value Book Value Fair Value Receivable P 22,500 P 22,500 22,500 37,500 11,250 33,750 30,000 11,250 P 60,000 67,500 7,500 Inventories Equipment Payable P67,500 71,250 7,500 The partner's capital accounts are to be equal after all contributions of assets and assumptions of liabilities. Determine the total assets of the partnership.

Jane and Kathy are joining their separate business to form a partnership. Cash and non-cash assets are to be contributed for a total capital of P300,000. The non-cash assets are to be contributed and liabilities to be assumed are as follows: Jane Kathy Book Value Fair Value Book Value Fair Value Receivable P 22,500 P 22,500 22,500 37,500 11,250 33,750 30,000 11,250 P 60,000 67,500 7,500 Inventories Equipment Payable P67,500 71,250 7,500 The partner's capital accounts are to be equal after all contributions of assets and assumptions of liabilities. Determine the total assets of the partnership.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 2BD

Related questions

Question

Transcribed Image Text:Jane and Kathy are joining their separate business to form a partnership. Cash and non-cash assets are to be

contributed for a total capital of P300,000. The non-cash assets are to be contributed and liabilities to be assumed are as

follows:

Jane

Kathy

Book Value Fair Value

Book Value

Fair Value

Receivable

Inventories

Equipment

Payable

P 22,500

22,500

37,500

11,250

P 22,500

33,750

30,000

11,250

P 60,000

67,500

7,500

P67,500

71,250

7,500

The partner's capital accounts are to be equal after all contributions of assets and assumptions of liabilities. Determine

the total assets of the partnership.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College