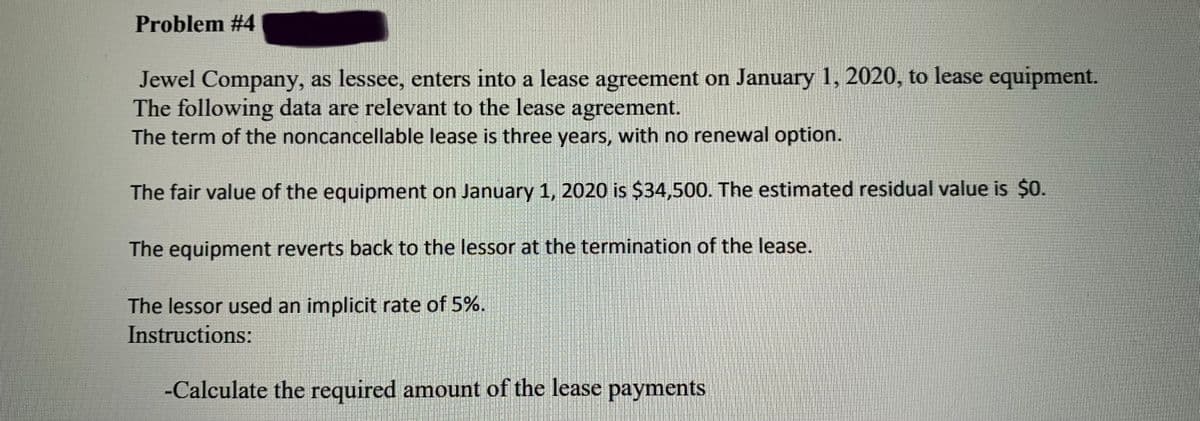

Jewel Company, as lessee, enters into a lease agreement on January 1, 2020, to lease equipment. The following data are relevant to the lease agreement. The term of the noncancellable lease is three years, with no renewal option. The fair value of the equipment on January 1, 2020 is $34,500. The estimated residual value is $0. The equipment reverts back to the lessor at the termination of the lease. The lessor used an implicit rate of 5%.

Q: Morgan leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company.…

A: The economic life of the asset= 6 years Lease term= 6 years The cost of the asset= $291000 The fair…

Q: Ivanhoe Leasing Company agrees to lease equipment to Shamrock Corporation on January 1, 2020. The…

A: Given than : Lease term =7 yearsEconomic life =9 years Fair value =$ 657,000Guaranteed residual…

Q: On January 1, 2021, Sunland, Inc. signs a 10-year noncancelable lease agreement to lease a storage…

A: Amortization: It is the process of allocating the value of an intangible asset over its definite…

Q: Wells Leasing Company signs an agreement on January 1. 2020, to lease equipment to Manchester…

A: Lease: A lease refers to an agreement in which the lessor transfers the leased to leased assets in…

Q: Patsy Co. and Philip Inc. sign a lease agreement dated January 1, 2020. The lease agreement…

A: Fari value of leased Assets: Fair value of the leased asset = PV of annual lease payment + PV of…

Q: Ivanhoe Leasing Company agrees to lease equipment to Shamrock Corporation on January 1, 2020. The…

A: Given, 1. The term of the lease is 7 years with no renewal option, and the machinery has an…

Q: Harlander Corporation leased industrial equipment to American Manufacturing on January 1, 2019. The…

A: A loan amortization schedule is a comprehensive table of periodic loan payments that shows the…

Q: Concord Leasing Company agrees to lease equipment to Marigold Corporation on January 1, 2020. The…

A: Hey, since there are multiple sub-parts questions posted, we will answer the first three sub-parts…

Q: On January 1, 2021, Sheridan, Inc. signs a 10-year noncancelable lease agreement to lease a storage…

A: A lease payment is the monthly equivalent of rent that is specifically defined in a contract between…

Q: mpany, a lessor, actually sold a machinery that it had been leasing under a sale type lease. On…

A: This is an operating Lease as the operating lease is a lease wherein the ownership is not…

Q: Laura Leasing Company signs an agreement on January 1, 2020, to lease equipment to Marigold Company.…

A: A lease is classified as a finance lease if it transfers substantially all the risks and rewards…

Q: Ivanhoe Leasing Company agrees to lease equipment to Shamrock Corporation on January 1, 2020. The…

A: Lease: A lease is an agreement by which one party conveys land, property, administrations, and so…

Q: Compute the value of the lease liability at lease commencement. Lease liability $

A: Lease refers to a contract between two parties under which one party who is the real owner of an…

Q: ncancelable and requires equal rental payments to be made at the end of each year. 2. The cost of…

A: calculation of annual rentals Desired Rate of return = 10% Lease Term= 8 years Salvage value = 0…

Q: Rexon Company leases non-specialized equipment to Ten-Care Company beginning January 1, 2019. The…

A: A lease is classified as Sale Type lease if the following conditions are satisfied, The lease terms…

Q: On January 1, 2021, Blossom, Inc. signs a 10-year noncancelable lease agreement to lease a storage…

A: A contract in which terms and conditions are mentioned at which one party agrees to pay a regular…

Q: The Rexon Company leases non-specialized equipment to Ten-Care Company beginning January 1, 2020.…

A:

Q: Laura Leasing Company signs an agreement on January 1, 2020, to lease equipment to Whispering…

A: Calculate present value (PV) of minimum lease payments: Note: PV of annuity due at implicit rate of…

Q: On January 1, 2020, Evans Company entered into a non-cancelable lease for a machine to be used in…

A:

Q: Zest Company, as lessee, enters into a lease agreement on January 1, 2018, to lease equipment. The…

A: If the annuity factor is: Annuity factor=1r×1-11+rn-1 =15%×1-11+5%4-1…

Q: Rexon Company leases non-specialized equipment to Ten-Care Company beginning January 1, 2019. The…

A: Year PV factor @ 12% Remarks 1 0.89286 = 1 / 1.12 2 0.79719…

Q: Prepare all of the journal entries for the lessee for 2020 to record the lease agreement, the lease…

A: Lease agreement: The lease agreement is a contractual obligation created out of lease agreement,…

Q: On January 1, 2020, Evans Company entered into a non-cancelable lease for a machine to be used in…

A: Lease: Lease is a contractual agreement whereby the right to use an asset for a particular period of…

Q: Laura Leasing Company signs an agreement on January 1, 2020, to lease equipment to Larkspur Company.…

A: Term of Lease=3 years The estimated economic life of the asset=5 years Fair Value of the asset on…

Q: a Leasing Company signs an agreement on January 1, 2020, to lease equipment to Shamrock Company. The…

A: Journal entries are those where the transactions into the books of company and it is the very…

Q: Windsor Leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company.…

A: Lease Liability upon initial recognition shall be measured at lower of Present Value of Minimum…

Q: On January 1, 2019, Amity Company leases a crane to Baltimore Company. The lease contains the…

A: Journal entries: It is the duty of the accountant to record and summarize business economic and non…

Q: Skysong Leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company.…

A: PV of residual value=Residual value×PV factor @8%, 6 years=$20,010×0.6301696=$12,609.69

Q: An entity is a manufacturer of machinery. It uses lease agreements to sell its product, On January…

A: Solution: Amount of sales revenue should be recognized by entity = Present value lease payments +…

Q: Marin Leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company. The…

A: Note:- Since the lessor's desired rate of return on its investment is missing in the question,…

Q: Suppose Shamrock expects the residual value at the end of the lease term to be $45,000 but still…

A: Lease liability at the commencement of the lease is the present value of all the future lease…

Q: On January 1, 2020, Evans Company entered into a non-cancelable lease for a machine to be used in…

A:

Q: Larkspur Leasing Company signs a lease agreement on January 1, 2020, to lease electronic equipment…

A: Since the factor tables have not been given in the question, the present value factor and present…

Q: Jensen Corporation leased industrial equipment to Francis Manufacturing on January 1, 2019. The…

A: Journal Entries- Journal entries refer to the certified book of a company which is used to record…

Q: Marin Leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company. The…

A: Lease term: 6 years Economic life of Asset: 6 Years The Cost of The Asset: $451000 Fair value of The…

Q: Laura Leasing Company signs an agreement on January 1, 2020, to lease equipment to Larkspur Company.…

A: Lease: It is a formal agreement between two parties where in one party lends to another, property or…

Q: Marin Leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company. The…

A: Upon Initial recognition, the lessee shall measure lease liability at lower of Fair Value of Asset…

Q: Ivanhoe Leasing Company agrees to lease equipment to Shamrock Corporation on January 1, 2020. The…

A: Given, 1. The term of the lease is 7 years with no renewal option, and the machinery has an…

Q: On January 1, 2021, Sandhill, Inc. signs a 10-year noncancelable lease agreement to lease a storage…

A: Given information: Fair value $5,800,000 Lease period 10 years Expected rate of return 9%…

Q: Indicate the type of lease Eubank Company has entered into and what accounting treatment is…

A:

Q: n. Instructions: 1. Using the lease classification tests, determine the nature of this lease for the…

A: Journal: Journal is considered as a book of original entry because all the transactions that have…

Q: Laura Leasing Company signs an agreement on January 1, 2020, to lease equipment to Tamarisk Company.…

A: Calculate the Present Value of Minimum Lease Payment : The present value of minimum lease payments…

Q: An entity is a manufacturer of machinery, It uses lease agreements to sell its product, On January…

A: Lease receivable = annual rental x present value factors of annuity due 8% for 5 periods +…

Q: Glaus Leasing Company agrees to lease equipment to Jensen Corporation on January 1, 2020. The…

A: Since we are entitled to answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: Larkspur Leasing Company signs a lease agreement on January 1, 2020, to lease electronic equipment…

A: 1)

Q: Rexon Company leases non-specialized equipment to Ten-Care Company beginning January 1, 2019. The…

A: Amount of the equal rental receipts = Amount recover through annual lease payments / Present value…

Q: Laura Leasing Company signs an agreement on January 1, 2020, to lease equipment to Bonita Company.…

A: given that, the fair value of the asset at January 1, 2020, is $75,000 the residual value of $8,000,…

Q: Monty Leasing Company agrees to lease equipment to Flounder Corporation on January 1, 2020. The…

A: Leasing an asset or a resource means giving the asset on rent for regular payments.

Q: Skysong Leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company.…

A: The following information is given in the question: The Fair value of a leased asset the lessor…

Q: Next Level Assuming that the lease is a sales-type lease from Rexon’s point of view, calculate the…

A: 1) The amount of equal rental receipt = Equipment cost / Annuity factory @ 10% for 8 years Annuity…

Please help solve

Step by step

Solved in 2 steps

- Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.Lessee and Lessor Accounting Issues Diego Leasing Company agrees to provide La Jolla Company with equipment under a noncancelable lease for 5 years. The equipment has a 5-year life, cost Diego 25,000, and will have no residual value when the lease term ends. The fair value of the equipment is 30,000. La Jolla agrees to pay all executory costs (500 per year) throughout the lease period directly to a third party. On January 1, 2019, the equipment is delivered. Diego expects a 14% return on its net investment. The five equal annual rents are payable in advance starting January 1, 2019. Required: 1. Assuming this is a sales-type lease for the Diego and a finance lease for the La Jolla, prepare a table summarizing the lease and interest payments suitable for use by either party. 2. Next Level On the assumption that both companies adjust and close books each December 31, prepare journal entries relating to the lease for both companies through December 31, 2020, based on data derived in the table. Assume that La Jolla depreciates similar equipment by the straight line method

- Lessee and Lessor Accounting Issues The following information is available for a noncancelable lease of equipment entered into on March 1, 2019. The lease is classified as a sales-type lease by the lessor (Anson Company) and as a finance lease by the lessee (Bullard Company). Assume that the lease payments are nude at the beginning of each month, interest and straight-line depreciation are recognized at the end of each month, and the residual value of the leased asset is zero at the end of a 3-year life. Required: 1. Record the lease (including the initial receipt of 2,000) and the receipt of the second and third installments of 2,000 in Ansons accounts. Carry computations to the nearest dollar. 2. Record the lease (including the initial payment of 2,000), the payment of the second and third installments of 2,000, and monthly depreciation in Bullards accounts. The lessee records the lease obligation at net present value. Carry computations to the nearest dollar.Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of 100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is 2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswells incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of 7,000 annually, related to taxes on the property, are paid by Caswell directly to the taxing authority on Dec. 31 of each year. Required: 1. Determine what type of lease this is for the lessee. 2. Prepare appropriate journal entries on the lessees books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2019 and 2020.Sales-Type Lease with Guaranteed Residual Value Calder Company, the lessor, enters into a lease with Darwin Company, the lessee, to provide heavy equipment beginning January 1, 2017. The lease is appropriately classified as a sales-type lease. The lease terms, provisions, and related events are as follows: The lease is noncancelable, has a term of 8 years, and has no renewal or bargain purchase option. The annual rentals are 65,000, payable at the end of each year. The interest rate implicit in the lease is 15%. Darwin agrees to pay all executory costs directly to a third party. The cost of the equipment is 280,000. The fair value of the equipment to Calder is 308,021.03. Calder incurs no material initial direct costs. Calder expects that it will be able to collect all lease payments. Calder estimates that the fair value at the end of the lease term will be 50,000 and that the economic life the equipment is 9 years. This residual value is guaranteed by Darwin. The following present value factors are relevant: PV of an ordinary annuity n = 8, i = 15% = 4.487322 PV n = 8, i = 15% = 0.326902 PV n = 1, i = 15% = 0.869565 Required: 1. Determine the proper classification of the lease. 2. Prepare a table summarizing the lease receipts and interest income earned by Calder for this lease. 3. Prepare journal entries for Calder for the years 2019, 2020, and 2021. 4. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the present value of next years payment approach to classify the lease receivable as current and noncurrent. 5. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the change in present value approach to classify the lease receivable as current and noncurrent.

- Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement dated January 1, 2019, that provides for it to lease non-specialized heavy equipment from Scott Rental Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of 20,000 to be paid in advance at the beginning of each year. 2. The cost, and also fair value, of the heavy equipment to Scott at the inception of the lease is 68,036.62. The equipment has an estimated life of 4 years and has a zero estimated residual value at the end of this time. 3. Adden agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. Scotts interest rate implicit in the lease is 12%. Adden is aware of this rate, which is equal to its borrowing rate. 6. Adden uses the straight-line method to record depreciation on similar equipment. 7. Executory costs paid at the end of the year by Adden are: Required: 1. Next Level Determine what type of lease this is for Adden. 2. Prepare a table summarizing the lease payments and interest expense for Adden. 3. Prepare journal entries for Adden for the years 2019 and 2020.

- Leased Assets Koffman and Sons signed a four-year lease for a forklift on January 1, 2016. Annual lease payments of $1,510, based on an interest rate of 8%, are to be made every December 31, beginning with December 31, 2016. Required Assume that the lease is treated as an operating lease. Will the value of the forklift appear on Koffmans balance sheet? What account will indicate that lease payments have been made? Assume that the lease is treated as a capital lease. Prepare any journal entries needed when the lease is signed. Explain why the value of the leased asset is not recorded at $6,040 (1,5104). Prepare the journal entry to record the first lease payment on December 31, 2016. Calculate the amount of depreciation expense for the year 2016. At what amount would the lease obligation be presented on the balance sheet as of December 31, 2016?Comprehensive Landlord Company and Tenant Company enter into a noncancelable, direct financing lease on January 1, 2019, for nonspecialized equipment that cost the Landlord 280,000 (useful life is 6 years with no residual value). The fair value of the equipment is 300,000. The interest rate implicit in the lease is 14%. The 6-year lease requires 6 equal annual amounts payable each January 1, beginning with January 1, 2019. Tenant pays all executory costs directly to a third party on December 1 of each year. The equipment reverts to the lessor at the termination of the lease. Assume that there are no initial direct costs. Landlord expects to collect all rental payments. Required: 1. Next Level (a) Show how landlord should compute the annual rental amounts, (b) Discuss how the Tenant Company should compute the present value of the lease payments. What additional information would be required to make this computation? 2. Next Level Prepare a table summarizing the lease and interest receipts that would be suitable for Landlord. Under what conditions would this table be suitable for Tenant? 3. Assuming that the table prepared in Requirement 2 is suitable for both the lessee and the lessor, prepare the journal entries for both firms for the years 2019 and 2020. Use the straight-line depreciation method for the leased equipment. The executory costs paid by the lessee are in 2019: insurance, 700 and property taxes, 800; in 2020: insurance, 600 and property taxes, 750. 4. Next Level Show the items and amounts that would be reported on the comparative 2019 and 2020 income statements and ending balance sheets for both the lessor and the lessee, using the change in present value approach.Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.