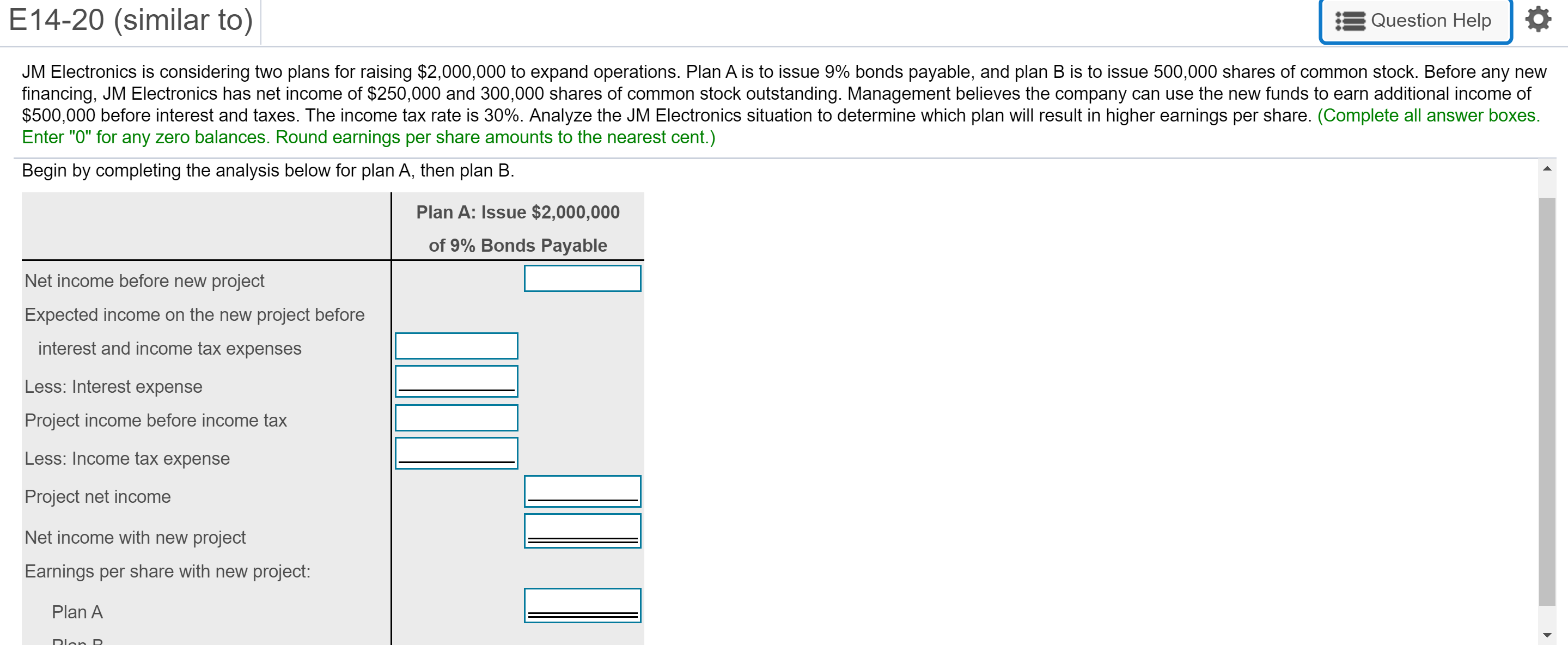

JM Electronics is considering two plans for raising $2,000,000 to expand operations. Plan A is to issue 9% bonds payable, and plan B is to issue 500,000 shares of common stock. Before any new financing, JM Electronics has net income of $250,000 and 300,000 shares of common stock outstanding. Management believes the company can use the new funds to earn additional income of $500,000 before interest and taxes. The income tax rate is 30%. Analyze the JM Electronics situation to determine which plan will result in higher earnings per share. (Complete all answer boxes. Enter "0" for any zero balances. Round earnings per share amounts to the nearest cent.) Begin by completing the analysis below for plan A, then plan B. Plan A: Issue $2,000,000 of 9% Bonds Payable Net income before new project Expected income on the new project before interest and income tax expenses Less: Interest expense Project income before income tax Less: Income tax expense Project net income Net income with new project Earnings per share with new project: Plan A Dlan D II

JM Electronics is considering two plans for raising $2,000,000 to expand operations. Plan A is to issue 9% bonds payable, and plan B is to issue 500,000 shares of common stock. Before any new financing, JM Electronics has net income of $250,000 and 300,000 shares of common stock outstanding. Management believes the company can use the new funds to earn additional income of $500,000 before interest and taxes. The income tax rate is 30%. Analyze the JM Electronics situation to determine which plan will result in higher earnings per share. (Complete all answer boxes. Enter "0" for any zero balances. Round earnings per share amounts to the nearest cent.) Begin by completing the analysis below for plan A, then plan B. Plan A: Issue $2,000,000 of 9% Bonds Payable Net income before new project Expected income on the new project before interest and income tax expenses Less: Interest expense Project income before income tax Less: Income tax expense Project net income Net income with new project Earnings per share with new project: Plan A Dlan D II

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

ChapterMB: Model-building Problems

Section: Chapter Questions

Problem 8M

Related questions

Question

Need help ASAP, thanks!

Transcribed Image Text:JM Electronics is considering two plans for raising $2,000,000 to expand operations. Plan A is to issue 9% bonds payable, and plan B is to issue 500,000 shares of common stock. Before any new

financing, JM Electronics has net income of $250,000 and 300,000 shares of common stock outstanding. Management believes the company can use the new funds to earn additional income of

$500,000 before interest and taxes. The income tax rate is 30%. Analyze the JM Electronics situation to determine which plan will result in higher earnings per share. (Complete all answer boxes.

Enter "0" for any zero balances. Round earnings per share amounts to the nearest cent.)

Begin by completing the analysis below for plan A, then plan B.

Plan A: Issue $2,000,000

of 9% Bonds Payable

Net income before new project

Expected income on the new project before

interest and income tax expenses

Less: Interest expense

Project income before income tax

Less: Income tax expense

Project net income

Net income with new project

Earnings per share with new project:

Plan A

Dlan D

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning