How much should John deposit into his saving account monthly now? Round your answer te nearest cent. If John wants the one million dollars in his saving account to last him 20 years into his retirement, how much could he withdraw from the saving account monthly? You can assum saving account will pay the same 2.4% annual interest rate. Round your answer to the neares cent. TF John inor bin monthl: donecit o)br のう00 も

How much should John deposit into his saving account monthly now? Round your answer te nearest cent. If John wants the one million dollars in his saving account to last him 20 years into his retirement, how much could he withdraw from the saving account monthly? You can assum saving account will pay the same 2.4% annual interest rate. Round your answer to the neares cent. TF John inor bin monthl: donecit o)br のう00 も

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter27: Time Value Of Money (compound)

Section: Chapter Questions

Problem 6E

Related questions

Question

Please see Image

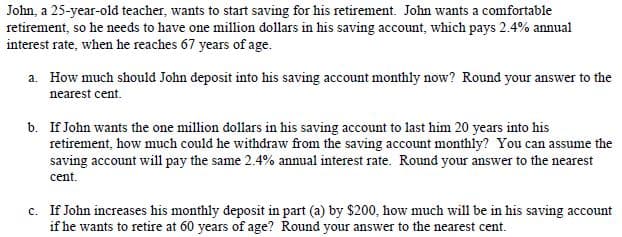

Transcribed Image Text:John, a 25-year-old teacher, wants to start saving for his retirement. John wants a comfortable

retirement, so he needs to have one million dollars in his saving account, which pays 2.4% annual

interest rate, when he reaches 67 years of age.

a. How much should John deposit into his saving account monthly now? Round your answer to the

nearest cent.

b. If John wants the one million dollars in his saving account to last him 20 years into his

retirement, how much could he withdraw from the saving account monthly? You can assume the

saving account will pay the same 2.4% annual interest rate. Round your answer to the nearest

cent.

c. If John increases his monthly deposit in part (a) by $200, how much will be in his saving account

if he wants to retire at 60 years of age? Round your answer to the nearest cent.

Expert Solution

Step 1

Period of investment =42 years

Retirement amount =$1000000

Annual interest =2.4%

Step 2

Future value FACTOR =(1+r)n-1/r

Future value FACTOR =(1.024)-42-1/0.024

Future value FACTOR =71.15

Future value =Future value FACTOR x annual payment

1000000=71.15 × annual payment

Annual payment =14054.81

Monthly payment =$1171.23

This amount should deposits in savings accounts monthly for retirement.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning