Johnson Company calculates its allowance for uncollectible accounts as 20% of its ending balance in gross accounts receivable. The allowance for uncollectible accounts had a credit balance of $21,000 at the beginning of 2021. No previously written-off accounts receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totaled $350,200, and prior to recording the adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 38,400 Required: 1. What was the balance in gross accounts receivable as of 12/31/2020? 2. What journal entry should Johnson record to recognize bad debt expense for 2021? 3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of accounts receivable written off during 2021. 4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021? Required 1 Required 2 Required 3 Required 4 What was the balance in gross accounts receivable as of 12/31/2020? Balance in gross accounts receiva ble 1 Record the entry to recognize bad debt expense for 2021 Note: Enter debits before credits. General Journal Year Debit Credit 2021 Record entry View general journal Clear entry Required 1 Required 3 Johnson Company calculates its alllowance for uncollectible accounts as 20% of its ending balance in gross accounts receivable. The allowance for uncollectible accounts had a credit balance of $21,000 at the beginning of 2021. No previously written-off accounts receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totaled $350,200, and prior to recording the adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 38,400 Required: 1. What was the balance in gross accounts receivable as of 12/31/2020? 2. What journal entry should Johnson record to recognize bad debt expense for 2021? 3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of accounts receivable written off during 2021. 4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021? Required 1 Required 2 Required 3 Required 4 Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of accounts receivable written off during 2021 Amount of accounts receivable written off Required 2 Required 4 Johnson Company calculates its allowance for uncollectible accounts as 20% of its ending balance in gross accounts receivable. The allowance for uncollectible accounts had a credit balance of $21,000 at the beginning of 2021. No previously written-off accounts receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totaled $350,200, and prior to recording the adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 38,400. Required: 1. What was the balance in gross accounts receivable as of 12/31/2020? 2. What journal entry should Johnson record to recognize bad debt expense for 2021? 3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of accounts receivable written off during 2021. 4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021? Required 3 Required 1 Required 2 Required 4 If Johnson instead used the direct write-off method, what would bad debt expense be for 2021? Bad debt expense for 2021 Required 3 Required 4

Johnson Company calculates its allowance for uncollectible accounts as 20% of its ending balance in gross accounts receivable. The allowance for uncollectible accounts had a credit balance of $21,000 at the beginning of 2021. No previously written-off accounts receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totaled $350,200, and prior to recording the adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 38,400 Required: 1. What was the balance in gross accounts receivable as of 12/31/2020? 2. What journal entry should Johnson record to recognize bad debt expense for 2021? 3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of accounts receivable written off during 2021. 4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021? Required 1 Required 2 Required 3 Required 4 What was the balance in gross accounts receivable as of 12/31/2020? Balance in gross accounts receiva ble 1 Record the entry to recognize bad debt expense for 2021 Note: Enter debits before credits. General Journal Year Debit Credit 2021 Record entry View general journal Clear entry Required 1 Required 3 Johnson Company calculates its alllowance for uncollectible accounts as 20% of its ending balance in gross accounts receivable. The allowance for uncollectible accounts had a credit balance of $21,000 at the beginning of 2021. No previously written-off accounts receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totaled $350,200, and prior to recording the adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 38,400 Required: 1. What was the balance in gross accounts receivable as of 12/31/2020? 2. What journal entry should Johnson record to recognize bad debt expense for 2021? 3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of accounts receivable written off during 2021. 4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021? Required 1 Required 2 Required 3 Required 4 Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of accounts receivable written off during 2021 Amount of accounts receivable written off Required 2 Required 4 Johnson Company calculates its allowance for uncollectible accounts as 20% of its ending balance in gross accounts receivable. The allowance for uncollectible accounts had a credit balance of $21,000 at the beginning of 2021. No previously written-off accounts receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totaled $350,200, and prior to recording the adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 38,400. Required: 1. What was the balance in gross accounts receivable as of 12/31/2020? 2. What journal entry should Johnson record to recognize bad debt expense for 2021? 3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of accounts receivable written off during 2021. 4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021? Required 3 Required 1 Required 2 Required 4 If Johnson instead used the direct write-off method, what would bad debt expense be for 2021? Bad debt expense for 2021 Required 3 Required 4

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 94.2C

Related questions

Question

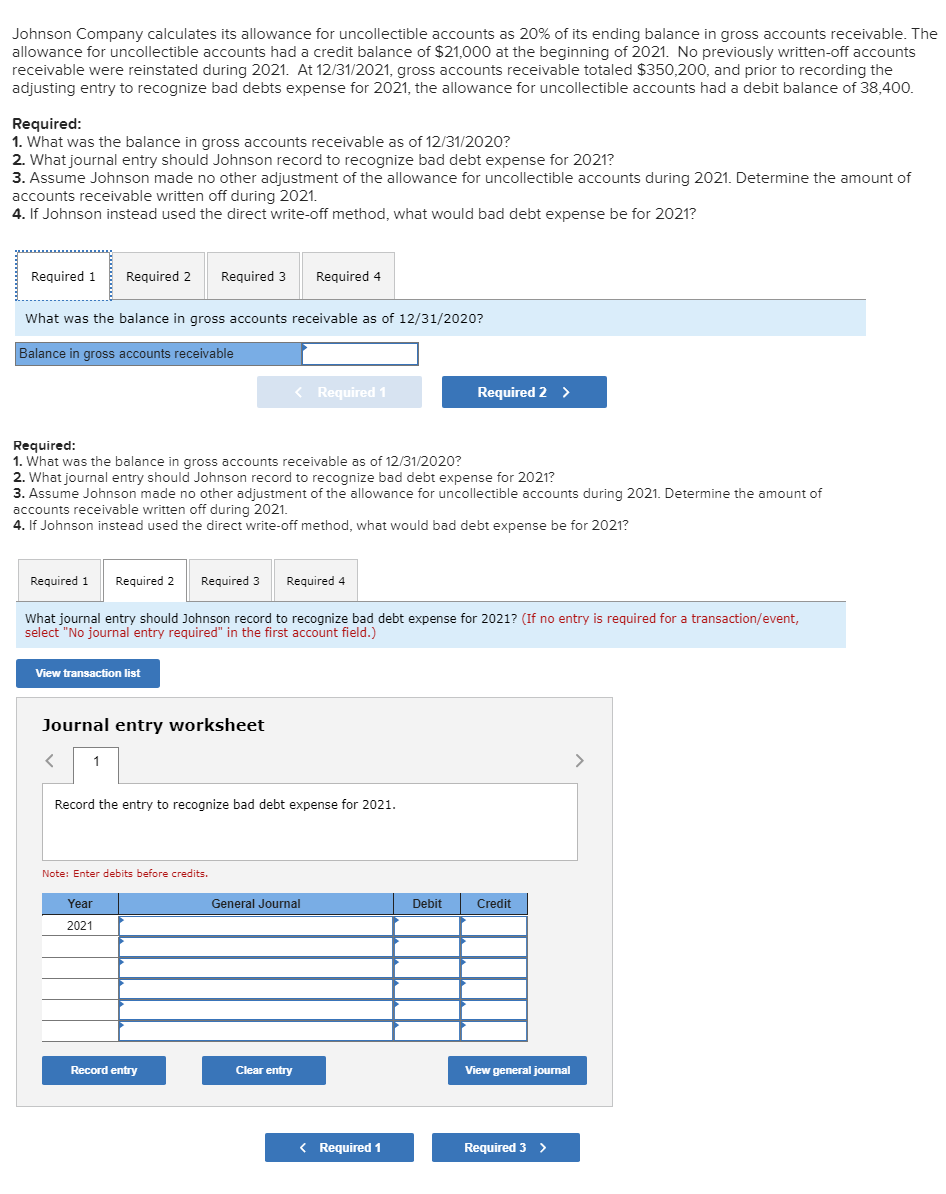

Transcribed Image Text:Johnson Company calculates its allowance for uncollectible accounts as 20% of its ending balance in gross accounts receivable. The

allowance for uncollectible accounts had a credit balance of $21,000 at the beginning of 2021. No previously written-off accounts

receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totaled $350,200, and prior to recording the

adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 38,400

Required:

1. What was the balance in gross accounts receivable as of 12/31/2020?

2. What journal entry should Johnson record to recognize bad debt expense for 2021?

3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of

accounts receivable written off during 2021.

4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021?

Required 1

Required 2

Required 3

Required 4

What was the balance in gross accounts receivable as of 12/31/2020?

Balance in gross accounts receiva ble

<Required 1

Required 2

Required:

1. What was the balance in gross accounts receivable as of 12/31/2020?

2. What journal entry should Johnson record to recognize bad debt expense for 2021?

3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of

accounts receivable written off during 2021.

4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021?

Required 1

Required 2

Required 3

Required 4

What journal entry should Johnson record to recognize bad debt expense for 2021? (If no entry is required for a transaction/event,

select "No journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

>

1

Record the entry to recognize bad debt expense for 2021

Note: Enter debits before credits.

General Journal

Year

Debit

Credit

2021

Record entry

View general journal

Clear entry

Required 1

Required 3

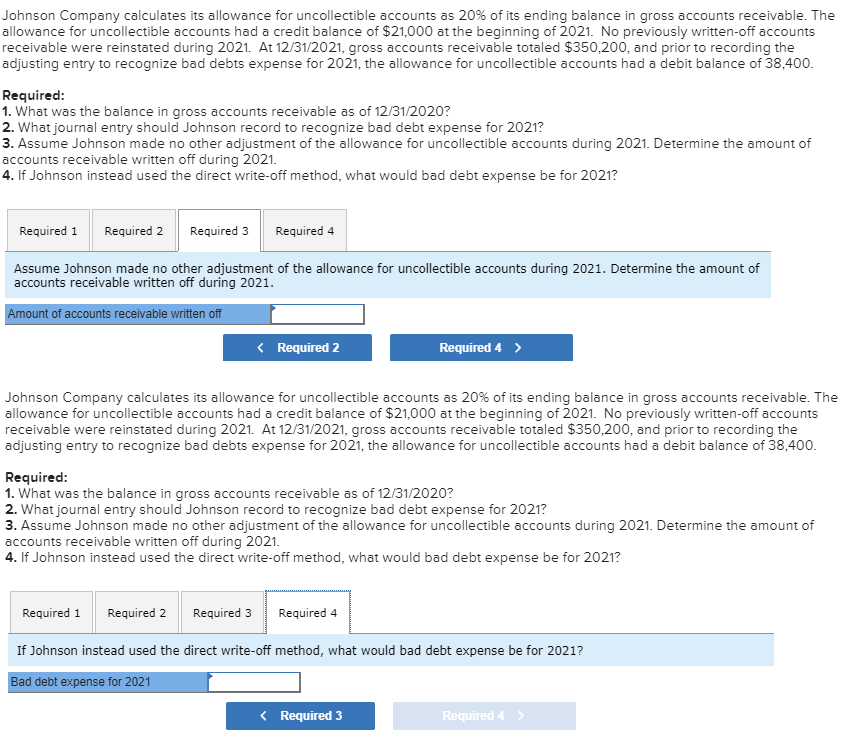

Transcribed Image Text:Johnson Company calculates its alllowance for uncollectible accounts as 20% of its ending balance in gross accounts receivable. The

allowance for uncollectible accounts had a credit balance of $21,000 at the beginning of 2021. No previously written-off accounts

receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totaled $350,200, and prior to recording the

adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 38,400

Required:

1. What was the balance in gross accounts receivable as of 12/31/2020?

2. What journal entry should Johnson record to recognize bad debt expense for 2021?

3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of

accounts receivable written off during 2021.

4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021?

Required 1

Required 2

Required 3

Required 4

Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of

accounts receivable written off during 2021

Amount of accounts receivable written off

Required 2

Required 4

Johnson Company calculates its allowance for uncollectible accounts as 20% of its ending balance in gross accounts receivable. The

allowance for uncollectible accounts had a credit balance of $21,000 at the beginning of 2021. No previously written-off accounts

receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totaled $350,200, and prior to recording the

adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 38,400.

Required:

1. What was the balance in gross accounts receivable as of 12/31/2020?

2. What journal entry should Johnson record to recognize bad debt expense for 2021?

3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of

accounts receivable written off during 2021.

4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021?

Required 3

Required 1

Required 2

Required 4

If Johnson instead used the direct write-off method, what would bad debt expense be for 2021?

Bad debt expense for 2021

Required 3

Required 4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub