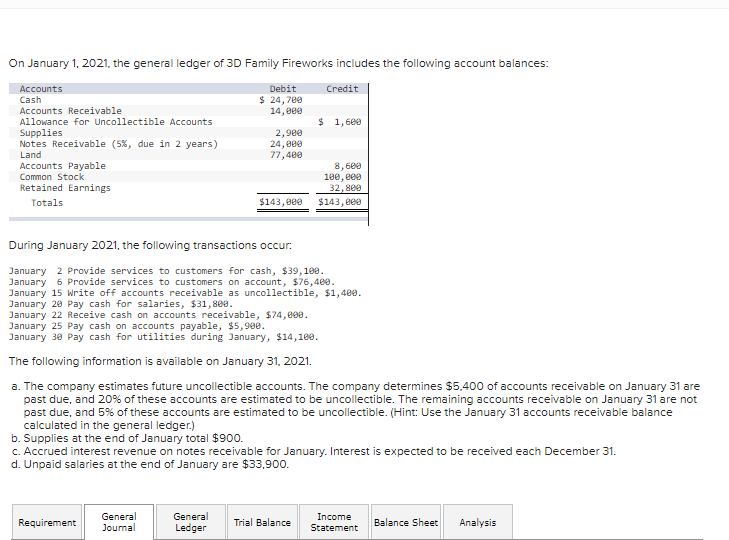

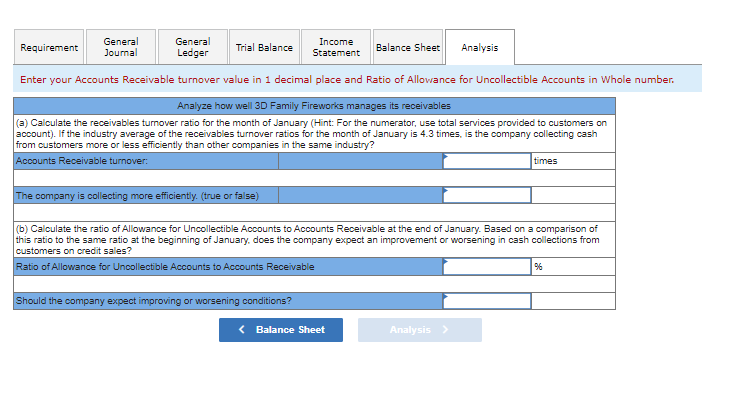

Journal entry: 1. Provide services to customers for cash, $39,100. 2. Provide services to customers on account, $76,400. 3. Write off accounts receivable as uncollectible, $1,400. 4. Pay cash for salaries, $31,800. 5. Receive cash on accounts receivable, $74,000. 6. Pay cash on accounts payable, $5,900. 7. Pay cash for utilities during January, $14,100. 8, The company estimates future uncollectible accounts. The company determines $5,400 of accounts receivable on January 31 are past due, and 20% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) Record the adjusting entry for uncollectible accounts. 9. Supplies at the end of January total $900. Record the adjusting entry for supplies. 10. Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31. Record the adjusting entry for interest. 11. Unpaid salaries at the end of January are $33,900. Record the adjusting entry for salaries. 12. Record the closing entry for revenue. 13. Record the closing entry for expenses. there are separated parts to one question. thank you sm!

1. Provide services to customers for cash, $39,100.

2. Provide services to customers on account, $76,400.

3. Write off accounts receivable as uncollectible, $1,400.

4. Pay cash for salaries, $31,800.

5. Receive cash on accounts receivable, $74,000.

6. Pay cash on accounts payable, $5,900.

7. Pay cash for utilities during January, $14,100.

8, The company estimates future uncollectible accounts. The company determines $5,400 of accounts receivable on January 31 are past due, and 20% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) Record the

9. Supplies at the end of January total $900. Record the adjusting entry for supplies.

10. Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31. Record the adjusting entry for interest.

11. Unpaid salaries at the end of January are $33,900. Record the adjusting entry for salaries.

12. Record the closing entry for revenue.

13. Record the closing entry for expenses.

there are separated parts to one question. thank you sm!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images