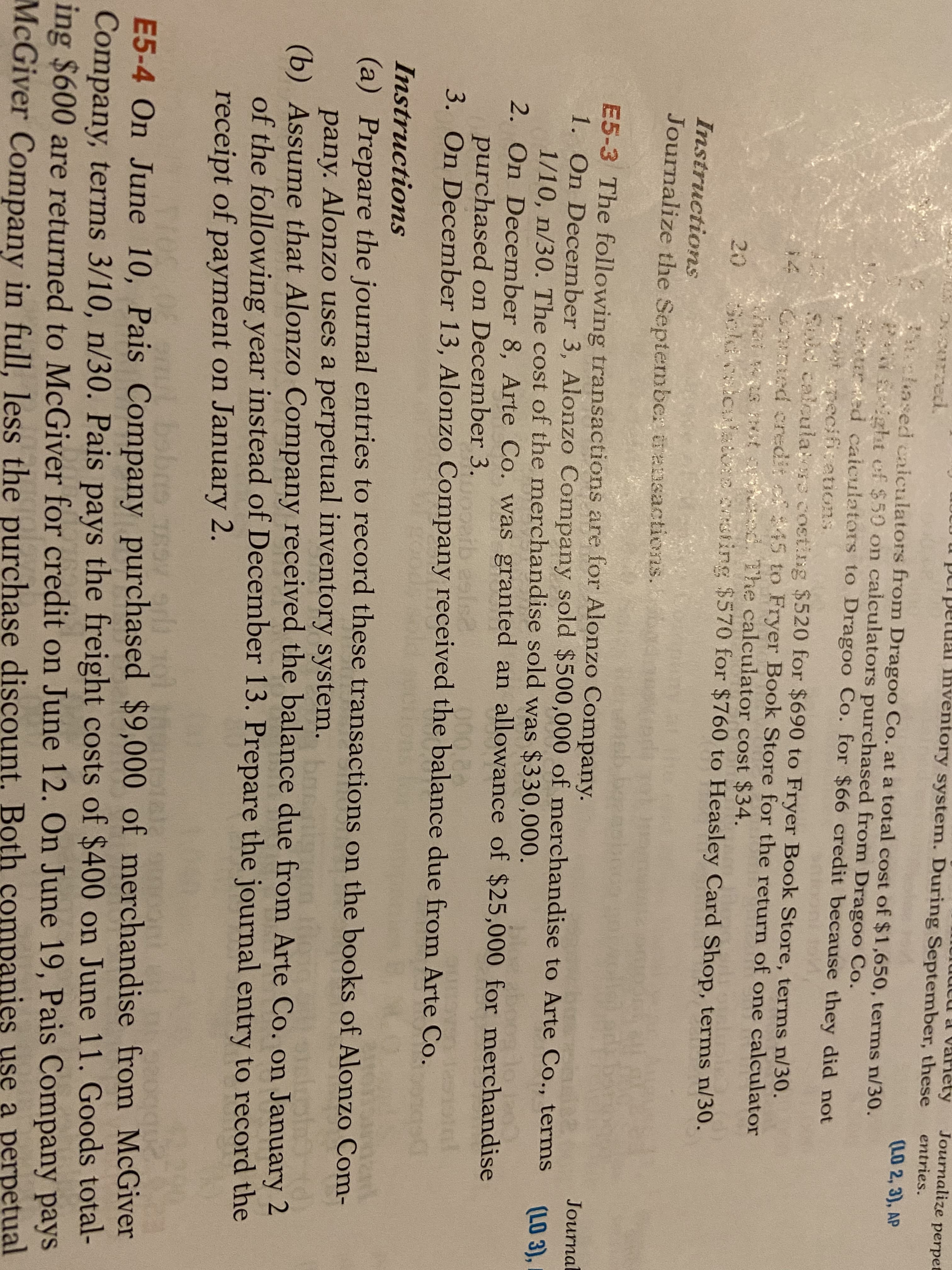

Journalize perpet luutu a variety purpetual lnventory system. During September, these entries. curzed. (LO 2, 3), AP 3ochased caiculators from Dragoo Co. at a total cost of $1,650, terms n/30. PNSeight of $50 on calculators purchased from Dragoo Co. ured caiculators to Dragoo Co. for $66 credit because they did not at pecifications Sld calcula s costing $520 for $690 to Fryer Book Store, terms n/30. Crnted credit of$45 to Fryer Book Store for the return of one calculator hai ws tst sheed. The calculator cost $34. Scldicul e onting $570 for $760 to Heasley Card Shop, terms n/30. 14 20 Instructions Journalize the Septembe: ansactions. E5-3 The following transactions are for Alonzo Company. 1. On December 3, Alonzo Company sold $500,000 of merchandise to Arte Co., terms 1/10, n/30. The cost of the merchandise sold was $330,000. 2. On December 8, Arte Co. was granted an allowance of $25,000 for merchandise purchased on December 3. 3. On December 13, Alonzo Company received the balance due from Arte Co. Journal (LO 3), Instructions (a) Prepare the journal entries to record these transactions on the books of Alonzo Com- pany. Alonzo uses a perpetual inventory system.e (b) Assume that Alonzo Company received the balance due from Arte Co. on January 2 of the following year instead of December 13. Prepare the journal entry to record the receipt of payment on January 2. bae TEOV r E5-4 On June 10, Pais Company purchased $9,000 of merchandise from McGiver Company, terms 3/10, n/30. Pais pays the freight costs of $400 on June 11. Goods total- ing $600 are returned to McGiver for credit on June 12. On June 19, Pais Company pays McGiver Company in full, less the purchase discount. Both companies use a perpetual bobrs

Journalize perpet luutu a variety purpetual lnventory system. During September, these entries. curzed. (LO 2, 3), AP 3ochased caiculators from Dragoo Co. at a total cost of $1,650, terms n/30. PNSeight of $50 on calculators purchased from Dragoo Co. ured caiculators to Dragoo Co. for $66 credit because they did not at pecifications Sld calcula s costing $520 for $690 to Fryer Book Store, terms n/30. Crnted credit of$45 to Fryer Book Store for the return of one calculator hai ws tst sheed. The calculator cost $34. Scldicul e onting $570 for $760 to Heasley Card Shop, terms n/30. 14 20 Instructions Journalize the Septembe: ansactions. E5-3 The following transactions are for Alonzo Company. 1. On December 3, Alonzo Company sold $500,000 of merchandise to Arte Co., terms 1/10, n/30. The cost of the merchandise sold was $330,000. 2. On December 8, Arte Co. was granted an allowance of $25,000 for merchandise purchased on December 3. 3. On December 13, Alonzo Company received the balance due from Arte Co. Journal (LO 3), Instructions (a) Prepare the journal entries to record these transactions on the books of Alonzo Com- pany. Alonzo uses a perpetual inventory system.e (b) Assume that Alonzo Company received the balance due from Arte Co. on January 2 of the following year instead of December 13. Prepare the journal entry to record the receipt of payment on January 2. bae TEOV r E5-4 On June 10, Pais Company purchased $9,000 of merchandise from McGiver Company, terms 3/10, n/30. Pais pays the freight costs of $400 on June 11. Goods total- ing $600 are returned to McGiver for credit on June 12. On June 19, Pais Company pays McGiver Company in full, less the purchase discount. Both companies use a perpetual bobrs

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 1PA: Record journal entries for the following transactions of Furniture Warehouse. A. Aug. 3: Sold 15...

Related questions

Question

Transcribed Image Text:Journalize perpet

luutu a variety

purpetual lnventory system. During September, these

entries.

curzed.

(LO 2, 3), AP

3ochased caiculators from Dragoo Co. at a total cost of $1,650, terms n/30.

PNSeight of $50 on calculators purchased from Dragoo Co.

ured caiculators to Dragoo Co. for $66 credit because they did not

at pecifications

Sld calcula s costing $520 for $690 to Fryer Book Store, terms n/30.

Crnted credit of$45 to Fryer Book Store for the return of one calculator

hai ws tst sheed. The calculator cost $34.

Scldicul e onting $570 for $760 to Heasley Card Shop, terms n/30.

14

20

Instructions

Journalize the Septembe: ansactions.

E5-3 The following transactions are for Alonzo Company.

1. On December 3, Alonzo Company sold $500,000 of merchandise to Arte Co., terms

1/10, n/30. The cost of the merchandise sold was $330,000.

2. On December 8, Arte Co. was granted an allowance of $25,000 for merchandise

purchased on December 3.

3. On December 13, Alonzo Company received the balance due from Arte Co.

Journal

(LO 3),

Instructions

(a) Prepare the journal entries to record these transactions on the books of Alonzo Com-

pany. Alonzo uses a perpetual inventory system.e

(b) Assume that Alonzo Company received the balance due from Arte Co. on January 2

of the following year instead of December 13. Prepare the journal entry to record the

receipt of payment on January 2.

bae

TEOV r

E5-4 On June 10, Pais Company purchased $9,000 of merchandise from McGiver

Company, terms 3/10, n/30. Pais pays the freight costs of $400 on June 11. Goods total-

ing $600 are returned to McGiver for credit on June 12. On June 19, Pais Company pays

McGiver Company in full, less the purchase discount. Both companies use a perpetual

bobrs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning