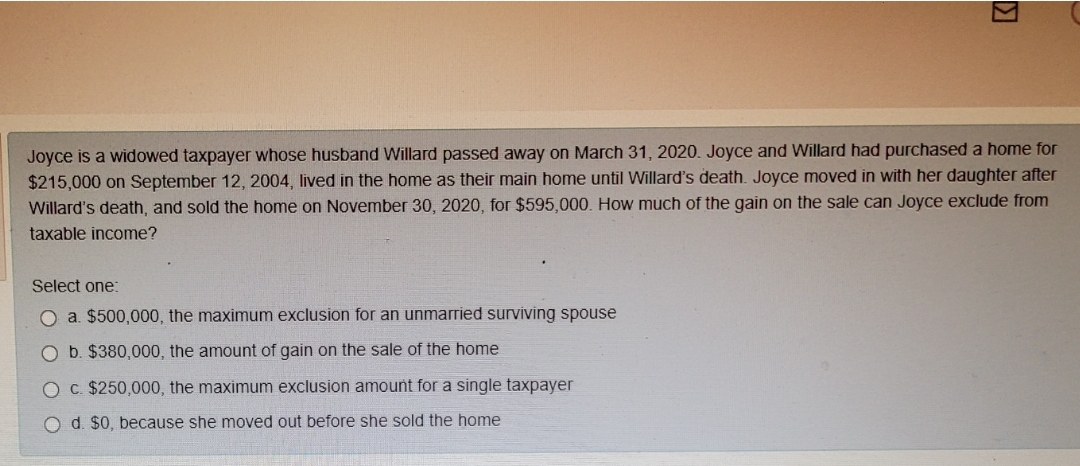

Joyce is a widowed taxpayer whose husband Willard passed away on March 31, 2020. Joyce and Willard had purchased a home for $215,000 on September 12, 2004, lived in the home as their main home until Willard's death. Joyce moved in with her daughter after Willard's death, and sold the home on November 30, 2020 , for $595,000. How much of the gain on the sale can Joyce exclude from taxable income? Select one: O a $500,000, the maximum exclusion for an unmarried surviving spouse O b. $380,000, the amount of gain on the sale of the home O C. $250,000, the maximum exclusion amount for a single taxpayer O d. $0, because she moved out before she sold the home

Joyce is a widowed taxpayer whose husband Willard passed away on March 31, 2020. Joyce and Willard had purchased a home for $215,000 on September 12, 2004, lived in the home as their main home until Willard's death. Joyce moved in with her daughter after Willard's death, and sold the home on November 30, 2020 , for $595,000. How much of the gain on the sale can Joyce exclude from taxable income? Select one: O a $500,000, the maximum exclusion for an unmarried surviving spouse O b. $380,000, the amount of gain on the sale of the home O C. $250,000, the maximum exclusion amount for a single taxpayer O d. $0, because she moved out before she sold the home

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 40P

Related questions

Question

Transcribed Image Text:Joyce is a widowed taxpayer whose husband Willard passed away on March 31, 2020. Joyce and Willard had purchased a home for

$215,000 on September 12, 2004, lived in the home as their main home until Willard's death. Joyce moved in with her daughter after

Willard's death, and sold the home on November 30, 2020 , for $595,000. How much of the gain on the sale can Joyce exclude from

taxable income?

Select one:

O a. $500,000, the maximum exclusion for an unmarried surviving spouse

O b. $380,000, the amount of gain on the sale of the home

O C. $250,000, the maximum exclusion amount for a single taxpayer

O d. $0, because she moved out before she sold the home

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT