Ken is a self-employed architect in a small firm with four employees: himself, his office assistant, and two drafters, all o worked for Ken full-time for the last four years. The office assistant earns $37,500 per year and each drafter earns $55 earnings from self-employment (after deducting all expenses and one-half of self-employment taxes) are $325,000. Ke whether to establish a SIMPLE plan and has a few questions. Required: a. Is he eligible to establish a SIMPLE plan? b. Is he required to cover his employees under the plan? c. If his employees must be covered, what is the maximum amount that can be contributed on their behalf? d. If the employees are not covered, what is the maximum amount Ken can contribute for himself? e. If Ken is required to contribute for his employees and chooses to contribute the maximum amount, what is the maxin Ken can contribute for himself? (Hint: Calculate the employee amounts first.) Ignore any changes in Ken's self-emplo

Ken is a self-employed architect in a small firm with four employees: himself, his office assistant, and two drafters, all o worked for Ken full-time for the last four years. The office assistant earns $37,500 per year and each drafter earns $55 earnings from self-employment (after deducting all expenses and one-half of self-employment taxes) are $325,000. Ke whether to establish a SIMPLE plan and has a few questions. Required: a. Is he eligible to establish a SIMPLE plan? b. Is he required to cover his employees under the plan? c. If his employees must be covered, what is the maximum amount that can be contributed on their behalf? d. If the employees are not covered, what is the maximum amount Ken can contribute for himself? e. If Ken is required to contribute for his employees and chooses to contribute the maximum amount, what is the maxin Ken can contribute for himself? (Hint: Calculate the employee amounts first.) Ignore any changes in Ken's self-emplo

Chapter3: Business Income And Expenses

Section: Chapter Questions

Problem 11MCQ

Related questions

Question

If you are able to please explain each step and bold the answers.

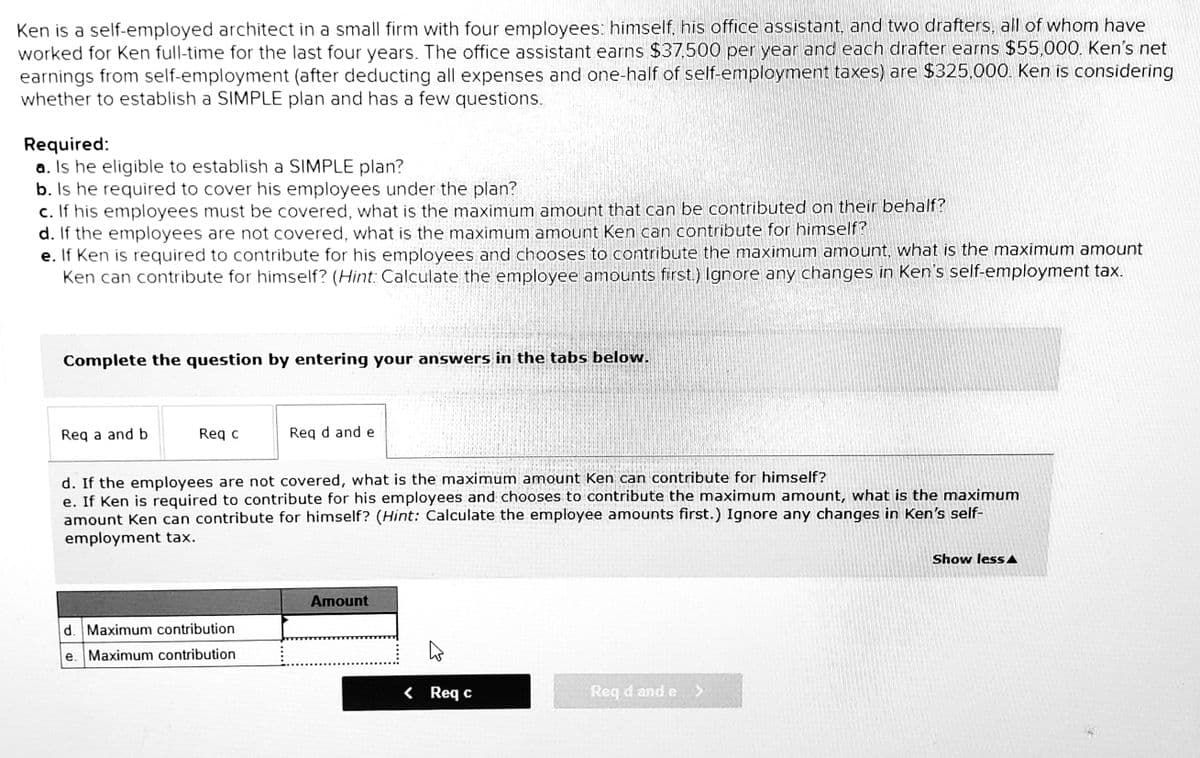

Transcribed Image Text:Ken is a self-employed architect in a small firm with four employees: himself, his office assistant, and two drafters, all of whom have

worked for Ken full-time for the last four years. The office assistant earns $37,500 per year and each drafter earns $55,000. Ken's net

earnings from self-employment (after deducting all expenses and one-half of self-employment taxes) are $325.000. Ken is considering

whether to establish a SIMPLE plan and has a few questions.

Required:

a. Is he eligible to establish a SIMPLE plan?

b. Is he required to cover his employees under the plan?

c. If his employees must be covered, what is the maximum amount that can be contributed on their behalf?

d. If the employees are not covered, what is the maximum amount Ken can contribute for himself?

e. If Ken is required to contribute for his employees and chooses to contribute the maximum amount, what is the maximum amount

Ken can contribute for himself? (Hint: Calculate the employee amounts first.) Ignore any changes in Ken's self-employment tax.

Complete the question by entering your answers in the tabs below.

Req a and b

Req c

Req d and e

d. If the employees are not covered, what is the maximum amount Ken can contribute for himself?

e. If Ken is required to contribute for his employees and chooses to contribute the maximum amount, what is the maximum

amount Ken can contribute for himself? (Hint: Calculate the employee amounts first.) Ignore any changes in Ken's self-

employment tax.

Show less A

Amount

d. Maximum contribution

e. Maximum contribution

< Req c

Req d and e>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you