Kenneth Halabi is a financial executive with Pharoah Enterprises. Although Kenneth has not had any formal training in finance accounting, he has a good sense for numbers and has helped the company grow from a very small company ($540,000 in sales) a large operation ($48.60 million in sales). With the business growing steadily, however, the company needs to make a number a difficult financial decisions in which Kenneth feels a little over his head. He therefore has decided to hire a new employee with numbers expertise to help him. As a basis for determining whom to employ, he has decided to ask each prospective employee to prepare answers to questions relating to situations he has encountered recently. The following are the facts for the second question asked of prospective employees. Last year the company exchanged a piece of land for a non-interest-bearing note. The note is to be paid at the rate of $14,300 per year for nine years, beginning one year from the date of disposal of the land. An appropriate rate of interest for the note was 10% (market rate). At the time the land was originally purchased, it cost $85,800. Click here to viour stable DOCCI

Kenneth Halabi is a financial executive with Pharoah Enterprises. Although Kenneth has not had any formal training in finance accounting, he has a good sense for numbers and has helped the company grow from a very small company ($540,000 in sales) a large operation ($48.60 million in sales). With the business growing steadily, however, the company needs to make a number a difficult financial decisions in which Kenneth feels a little over his head. He therefore has decided to hire a new employee with numbers expertise to help him. As a basis for determining whom to employ, he has decided to ask each prospective employee to prepare answers to questions relating to situations he has encountered recently. The following are the facts for the second question asked of prospective employees. Last year the company exchanged a piece of land for a non-interest-bearing note. The note is to be paid at the rate of $14,300 per year for nine years, beginning one year from the date of disposal of the land. An appropriate rate of interest for the note was 10% (market rate). At the time the land was originally purchased, it cost $85,800. Click here to viour stable DOCCI

Chapter12: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 1gM

Related questions

Question

Ee 117.

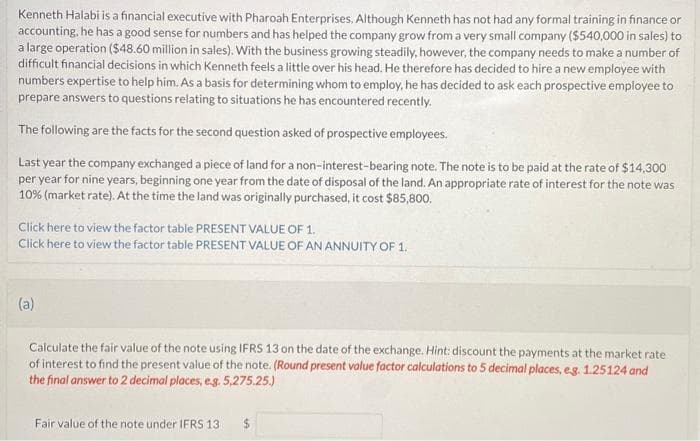

Transcribed Image Text:Kenneth Halabi is a financial executive with Pharoah Enterprises. Although Kenneth has not had any formal training in finance or

accounting, he has a good sense for numbers and has helped the company grow from a very small company ($540,000 in sales) to

a large operation ($48.60 million in sales). With the business growing steadily, however, the company needs to make a number of

difficult financial decisions in which Kenneth feels a little over his head. He therefore has decided to hire a new employee with

numbers expertise to help him. As a basis for determining whom to employ, he has decided to ask each prospective employee to

prepare answers to questions relating to situations he has encountered recently.

The following are the facts for the second question asked of prospective employees.

Last year the company exchanged a piece of land for a non-interest-bearing note. The note is to be paid at the rate of $14,300

per year for nine years, beginning one year from the date of disposal of the land. An appropriate rate of interest for the note was

10% (market rate). At the time the land was originally purchased, it cost $85,800.

Click here to view the factor table PRESENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1.

(a)

Calculate the fair value of the note using IFRS 13 on the date of the exchange. Hint: discount the payments at the market rate

of interest to find the present value of the note. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and

the final answer to 2 decimal places, e.g. 5,275.25.)

Fair value of the note under IFRS 13

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning