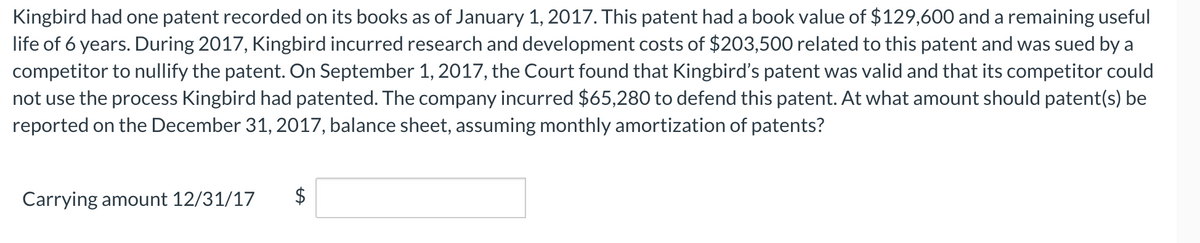

Kingbird had one patent recorded on its books as of January 1, 2017. This patent had a book value of $129,600 and a remaining useful life of 6 years. During 2017, Kingbird incurred research and development costs of $203,500 related to this patent and was sued by a competitor to nullify the patent. On September 1, 2017, the Court found that Kingbird's patent was valid and that its competitor could not use the process Kingbird had patented. The company incurred $65,280 to defend this patent. At what amount should patent(s) be reported on the December 31, 2017, balance sheet, assuming monthly amortization of patents? Carrying amount 12/31/17 2$

Kingbird had one patent recorded on its books as of January 1, 2017. This patent had a book value of $129,600 and a remaining useful life of 6 years. During 2017, Kingbird incurred research and development costs of $203,500 related to this patent and was sued by a competitor to nullify the patent. On September 1, 2017, the Court found that Kingbird's patent was valid and that its competitor could not use the process Kingbird had patented. The company incurred $65,280 to defend this patent. At what amount should patent(s) be reported on the December 31, 2017, balance sheet, assuming monthly amortization of patents? Carrying amount 12/31/17 2$

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 7MC

Related questions

Question

100%

Transcribed Image Text:Kingbird had one patent recorded on its books as of January 1, 2017. This patent had a book value of $129,600 and a remaining useful

life of 6 years. During 2017, Kingbird incurred research and development costs of $203,500 related to this patent and was sued by a

competitor to nullify the patent. On September 1, 2017, the Court found that Kingbird's patent was valid and that its competitor could

not use the process Kingbird had patented. The company incurred $65,280 to defend this patent. At what amount should patent(s) be

reported on the December 31, 2017, balance sheet, assuming monthly amortization of patents?

Carrying amount 12/31/17

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning