l LTE 11:10 project cost accounting fe07... Done 3 of 3 Problem 2. Preparing Master budgets UBS Company, a manufacturing business that sells baskets, wants a master budget prepared for the first three months of this year (January, February and March) The managers of the different departments have provided the following information: The Sales Manager has projected the following sales: January 6,000 units February 5,000 units March 6,000 units Projected selling price is $40.00/unit Your Production Manager gave the following information: Ending Inventory is to be 20% of next month's production need **rounded to the nearest 10. April's Projected Sales 5,500 units, May 11250 units December 20X5 Ending Inventory was 1,000 units The Manufacturing Manager has estimated the following Each unit will require 4 grams of material Material in Ending Inventory is 20% of next month's needs December's Ending Material Inventory was 4,800 g Project cost of material: $2.50/gram The Personnel Manager has estimated that Direct Labor will be projected at: 0.75 hours of Direct Labor per unit Direct Labor Cost: $8.50/hour The Facilities Manager has estimated that the Manufacturing Overhead will be projected at: Variable Overhead Rate to be $8 per Direct Labor hours Fixed Overhead Rate to be $3,000 per month The Accounting Department Manager has provided the following information: Selling and Administrative Expenses are projected to be a monthly cost of Salaries $6,000 Rent $1,500 Advertising $1,100 Telephone $300 Other $500 For the operating budget, you are expected to prepare the following: Sales Budget Production Budget Direct Materials Budget Direct Labor Budget Manufacturing Overhead Budget Selling & Administrative Expenses Budget

l LTE 11:10 project cost accounting fe07... Done 3 of 3 Problem 2. Preparing Master budgets UBS Company, a manufacturing business that sells baskets, wants a master budget prepared for the first three months of this year (January, February and March) The managers of the different departments have provided the following information: The Sales Manager has projected the following sales: January 6,000 units February 5,000 units March 6,000 units Projected selling price is $40.00/unit Your Production Manager gave the following information: Ending Inventory is to be 20% of next month's production need **rounded to the nearest 10. April's Projected Sales 5,500 units, May 11250 units December 20X5 Ending Inventory was 1,000 units The Manufacturing Manager has estimated the following Each unit will require 4 grams of material Material in Ending Inventory is 20% of next month's needs December's Ending Material Inventory was 4,800 g Project cost of material: $2.50/gram The Personnel Manager has estimated that Direct Labor will be projected at: 0.75 hours of Direct Labor per unit Direct Labor Cost: $8.50/hour The Facilities Manager has estimated that the Manufacturing Overhead will be projected at: Variable Overhead Rate to be $8 per Direct Labor hours Fixed Overhead Rate to be $3,000 per month The Accounting Department Manager has provided the following information: Selling and Administrative Expenses are projected to be a monthly cost of Salaries $6,000 Rent $1,500 Advertising $1,100 Telephone $300 Other $500 For the operating budget, you are expected to prepare the following: Sales Budget Production Budget Direct Materials Budget Direct Labor Budget Manufacturing Overhead Budget Selling & Administrative Expenses Budget

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 20E: Eastman, Inc., manufactures and sells three products: R, S, and T. In January, Eastman, Inc.,...

Related questions

Question

Transcribed Image Text:l LTE

11:10

project cost accounting

fe07...

Done

3 of 3

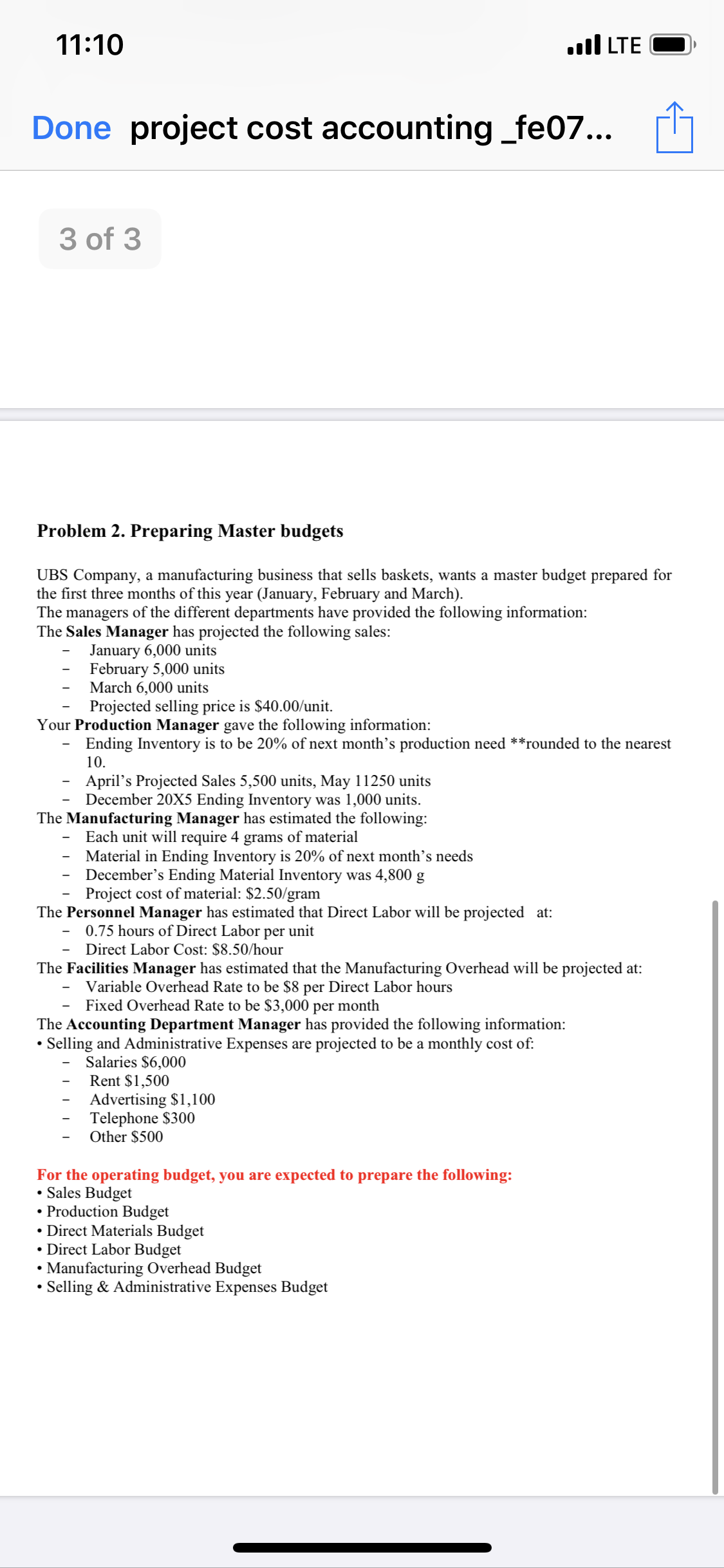

Problem 2. Preparing Master budgets

UBS Company, a manufacturing business that sells baskets, wants a master budget prepared for

the first three months of this year (January, February and March)

The managers of the different departments have provided the following information:

The Sales Manager has projected the following sales:

January 6,000 units

February 5,000 units

March 6,000 units

Projected selling price is $40.00/unit

Your Production Manager gave the following information:

Ending Inventory is to be 20% of next month's production need **rounded to the nearest

10.

April's Projected Sales 5,500 units, May 11250 units

December 20X5 Ending Inventory was 1,000 units

The Manufacturing Manager has estimated the following

Each unit will require 4 grams of material

Material in Ending Inventory is 20% of next month's needs

December's Ending Material Inventory was 4,800 g

Project cost of material: $2.50/gram

The Personnel Manager has estimated that Direct Labor will be projected at:

0.75 hours of Direct Labor per unit

Direct Labor Cost: $8.50/hour

The Facilities Manager has estimated that the Manufacturing Overhead will be projected at:

Variable Overhead Rate to be $8 per Direct Labor hours

Fixed Overhead Rate to be $3,000 per month

The Accounting Department Manager has provided the following information:

Selling and Administrative Expenses are projected to be a monthly cost of

Salaries $6,000

Rent $1,500

Advertising $1,100

Telephone $300

Other $500

For the operating budget, you are expected to prepare the following:

Sales Budget

Production Budget

Direct Materials Budget

Direct Labor Budget

Manufacturing Overhead Budget

Selling & Administrative Expenses Budget

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 5 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning