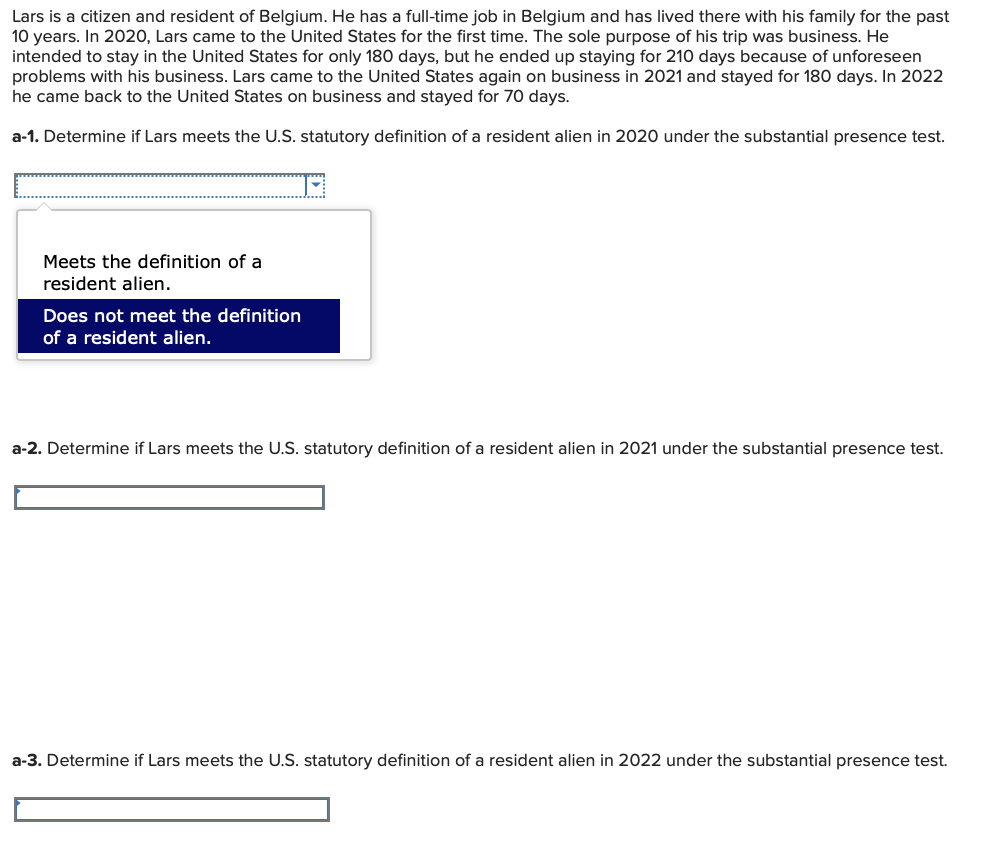

Lars is a citizen and resident of Belgium. He has a full-time job in Belgium and has lived there with his family for the past 10 years. In 2020, Lars came to the United States for the first time. The sole purpose of his trip was business. He intended to stay in the United States for only 180 days, but he ended up staying for 210 days because of unforeseen problems with his business. Lars came to the United States again on business in 2021 and stayed for 180 days. In 2022 he came back to the United States on business and stayed for 70 days. a-1. Determine if Lars meets the U.S. statutory definition of a resident alien in 2020 under the substantial presence test. Meets the definition of a resident alien. Does not meet the definition of a resident alien. a-2. Determine if Lars meets the U.S. statutory definition of a resident alien in 2021 under the substantial presence test. a-3. Determine if Lars meets the U.S. statutory definition of a resident alien in 2022 under the substantial presence test.

Lars is a citizen and resident of Belgium. He has a full-time job in Belgium and has lived there with his family for the past 10 years. In 2020, Lars came to the United States for the first time. The sole purpose of his trip was business. He intended to stay in the United States for only 180 days, but he ended up staying for 210 days because of unforeseen problems with his business. Lars came to the United States again on business in 2021 and stayed for 180 days. In 2022 he came back to the United States on business and stayed for 70 days. a-1. Determine if Lars meets the U.S. statutory definition of a resident alien in 2020 under the substantial presence test. Meets the definition of a resident alien. Does not meet the definition of a resident alien. a-2. Determine if Lars meets the U.S. statutory definition of a resident alien in 2021 under the substantial presence test. a-3. Determine if Lars meets the U.S. statutory definition of a resident alien in 2022 under the substantial presence test.

Chapter6: Business Expenses

Section: Chapter Questions

Problem 33P

Related questions

Question

Please guide through A., B, C thnank you!

Transcribed Image Text:Lars is a citizen and resident of Belgium. He has a full-time job in Belgium and has lived there with his family for the past

10 years. In 2020, Lars came to the United States for the first time. The sole purpose of his trip was business. He

intended to stay in the United States for only 180 days, but he ended up staying for 210 days because of unforeseen

problems with his business. Lars came to the United States again on business in 2021 and stayed for 180 days. In 2022

he came back to the United States on business and stayed for 70 days.

a-1. Determine if Lars meets the U.S. statutory definition of a resident alien in 2020 under the substantial presence test.

Meets the definition of a

resident alien.

Does not meet the definition

of a resident alien.

a-2. Determine if Lars meets the U.S. statutory definition of a resident alien in 2021 under the substantial presence test.

a-3. Determine if Lars meets the U.S. statutory definition of a resident alien in 2022 under the substantial presence test.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT