Laura earns a base salary of $50,000 as an event planner and is subject to the following hypothetical income tax bracket. Laura is considering taking on an additional wedding that will increase her income by $5,000. In order for Laura to deem the wedding worth her time, it must earn her $3,000 after taxes. Please round all answers to two decimal places. Income Tax rate $0-$10,000 5% $10,001-$30,000 10% 20% $30,001-$50,000 $50,001+ 50% What is the marginal tax rate associated with taking on this wedding? 50 What is Laura's average tax rate if the extra wedding is accepted? 0.1636

Laura earns a base salary of $50,000 as an event planner and is subject to the following hypothetical income tax bracket. Laura is considering taking on an additional wedding that will increase her income by $5,000. In order for Laura to deem the wedding worth her time, it must earn her $3,000 after taxes. Please round all answers to two decimal places. Income Tax rate $0-$10,000 5% $10,001-$30,000 10% 20% $30,001-$50,000 $50,001+ 50% What is the marginal tax rate associated with taking on this wedding? 50 What is Laura's average tax rate if the extra wedding is accepted? 0.1636

Chapter12: Income Distribution, Poverty, And Discrimination

Section: Chapter Questions

Problem 10SQP

Related questions

Question

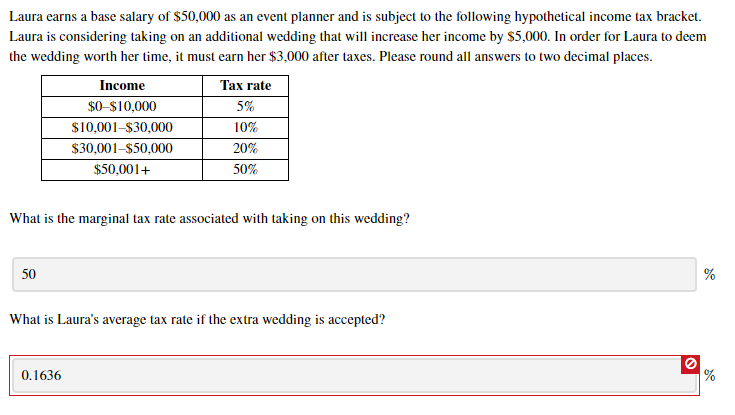

Transcribed Image Text:Laura earns a base salary of $50,000 as an event planner and is subject to the following hypothetical income tax bracket.

Laura is considering taking on an additional wedding that will increase her income by $5,000. In order for Laura to deem

the wedding worth her time, it must earn her $3,000 after taxes. Please round all answers to two decimal places.

Income

Tax rate

$0-$10,000

5%

$10,001-$30,000

10%

20%

$30,001-$50,000

$50,001+

50%

What is the marginal tax rate associated with taking on this wedding?

50

What is Laura's average tax rate if the extra wedding is accepted?

0.1636

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning