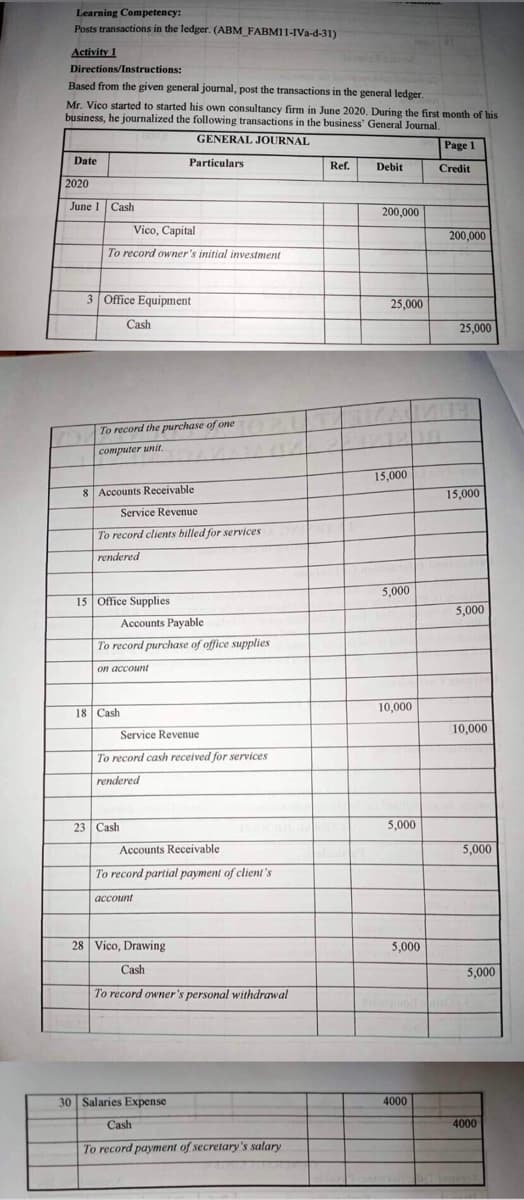

Learning Competency: Posts transactions in the ledger. (ABM_FABM11-IVa-d-31) Activity 1 Directions/Instructions: Based from the given general journal, post the transactions in the general ledger. Mr. Vico started to started his own consultancy firm in June 2020. During the first month of his business, he journalized the following transactions in the business' General Journal. GENERAL JOURNAL Page 1 Date Particulars Ref. Debit Credit Vico, Capital To record owner's initial investment 2020 June 1 Cash 3 Office Equipment Cash To record the purchase of one computer unit. 200,000 200,000 25,000 TKAISUED 15,000 25,000

Learning Competency: Posts transactions in the ledger. (ABM_FABM11-IVa-d-31) Activity 1 Directions/Instructions: Based from the given general journal, post the transactions in the general ledger. Mr. Vico started to started his own consultancy firm in June 2020. During the first month of his business, he journalized the following transactions in the business' General Journal. GENERAL JOURNAL Page 1 Date Particulars Ref. Debit Credit Vico, Capital To record owner's initial investment 2020 June 1 Cash 3 Office Equipment Cash To record the purchase of one computer unit. 200,000 200,000 25,000 TKAISUED 15,000 25,000

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter5: Accounting Systems

Section: Chapter Questions

Problem 1PA: Sage Learning Centers was established on July 20, 2016, to provide educational services. The...

Related questions

Question

Required:

• LEDGER (format/answer sheet provided)

Transcribed Image Text:Learning Competency:

Posts transactions in the ledger. (ABM_FABM11-IVa-d-31)

Activity 1

Directions/Instructions:

Based from the given general journal, post the transactions in the general ledger.

Mr. Vico started to started his own consultancy firm in June 2020. During the first month of his

business, he journalized the following transactions in the business' General Journal.

GENERAL JOURNAL

Page 1

Date

Particulars

Ref.

Debit

Vico, Capital

To record owner's initial investment

2020

June 1 Cash

3 Office Equipment

Cash

To record the purchase of one

computer unit.

8 Accounts Receivable

Service Revenue

To record clients billed for services

rendered

Accounts Payable

To record purchase of office supplies

on account

Service Revenue

To record cash received for services

rendered

Accounts Receivable

To record partial payment of client's

account

28 Vico, Drawing

Cash

To record owner's personal withdrawal

30 Salaries Expense

Cash

To record payment of secretary's salary

15 Office Supplies

18 Cash

23 Cash

200.000

25,000

15,000

5,000

10,000

5,000

5,000

4000

Credit

200,000

25,000

15,000

5,000

10,000

5,000

5,000

4000

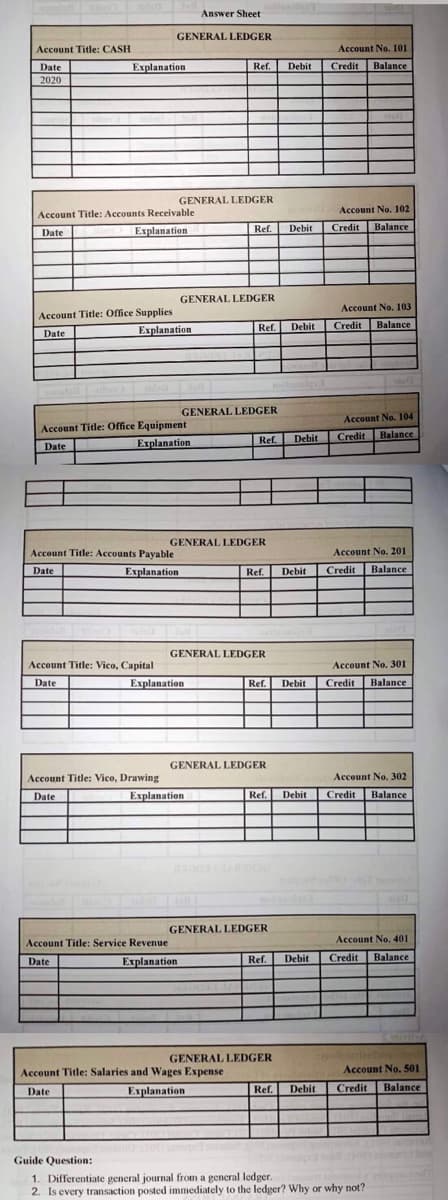

Transcribed Image Text:Answer Sheet

GENERAL LEDGER

Ref.

GENERAL LEDGER

Account Title: CASH

Date

Explanation

2020

Account Title: Accounts Receivable

Date

Explanation.

Account Title: Office Supplies

Date

Explanation

Account Title: Office Equipment

Date

Explanation

Account Title: Accounts Payable

Date

Explanation

Account Title: Vico, Capital

Date

Account Title: Vico, Drawing

Date

Account Title: Service Revenue

Date

Explanation

Account Title: Salaries and Wages Expense

Date

Explanation

Ref. Debit Credit

Guide Question:

1. Differentiate general journal from a general ledger.

2. Is every transaction posted immediately to the ledger? Why or why not?

Account No. 101

Credit Balance

Account No. 102

Credit

Balance

Account No. 103

Credit Balance

Account No. 104

Ref. Debit Credit Balance

Account No. 201

Credit

Balance

Account No. 301

Credit Balance

Account No. 302

Credit Balance

Account No. 401

Credit Balance

GENERAL LEDGER

Ref. Debit

GENERAL LEDGER

Explanation

GENERAL LEDGER

Ref. Debit

Explanation

GENERAL LEDGER

Debit

Ref. Debit

GENERAL LEDGER

Ref.

GENERAL LEDGER

Ref.

GENERAL LEDGER

Ref. Debit

Debit

Debit

Account No. 501

Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning