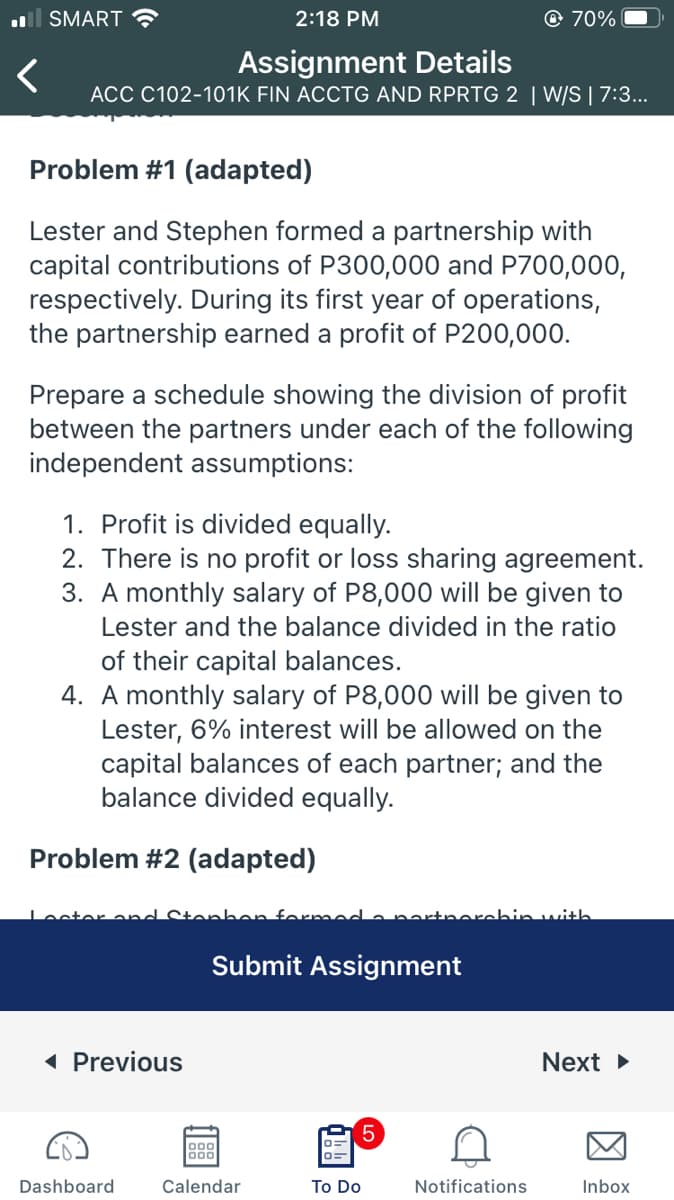

Lester and Stephen formed a partnership with capital contributions of P300,000 and P700,000, respectively. During its first year of operations, the partnership earned a profit of P200,000. Prepare a schedule showing the division of profit between the partners under each of the following independent assumptions: 1. Profit is divided equally. 2. There is no profit or loss sharing agreement. 3. A monthly salary of P8,000 will be given to Lester and the balance divided in the ratio of their capital balances. 4. A monthly salary of P8,000 will be given to Lester, 6% interest will be allowed on the capital balances of each partner; and the balance divided equally.

Lester and Stephen formed a partnership with capital contributions of P300,000 and P700,000, respectively. During its first year of operations, the partnership earned a profit of P200,000. Prepare a schedule showing the division of profit between the partners under each of the following independent assumptions: 1. Profit is divided equally. 2. There is no profit or loss sharing agreement. 3. A monthly salary of P8,000 will be given to Lester and the balance divided in the ratio of their capital balances. 4. A monthly salary of P8,000 will be given to Lester, 6% interest will be allowed on the capital balances of each partner; and the balance divided equally.

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 12.15EX

Related questions

Question

Transcribed Image Text:l SMART ?

2:18 PM

© 70%

Assignment Details

ACC C102-101K FIN ACCTG AND RPRTG 2 | W/S | 7:3...

Problem #1 (adapted)

Lester and Stephen formed a partnership with

capital contributions of P300,000 and P700,000,

respectively. During its first year of operations,

the partnership earned a profit of P200,000.

Prepare a schedule showing the division of profit

between the partners under each of the following

independent assumptions:

1. Profit is divided equally.

2. There is no profit or loss sharing agreement.

3. A monthly salary of P8,000 will be given to

Lester and the balance divided in the ratio

of their capital balances.

4. A monthly salary of P8,000 will be given to

Lester, 6% interest will be allowed on the

capital balances of each partner; and the

balance divided equally.

Problem #2 (adapted)

Loster a

nhon formed

partnerchin with

Submit Assignment

( Previous

Next

5.

Dashboard

Calendar

To Do

Notifications

Inbox

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning