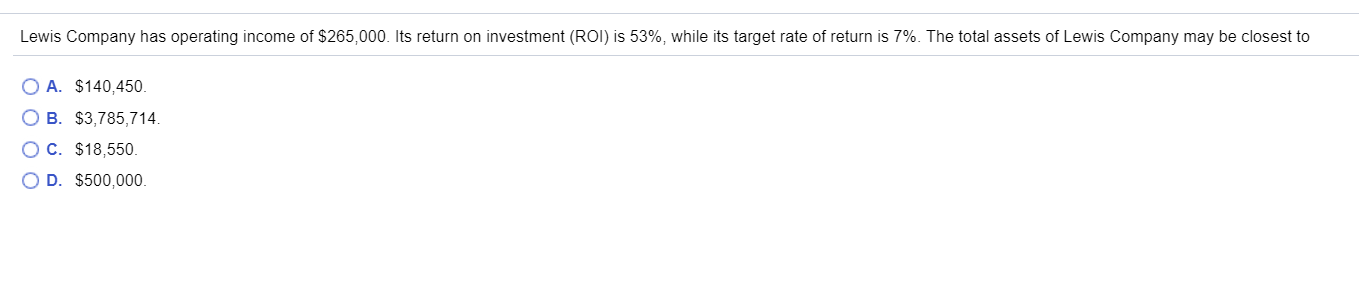

Lewis Company has operating income of $265,000. Its return on investment (ROI) is 53%, while its target rate of return is 7%. The total assets of Lewis Company may be closest to O A. $140,450. O B. $3,785,714. O C. $18,550. O D. $500,000

Lewis Company has operating income of $265,000. Its return on investment (ROI) is 53%, while its target rate of return is 7%. The total assets of Lewis Company may be closest to O A. $140,450. O B. $3,785,714. O C. $18,550. O D. $500,000

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter10: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 4BE: Profit margin, investment turnover, and ROI Briggs Company has operating income of 36,000, invested...

Related questions

Question

Transcribed Image Text:Lewis Company has operating income of $265,000. Its return on investment (ROI) is 53%, while its target rate of return is 7%. The total assets of Lewis Company may be closest to

O A. $140,450.

O B. $3,785,714.

O C. $18,550.

O D. $500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning