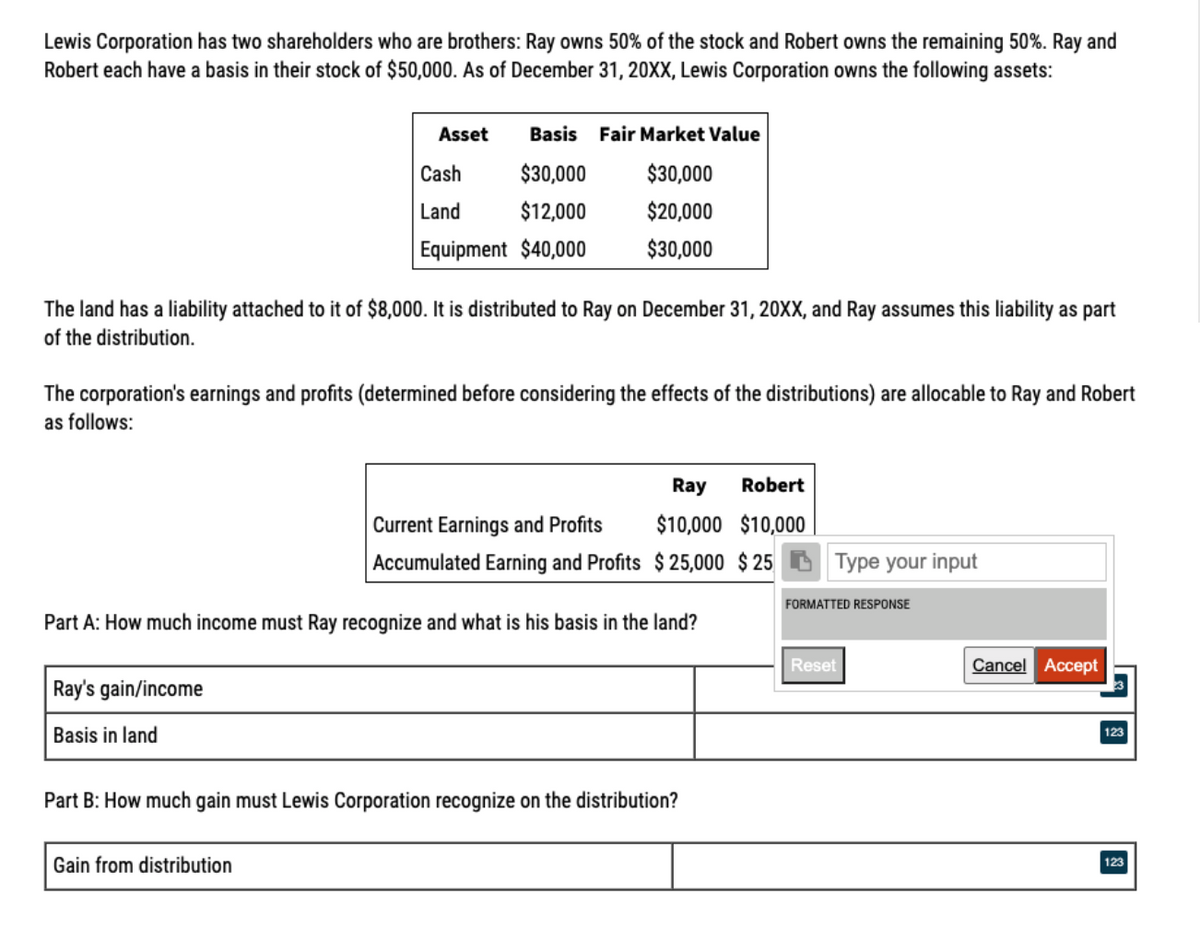

Lewis Corporation has two shareholders who are brothers: Ray owns 50% of the stock and Robert owns the remaining 50%. Ray and Robert each have a basis in their stock of $50,000. As of December 31, 20XX, Lewis Corporation owns the following assets: Asset Basis Fair Market Value Cash $30,000 $30,000 Land $12,000 $20,000 Equipment $40,000 $30,000 The land has a liability attached to it of $8,000. It is distributed to Ray on December 31, 20XX, and Ray assumes this liability as part of the distribution. The corporation's earnings and profits (determined before considering the effects of the distributions) are allocable to Ray and Robert as follows: Ray Robert Current Earnings and Profits $10,000 $10,000 Accumulated Earning and Profits $ 25,000 $ 25 D Type your input FORMATTED RESPONSE Part A: How much income must Ray recognize and what is his basis in the land? Reset Cancel Accept Ray's gain/income Basis in land 123 Part B: How much gain must Lewis Corporation recognize on the distribution? Gain from distribution 123

Lewis Corporation has two shareholders who are brothers: Ray owns 50% of the stock and Robert owns the remaining 50%. Ray and Robert each have a basis in their stock of $50,000. As of December 31, 20XX, Lewis Corporation owns the following assets: Asset Basis Fair Market Value Cash $30,000 $30,000 Land $12,000 $20,000 Equipment $40,000 $30,000 The land has a liability attached to it of $8,000. It is distributed to Ray on December 31, 20XX, and Ray assumes this liability as part of the distribution. The corporation's earnings and profits (determined before considering the effects of the distributions) are allocable to Ray and Robert as follows: Ray Robert Current Earnings and Profits $10,000 $10,000 Accumulated Earning and Profits $ 25,000 $ 25 D Type your input FORMATTED RESPONSE Part A: How much income must Ray recognize and what is his basis in the land? Reset Cancel Accept Ray's gain/income Basis in land 123 Part B: How much gain must Lewis Corporation recognize on the distribution? Gain from distribution 123

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 30P

Related questions

Question

solve it on excel only otherwise skip

Transcribed Image Text:Lewis Corporation has two shareholders who are brothers: Ray owns 50% of the stock and Robert owns the remaining 50%. Ray and

Robert each have a basis in their stock of $50,000. As of December 31, 20XX, Lewis Corporation owns the following assets:

Asset

Basis Fair Market Value

Cash

$30,000

$30,000

Land

$12,000

$20,000

Equipment $40,000

$30,000

The land has a liability attached to it of $8,000. It is distributed to Ray on December 31, 20XX, and Ray assumes this liability as part

of the distribution.

The corporation's earnings and profits (determined before considering the effects of the distributions) are allocable to Ray and Robert

as follows:

Ray

Robert

Current Earnings and Profits

$10,000 $10,000

Accumulated Earning and Profits $ 25,000 $ 25 D Type your input

FORMATTED RESPONSE

Part A: How much income must Ray recognize and what is his basis in the land?

Reset

Cancel Accept

Ray's gain/income

Basis in land

123

Part B: How much gain must Lewis Corporation recognize on the distribution?

Gain from distribution

123

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT