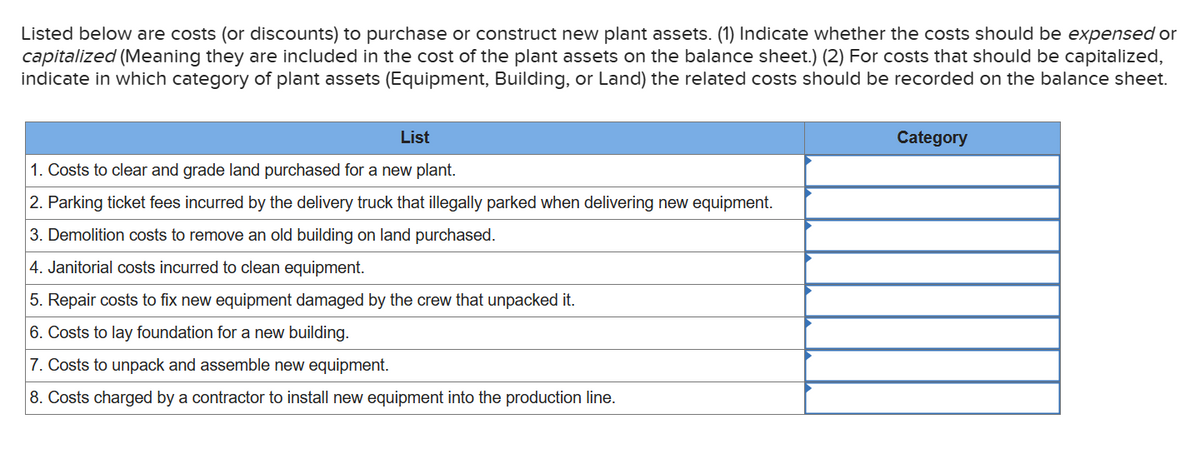

Listed below are costs (or discounts) to purchase or construct new plant assets. (1) Indicate whether the costs should be expensed or capitalized (Meaning they are included in the cost of the plant assets on the balance sheet.) (2) For costs that should be capitalized, indicate in which category of plant assets (Equipment, Building, or Land) the related costs should be recorded on the balance sheet. List 1. Costs to clear and grade land purchased for a new plant. 2. Parking ticket fees incurred by the delivery truck that illegally parked when delivering new equipment. 3. Demolition costs to remove an old building on land purchased. 4. Janitorial costs incurred to clean equipment. 5. Repair costs to fix new equipment damaged by the crew that unpacked it. 6. Costs to lay foundation for a new building. 7. Costs to unpack and assemble new equipment. 8. Costs charged by a contractor to install new equipment into the production line. Category

Listed below are costs (or discounts) to purchase or construct new plant assets. (1) Indicate whether the costs should be expensed or capitalized (Meaning they are included in the cost of the plant assets on the balance sheet.) (2) For costs that should be capitalized, indicate in which category of plant assets (Equipment, Building, or Land) the related costs should be recorded on the balance sheet. List 1. Costs to clear and grade land purchased for a new plant. 2. Parking ticket fees incurred by the delivery truck that illegally parked when delivering new equipment. 3. Demolition costs to remove an old building on land purchased. 4. Janitorial costs incurred to clean equipment. 5. Repair costs to fix new equipment damaged by the crew that unpacked it. 6. Costs to lay foundation for a new building. 7. Costs to unpack and assemble new equipment. 8. Costs charged by a contractor to install new equipment into the production line. Category

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter7: Fixed Assets, Natural Resources, And Intangible Assets

Section: Chapter Questions

Problem 7.1.3P

Related questions

Question

Transcribed Image Text:Listed below are costs (or discounts) to purchase or construct new plant assets. (1) Indicate whether the costs should be expensed or

capitalized (Meaning they are included in the cost of the plant assets on the balance sheet.) (2) For costs that should be capitalized,

indicate in which category of plant assets (Equipment, Building, or Land) the related costs should be recorded on the balance sheet.

List

1. Costs to clear and grade land purchased for a new plant.

2. Parking ticket fees incurred by the delivery truck that illegally parked when delivering new equipment.

3. Demolition costs to remove an old building on land purchased.

4. Janitorial costs incurred to clean equipment.

5. Repair costs to fix new equipment damaged by the crew that unpacked it.

6. Costs to lay foundation for a new building.

7. Costs to unpack and assemble new equipment.

8. Costs charged by a contractor to install new equipment into the production line.

Category

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What costs are included when capitalizing an asset on the balance sheet?

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,