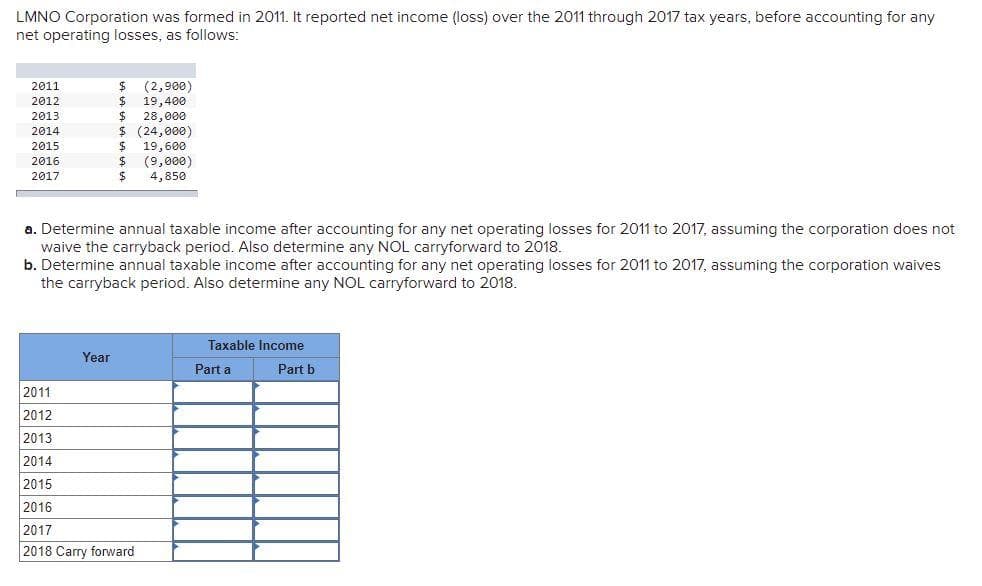

LMNO Corporation was formed in 2011. It reported net income (loss) over the 2011 through 2017 tax years, before accounting for any net operating losses, as follows: 2011 2012 2013 2014 2015 2016 2017 $ (2,900) $ 19,400 $ 28,000 $ (24,000) $ 19,600 $ (9,000) $ 4,850 a. Determine annual taxable income after accounting for any net operating losses for 2011 to 2017, assuming the corporation does not waive the carryback period. Also determine any NOL carryforward to 2018. b. Determine annual taxable income after accounting for any net operating losses for 2011 to 2017, assuming the corporation waives the carryback period. Also determine any NOL carryforward to 2018.

LMNO Corporation was formed in 2011. It reported net income (loss) over the 2011 through 2017 tax years, before accounting for any net operating losses, as follows: 2011 2012 2013 2014 2015 2016 2017 $ (2,900) $ 19,400 $ 28,000 $ (24,000) $ 19,600 $ (9,000) $ 4,850 a. Determine annual taxable income after accounting for any net operating losses for 2011 to 2017, assuming the corporation does not waive the carryback period. Also determine any NOL carryforward to 2018. b. Determine annual taxable income after accounting for any net operating losses for 2011 to 2017, assuming the corporation waives the carryback period. Also determine any NOL carryforward to 2018.

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 51P

Related questions

Question

Please do not give image format

Transcribed Image Text:LMNO Corporation was formed in 2011. It reported net income (loss) over the 2011 through 2017 tax years, before accounting for any

net operating losses, as follows:

2011

2012

2013

2014

2015

2016

2017

$ (2,900)

$ 19,400

$ 28,000

$ (24,000)

$ 19,600

$ (9,000)

$ 4,850

a. Determine annual taxable income after accounting for any net operating losses for 2011 to 2017, assuming the corporation does not

waive the carryback period. Also determine any NOL carryforward to 2018.

b. Determine annual taxable income after accounting for any net operating losses for 2011 to 2017, assuming the corporation waives

the carryback period. Also determine any NOL carryforward to 2018.

Year

2011

2012

2013

2014

2015

2016

2017

2018 Carry forward

Taxable Income

Part a

Part b

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you