LO 3 See Examala 2-5 Ralph Henwood was paid a salary of $64.600 during 20-- by Odesto Company. In addition, during the year Henwood started his own business as a public accountant and reported a net business income of s80.000 en his income tax return for 20--. Compute the following a. The amourt of FICA Laes that was withedd from his camings during 20- by Odesto Company. OASDI S b. Henwood's sel-employment tawes on the income derived from the public accunting business for 20--. OASDI S HI S

LO 3 See Examala 2-5 Ralph Henwood was paid a salary of $64.600 during 20-- by Odesto Company. In addition, during the year Henwood started his own business as a public accountant and reported a net business income of s80.000 en his income tax return for 20--. Compute the following a. The amourt of FICA Laes that was withedd from his camings during 20- by Odesto Company. OASDI S b. Henwood's sel-employment tawes on the income derived from the public accunting business for 20--. OASDI S HI S

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 72C: Case 3-72 Cash- or Accrual-Basis Accounting Karen Ragsdale owns a business that rents parking spots...

Related questions

Question

Payroll Accounting Class (2301-900)

Cengage - eBook Bieg/Toland's Payroll Accounting (2021, 31th Edition)

Ch. 3: Problem Case 3-8A

I need help with finding the formula used to get the answer

OASDI Taxable Wage Base = 137,700

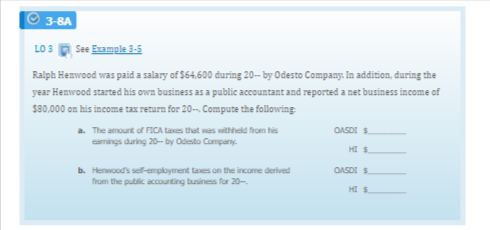

Transcribed Image Text:O 3-8A

LO 3 D See Example 3-5

Ralph Henwood was paid a salary of $64.600 during 20- by Odesto Company: In addition, during the

year Hemwood started his own business as a public accountant and reported a net business income of

$80.000 an his income tax return for 20-. Compute the following

a. The amount of FICA taves that was withheld from his

OASDI S

camings during 20- by Odesto Company.

HI S

b. Henwood's sel-employment laves on the income derived

from the public accounting business for 20-

OASDI S

HI S

Transcribed Image Text:lili

File

Insert

Page Laycut

Formulas

Data

Help

=|シ.

三三

2Wrap Text

Arial

10

A

王王|三三三

Merge & Center

Alignment

Paste

Clipboard

Font

A

B.

Name:

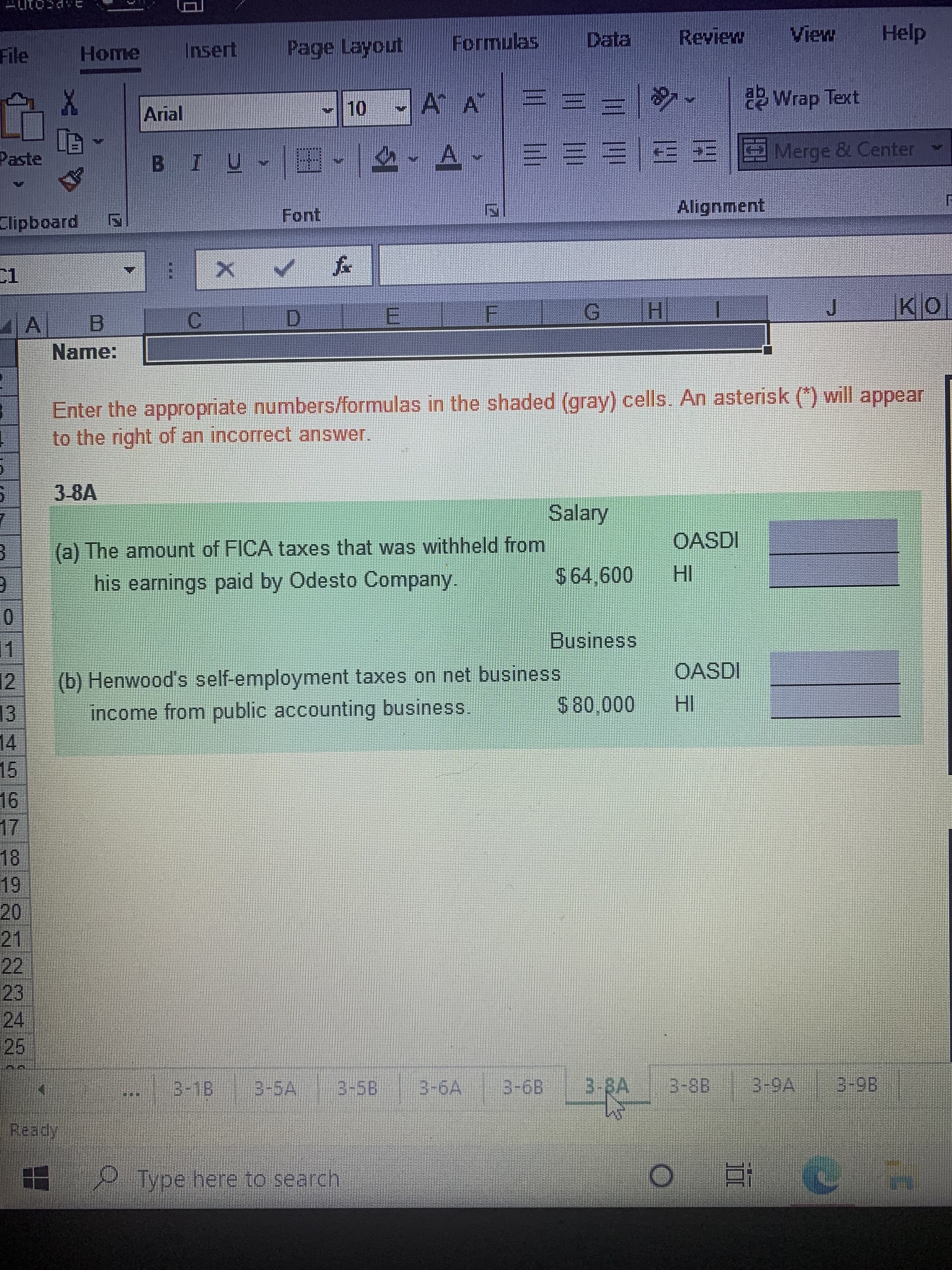

Enter the appropriate numbers/formulas in the shaded (gray) cells. An asterisk (*) will appear

to the right of an incorrect answer.

3-8A

Salary

(a) The amount of FICA taxes that was withheld from

OASDI

his earnings paid by Odesto Company.

IH

Business

1.

(b) Henwood's self-employment taxes on net business

2.

income from public accounting business.

OASDI

3.

4.

1.

21

22

23.

25

B-1B

B-6B

3-8B

H Type here to search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning