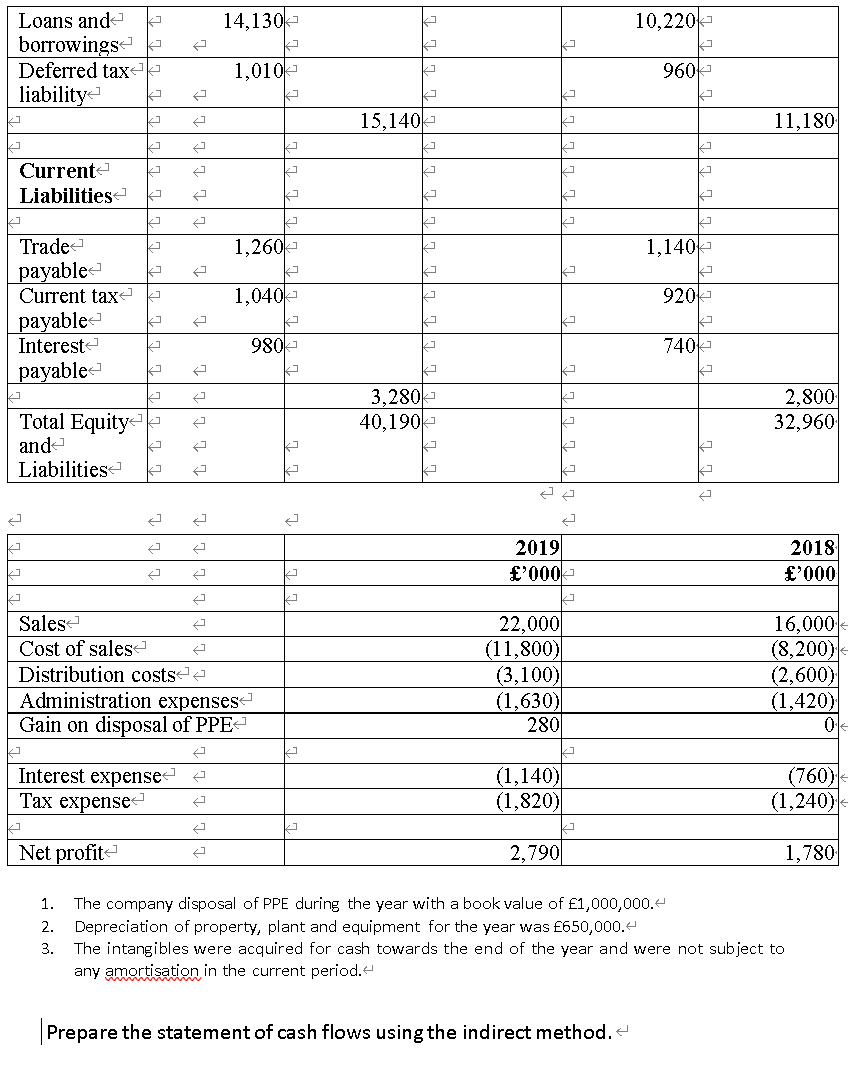

Loans and 14,130 10,220 borrowings a Deferred tax liability 1,010 960 15,140 11,180 Currente Liabilitiese Trade payable Current tax payable Interest payable 1,260 1,140 1,040 920 980- 740 3,280 40,190- 2,800 32,960 Total Equity and Liabilities 2019 £'000 2018 £'000 Sales Cost of sales= Distribution costsee 22,000 (11,800) (3,100) (1,630) 280 16,000 (8,200) (2,600) (1,420) Administration expenses Gain on disposal of PPE (1,140) (1,820) (760) (1,240) Interest expense Тах ехpense- Net profit 2,790 1,780 1. The company disposal of PPE during the year with a book value of £1,000,000. Depreciation of property, plant and equipment for the year was £650,000. The intangibles were acquired for cash towards the end of the year and were not subject to any amortisation in the current period. 2. 3. Prepare the statement of cash flows using the indirect method.

Loans and 14,130 10,220 borrowings a Deferred tax liability 1,010 960 15,140 11,180 Currente Liabilitiese Trade payable Current tax payable Interest payable 1,260 1,140 1,040 920 980- 740 3,280 40,190- 2,800 32,960 Total Equity and Liabilities 2019 £'000 2018 £'000 Sales Cost of sales= Distribution costsee 22,000 (11,800) (3,100) (1,630) 280 16,000 (8,200) (2,600) (1,420) Administration expenses Gain on disposal of PPE (1,140) (1,820) (760) (1,240) Interest expense Тах ехpense- Net profit 2,790 1,780 1. The company disposal of PPE during the year with a book value of £1,000,000. Depreciation of property, plant and equipment for the year was £650,000. The intangibles were acquired for cash towards the end of the year and were not subject to any amortisation in the current period. 2. 3. Prepare the statement of cash flows using the indirect method.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter11: Determining The Cost Of Capital

Section: Chapter Questions

Problem 1P: 11-1 After-Tax Cost of Debt

Calculate the after-tax cost of debt under each of the following...

Related questions

Question

Transcribed Image Text:Loans and

borrowings

Deferred taxek

liability

14,130

10,220-

1,010

960-

15,140

11,180

Current

Liabilities

Trade

payable

Current tax

1,260

1,140

1,040

920

payable

Interest

payable

980-

740k

3,280

40,190

2,800

32,960

Total Equity

and

Liabilities

2019

£'000

2018

£'000

Sales

Cost of sales

Distribution costse

Administration expenses

Gain on disposal of PPE

22,000

(11,800)

(3,100)

(1,630)

280

16,000

(8,200)

(2,600)

(1,420)

Interest expensee a

Тах еexpensee

(1,140)

(1,820)

(760)

(1,240)

Net profit

2,790

1,780

1.

The company disposal of PPE during the year with a book value of £1,000,000.

2. Depreciation of property, plant and equipment for the year was £650,000.4

The intangibles were acquired for cash towards the end of the year and were not sub ject to

any amortisation in the current period.e

3.

Prepare the statement of cash flows using the indirect method.

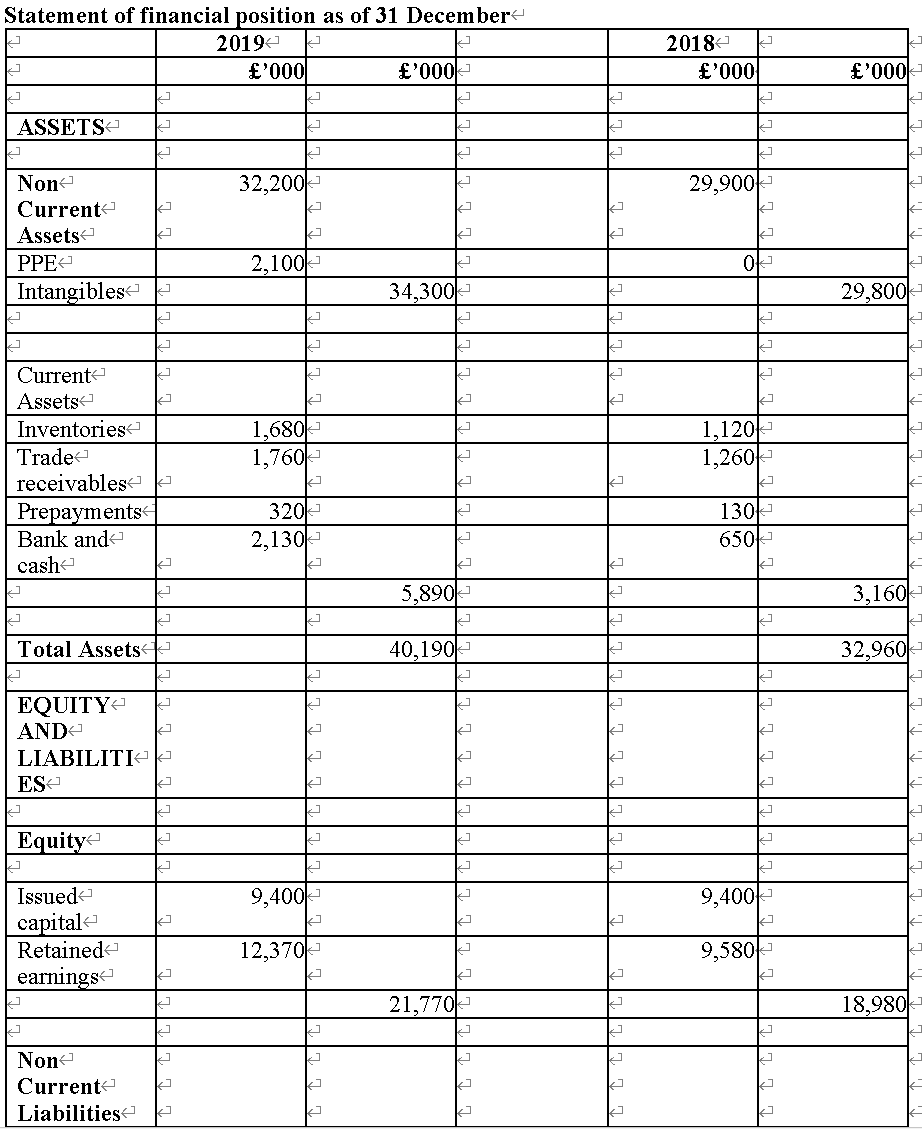

Transcribed Image Text:Statement of financial position as of 31 December

2019

000.3

2018

£'000

£'000

£'000

ASSETS

Non

32,200

29,900-

Current

Assets

PPE

2,100

Ok

Intangibles

34,300

29,800

Current

Assets

1,680-

1,760-

1,120

1,260

Inventories

Trade

receivables -

Prepayments

Bank and

320

2,130

130

650

cash

5,890

3,160

Total Assets<

40,190-

32,960

EQUITY

AND

LIABILITI

ES

Equity

9,400

Issued

capital

Retained

9,400

12,370-

9,580

earningse

21,770

18,980

Non

Current

Liabilities -

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning